Stock Markets EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely. Stock Markets Emerging Markets, March 03 Source: economist.com - Click to enlarge Malaysia Malaysia reports January trade Monday. Bank Negara meets Wednesday and is expected to keep rates steady at 3.25%. CPI rose 2.7% y/y in January. While the bank does not have an explicit inflation target, lower price pressures should allow it to hike very cautiously after it started the tightening cycle in January. Turkey Turkey reports

Topics:

Win Thin considers the following as important: Brazil, Chile, China, Colombia, Czech Republic, emerging markets, Featured, Hungary, Korea, Malaysia, Mexico, newsletter, Peru, Philippines, Poland, South Africa, Taiwan, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely. |

Stock Markets Emerging Markets, March 03 Source: economist.com - Click to enlarge |

MalaysiaMalaysia reports January trade Monday. Bank Negara meets Wednesday and is expected to keep rates steady at 3.25%. CPI rose 2.7% y/y in January. While the bank does not have an explicit inflation target, lower price pressures should allow it to hike very cautiously after it started the tightening cycle in January.

TurkeyTurkey reports February CPI Monday, which is expected to rise 10% y/y vs. 10.35% in January. While still above the 3-7% target range, inflation has eased from the peak of 13% y/y in November. The central bank then meets Wednesday and is expected to keep all rates steady.

HungaryHungary reports January retail sale Monday, which are expected to rise 6.2% y/y vs. 6.1% in January. January IP will be reported Wednesday and is expected to rise 5.6% y/y WDA. It reports February CPI Thursday, which is expected to rise 2.0% y/y vs. 2.1% in January. If so, inflation would be at the bottom of the 2-4% target range. January trade will be reported Friday.

TaiwanTaiwan reports January IP Monday and is expected to rise 4% y/y vs. 1.2% in December. It reports February CPI and trade Wednesday. CPI is expected to rise 1.95% y/y vs. 0.88% in January, while exports are expected to rise 9.1% y/y and imports by 7% y/y. While the central bank does not have an explicit inflation target, lower price pressures should allow it to remain on hold in 2018.

ColombiaColombia reports February CPI Monday, which is expected to rise 3.41% y/y vs. 3.68% in January. If so, inflation would be the lowest since July and remains in the bottom of the 2-4% target range. Next policy meeting is March 20 and no change is expected as the bank signaled a pause.

KoreaKorea reports February CPI Tuesday, which is expected to rise 1.2% y/y vs. 1.0% in January. If so, inflation would be well below the 2% target. We think the reappointment of BOK Governor Lee for a second term is a good move and should signal continuity and predictability. PhilippinesPhilippines reports February CPI Tuesday, which is expected to rise 4.1% y/y vs. 4.0% in January. If so, it would be above the 2-4% target range and will feed into expectations of an imminent rate hike. BSP next meets March 22. January trade will be reported Friday. Exports are expected to fall -3.7% y/y and imports to rise +14.7% y/y.

South AfricaSouth Africa reports Q4 GDP Tuesday, which is expected to grow 1.3% y/y vs. 0.8% in Q3. The sluggish economy remains a problem. CPI rose only 4.4% y/y in January, the lowest since March 2015 and in the bottom half of the 3-6% target range. SARB next meets March 28 and a 25 bp cut is possible then.

BrazilBrazil reports January IP Tuesday. February IPCA inflation will be reported Friday, which is expected to rise 2.84% y/y vs. 2.86% in January. If so, this would still be below the 2.5-6.5% target range. COPOM has signaled that another cut was possible. Next policy meeting is March 21 and another 25 bp cut to 6.5% is possible.

ChileChile reports February trade Wednesday. It reports February CPI Thursday, which is expected to rise 2.1% y/y vs. 2.2% in January. If so, inflation would be near the bottom of the 2-4% target range. The bank has signaled no further easing, but low price pressures would allow it to resume easing if the economy slows unexpectedly.

MexicoMexico reports February CPI Thursday, which is expected to rise 5.37% y/y vs. 5.55% in January. If so, it would be the lowest since March 2017 but still above the 2-4% target range. Banco de Mexico next meets April 12. It’s too early to make a call, but there is the potential for another rate hike then.

PolandNational Bank of Poland meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose only 1.9% y/y in February, which is near the bottom of the 1.5-3.5% target range. For now, the bank has maintained its intent to keep rates steady into 2019.

ChinaChina reports February trade Thursday. Exports are expected to rise 10% y/y and imports by 6.5% y/y. February CPI and PPI will be reported Friday. The former is expected to rise 2.4% y/y and the latter by 3.8% y/y.

PeruPeru central bank meets Thursday and is expected to cut rates 25 bp to 2.75%. CPI rose 1.2% y/y in February, close to the bottom of the 1-3% target range. The bank has been cutting rates every other month, which points to a 25 bp cut to 2.75% then after it stood pat in February.

Czech RepublicCzech Republic reports January trade and February CPI Friday. CPI is expected to rise 2.0% y/y vs. 2.2% in January. If so, inflation would be right in the middle of the 1-3% target range. Next policy meeting is March 29, and no change is expected. The bank has been hiking 25 bp every other meeting and so a hike at the May 3 meeting seems more likely.

|

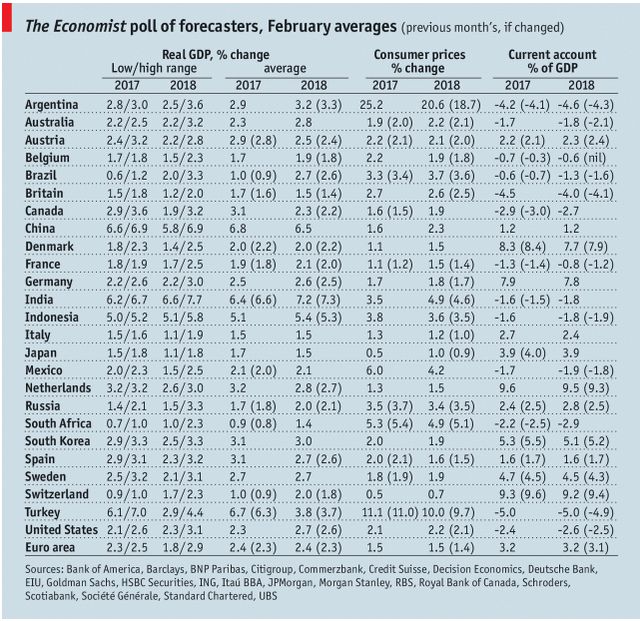

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Brazil,Chile,China,Colombia,Czech Republic,Emerging Markets,Featured,Hungary,Korea,Malaysia,Mexico,newsletter,Peru,Philippines,Poland,South Africa,Taiwan,Turkey,win-thin