Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months. Real disposable income is up 0.8% in the last six months but was down...

Read More »Political Developments Overshadow Economics

Overview: There is nervous calm in the capital markets today. The weakness of US shares yesterday is taking a toll today. An exception in the Asia Pacific region is the Hang Seng and the index of mainland shares that trade there, which up around 3.5% today on thUe easing of some Covid protocols. Europe’s Stoxx 600 is off for a fifth day, its longest losing streak in nearly two months. US futures are posting minor gains. Benchmark 10-year yields are mostly little...

Read More »Heading into the Weekend, Dollar’s Downside Momentum Stalls

Overview: The markets are putting the finishing touches on this week’s activity. Japan, returning from yesterday’s holiday bought equities, and its major indices jumped more than 2%. China, South Korea, and Australia struggled. Europe’s Stoxx 600 is firmer for the third consecutive session. It is up about 1.3% this week. US futures are also firmer after reversing earlier gains yesterday to close lower on the day. The US 10-year yield is flat near 2.88%, while...

Read More »Johnson Resigns, but Still not Clear if He Controls the Timing

Overview: The resignation of a UK prime minister makes for high political drama, but the markets hardly moved on it. Sterling, like most of the major currencies, are recovering against the dollar today. UK equities are higher but are not really outperforming their peers. Asia Pacific bourses rallied, with Taiwan leading the way with a 2.5% surge. Europe’s Stoxx 600 is up 1.4% after yesterday’s 1.65% gain. US futures are around 0.25%-0.35% better. Benchmark bond...

Read More »FX Daily, June 08: Marking Time ahead of the Week’s Big Events

Swiss Franc The Euro has fallen by 0.20% to 1.0916 EUR/CHF and USD/CHF, June 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets appear to be in a holding pattern ahead of this week’s big events, including the US CPI and the ECB meeting. Equities are little changed but with a heavier bias evident. Most of the large bourses in the Asia Pacific region were lower, except Australia, which eked...

Read More »FX Daily, November 24: Diverging PMIs Fail to Give the Dollar Lasting Support

Swiss Franc The Euro has risen by 0.04% to 1.0808 EUR/CHF and USD/CHF, November 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The contrast between the eurozone and US preliminary PMI readings caught the short-term market leaning the wrong way, and the dollar snapped back after extending its recent losses. However, today the US dollar is back on its heels and returning to yesterday’s lows against most major...

Read More »Emerging Markets: Week Ahead Preview

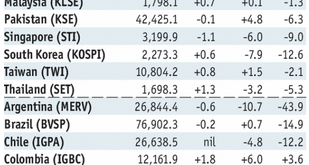

Stock Markets EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. Stock Markets Emerging Markets, August 22 - Click to...

Read More »Emerging Markets: Preview of the Week Ahead

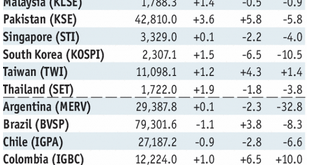

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX. Stock Markets Emerging Markets, May 30 Source: economist.com - Click to enlarge Indonesia Indonesia reports May CPI Monday, which is expected to rise...

Read More »Emerging Market Preview: Week Ahead

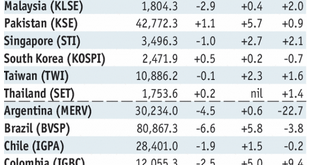

Stock Markets EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses. Stock Markets Emerging Markets, May 23 Source:...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org