Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday. Taleb famously supercharged his career – and earned a considerable sum of money (though turns out it was less than Taleb felt he deserved) – thanks to his trading profits from...

Read More »Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

Don’t let “traditional biases” stop you from diversifying into gold – Dalio on Linkedin “Risks are now rising and do not appear appropriately priced in” warns founder of world’s largest hedge fund Geo-political risk from North Korea & “risk of hellacious war” Risk that U.S. debt ceiling not raised; technical US default Safe haven gold likely to benefit by more than dollar, treasuries Investors should allocate at...

Read More »SocGen: Beware The Ghost Of 1993

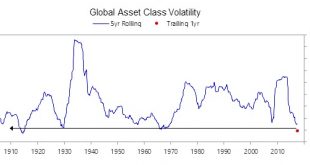

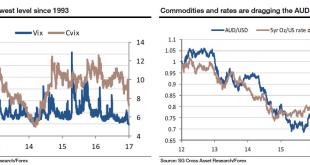

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note,...

Read More »How The Flash Crash Trader Was Scammed Out Of A $50 Million Fortune

The sad saga of Navinder Sarao, who on April 20, 2015 became the scapegoat for the May 2010 flash crash and was sentenced to up to 360 years in prison - he will find out later this year the actual length of his prison sentence - got its latest twist today thanks to a fascinating report how in addition to having lost his freedom, Nav also lost all of trading fortune, some $50 million of it. As Bloomberg's Liam Vaughn recounts, "it took Navinder Singh Sarao a long time to accept that he might...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Canadian Bank Starts Charging Negative 0.75% Rate On Most Foreign Cash Balances

BMO Nesbitt Burns - Click to enlarge Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada’s most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most...

Read More »BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the “VIX is now broken.” Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the “central banks’ central bank”...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org