Overview: The market continues to monitor developments in Israel and the Middle East. The economic calendar is light today and the market is showing a strong appetite for risk. Except for China and South Korea, large bourses in the Asia Pacific rallied. Japan's indices jumped more than 2% and Australia by 1% to lead the region. Europe's Stoxx 600 is up 1.5% near midday, which, if sustained would be the largest in nearly a month. US index futures are firmer. After...

Read More »European Rates Continue to Surge, Sending Stocks Spiraling Lower

Overview: Seven of the G10 central banks pumped the brakes between last week and this week as they purposely seek to push demand back into line with supply. And there are more signs that they are succeeding in weakening growth impulses. The dramatic surge in European bond yields continues today with 10-year rates mostly rising another 13-15 bp. Italian and Greek benchmark yields are up 22-24 bp. The US 10-year Treasury yield is up nearly five basis points to 3.50%....

Read More »Macro: Tell Us Something We Don’t Already Know

As September winds down, three sets of economic reports will draw the most attention. We will review them and then offer a snapshot of the emerging market central bank meetings. As we have seen in the UK and Norway, several emerging market countries raised rates early (beginning in the middle of last year) but still experienced an acceleration of inflation. It obviously begs the unanswerable question about the impact on US inflation if the Fed had taken its foot off...

Read More »Risk Appetites are Fickle

Overview: Yesterday’s strong US equity gains failed to carry over into today’s session. Japanese and Australian shares fared the best among the large Asia Pacific market, with the Nikkei off less than 0.4% and the ASX off less than 0.25%. However, China’s markets were off more than 1%, while Taiwan and South Korea indices slumped more than 2%. India is off nearly 1.5%. Europe’s Stoxx 600 is down 1.5% and is giving back all of its gains in the past three sessions. US...

Read More »US Holiday Facilitates Consolidative Tone

Overview: Most equity markets in the Asia Pacific region lost ground today. China’s Shenzhen, Hong Kong, and India were notable exceptions. The MSCI Asia Pacific Index is at its lowest level since June 2020. Europe’s Stoxx 600 is forging a base ahead of 4000 and is trading quietly with a small upside bias. The French stock market lagging after Macron lost his parliamentary majority, is raising questions about his reform agenda. US equity futures are firm, but the...

Read More »FX Daily, July 1: Second Verse Can’t be Worse than the First, Can it?

Swiss Franc The Euro has risen by 0.04% to 1.0641 EUR/CHF and USD/CHF, July 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The resurgence of the contagion in the US has stopped or reversed an estimated 40% of the re-openings, but the appetite for risk has begun the second half on a firm note, helped by manufacturing PMIs that were above preliminary estimates or better than expected. Except for Tokyo and...

Read More »EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect. Brexit negotiations have accelerated but we note that any deal must...

Read More »Emerging Market Week Ahead Preview

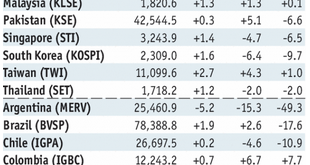

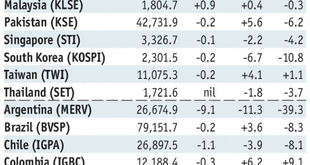

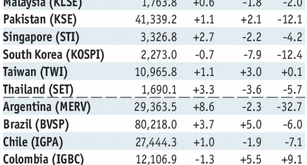

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.Yet it’s worth noting that the five best...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX. Stock Markets Emerging Markets, July 25 - Click to enlarge South Africa South Africa reports June money, loan, and budget data Monday. June...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org