I truly enjoyed the conversation with Hrvoje Morić. I hope you will enjoy it 2. Happy Weekend! In liberty, Claudio Claudio Grass, Hünenberg See, Switzerland This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here [embedded content]...

Read More »Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed. Yes, 2008. Also everything after. The Chinese have followed closely this style having realized what took Bernanke too long. That is, the...

Read More »De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part. KYC is a particularly...

Read More »The BIS Misses An Opportunity To Get Consistent With The Facts

Much has been made about the repo market since mid-September. Much continues to be made about it. The question is why. It is now near the middle of December and repo looks dicey despite repo operations and a not-QE small-scale asset purchase intended to increase the level of bank reserves. Always the focus on “funds” which may be available. It was John Adams who took on the task of defending several British soldiers on trial for the Boston Massacre. A wholly...

Read More »Seriously, Good Luck Dethroning the (euro)Dollar

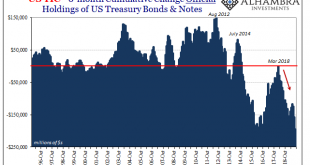

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y. Usually, it is the Chinese who are set to play the role of upstart. It makes sense. As the world’s second largest national economy...

Read More »Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey....

Read More »Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here...

Read More »Why the World’s Central Banks hold Gold – In their Own Words

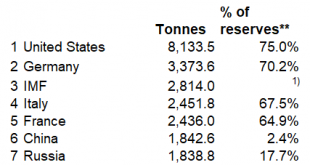

Collectively, the central bank sector claims to hold the world’s largest above ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range. This worldwide central bank group, also known as the official sector, spans central banks (such as the Deutsche...

Read More »The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org