Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be: “a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the economy; in which the...

Read More »FX Daily, May 21: Markets Pull Back after Flirting with Breakouts

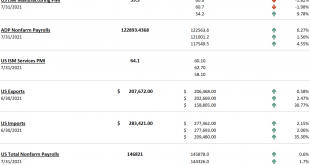

Swiss Franc The Euro has risen by 0.40% to 1.0634 EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: New two and a half month highs in the S&P 500 yesterday failed to have much sway in the Asia Pacific region and Europe today as US-China tensions escalate and profit-taking set in. Perhaps it is a bit of “buy the rumor sell the fact” type of activity on the back of upticks in the...

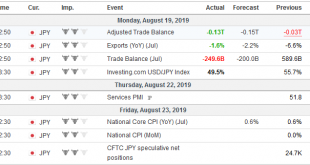

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

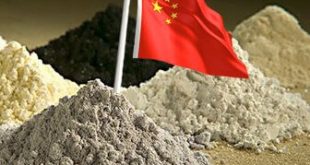

Read More »Rare Earths may Provide Leverage

Many American observers argue that the trade imbalance gives the US an advantage in a trade war with China. The US enjoys escalation dominance in tariffs because Chinese imports of US goods are so much less than the US imports of Chinese goods. However, the focus on quantities may be misleading. For example, the ability to find substitutes for the more expensive tariff imports could be a critical part of the evaluation....

Read More »There at the Beginning

Sometimes it is difficult to gain perspective. That is why it may be difficult to see the forest for the trees. It is as we spend most of our time climbing a mountain: One handhold and foothold at a time. Immediacy and urgency limit our peripheral and forward visions. The end of the first expansion since the Great Financial Crisis may be drawing close. There is a concern among officials and investors that the tools that...

Read More »The Future is Already Here–It is Just Not Evenly Distributed

When William Gibson would say that “the future is already here-it is just not evenly distributed,” he was referring to how wealth and location determine one’s access to technological advances (the future). Yet it equally can apply to the US-Chinese relationship. In a recent article in the Wall Street Journal, former Treasury Secretary Paulson seemed to express the views of many. If neither the US nor China changes its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org