Overview: The higher-than-expected US CPI and the strong expectation of a 100 bp hike by the Fed in two weeks is propelling the dollar higher. It jumped to almost JPY139.40 and the euro is off more than cent from yesterday's high (though holding above parity). Even where there has been favorable economic news, like the strong jobs report in Australia, is failed to dent the greenback. Most of the large bourses in the Asia Pacific regions advanced. Hong Kong is a...

Read More »Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the...

Read More »FX Daily, May 13: Long Lost Bond Vigilantes Sighted, Gives Dollar Fillip

Swiss Franc The Euro has fallen by 0.15% to 1.0957 EUR/CHF and USD/CHF, May 13(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is as if the bond vigilantes were pushed too far. US inflation is accelerating more than expected, and it cannot all be attributed to the base effect, and the Federal Reserve, to many investors, is tone-deaf. With powerful fiscal stimulus, nominal growth above 10%, and the...

Read More »FX Daily, June 25: Contagion Growth and Calendar-Effect Saps Investor Enthusiasm

Swiss Franc The Euro has fallen by 0.17% to 1.0644 EUR/CHF and USD/CHF, June 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Given the huge run-up in risk assets this quarter, and the technical indicators warning of corrective forces, concerns over the new infections is pushing on an open door. The S&P 500 gapped lower yesterday and fell 2.6%, led by energy and airlines. The NASDAQ snapped an eight-day...

Read More »FX Daily, March 17: Even Turn Around Tuesday is Flat

Swiss Franc The Euro has fallen by 0.21% to 1.0565 EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: While the markets are not as disorderly as they have been, the tone is fragile, and the animal spirits have been crushed. Australian stocks fell more than 10% last week and dropped another 9.7% yesterday before rebounding by almost 6% today to be one of the few Asia Pacific equity...

Read More »FX Daily, February 12: The Greenback Slips in Subdued Activity

Swiss Franc The Euro has fallen by 0.08% to 1.064 EUR/CHF and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is...

Read More »Emerging Markets: What has Changed

Summary Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly. Moody’s cut its 2018...

Read More »Emerging Market Week Ahead Preview

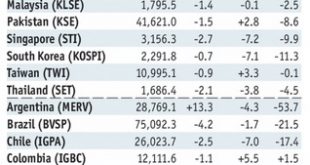

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »Emerging Markets: Preview of the Week Ahead

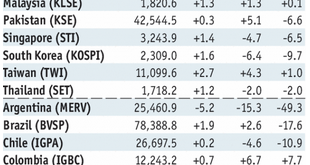

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More »Emerging Market Preview: Week Ahead

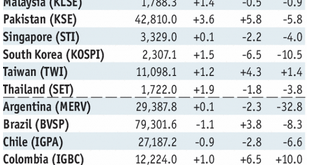

Stock Markets EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org