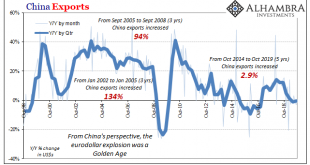

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving. For many of them, it is the typical broken windows stuff. The war devastated Europe and much of the...

Read More »Ein bedrohliches Zins-Szenario

Die Zinsen bleiben rekordtief: US-Notenbank Federal Reserve in Washington. Foto: Mark Wilson (Getty Images) Fast sechs Jahre ist es her, seit der einstige Finanzminister der USA und Topökonom Larry Summers im November 2013 in einer nur viertelstündigen Rede beim Internationalen Währungsfonds einem beinahe vergessenen Begriff wieder neue Prominenz verschafft hat: «Secular Stagnation» – Jahrhundert-Stagnation. Bekannt gemacht hat den Begriff Ende der 1930er-Jahre der US-Ökonom Alvin...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

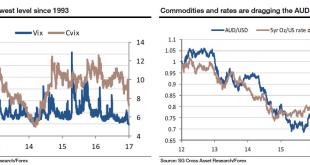

Read More »SocGen: Beware The Ghost Of 1993

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note,...

Read More »Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos’ elites discussed why the world needs to “get rid of currency,” the European Commission has introduced a proposal enforcing “restrictions on payments in cash.” With Rogoff, Stiglitz, Summers et al. all calling for the end of cash – because only terrorists and...

Read More »Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum. Unofficially, it’s the world’s...

Read More »The War On Cash Is Happening Faster Than We Could Have Imagined

Submitted by Simon Black via SovereignMan.com, It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos. But there have been...

Read More »Former Treasury Secretary Summers Calls For End Of Fed Independence

Larry Summers - Click to enlarge At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?…what could possibly go wrong? According to Market Watch, Summers argued that...

Read More »The Education Bubble: Is A Harvard MBA Worth $500,000?

College students are back at their desks this month facing bleak prospects. With tightening job markets leaving kids with no place else to go, universities continue to jack up fees. The upshot is growing signs that America is in the midst of an “education bubble,” just as big as those in stock, bond, and real estate markets. Case in point: four years at Harvard University now costs nearly $250,000 [1]. If you want an...

Read More »The Education Bubble: Is A Harvard MBA Worth $500,000?

The Education Bubble: Is A Harvard MBA Worth $500,000? Written by Peter Diekmeyer College students are back at their desks this month facing bleak prospects. With tightening job markets leaving kids with no place else to go, universities continue to jack up fees. The upshot is growing signs that America is in the midst of an “education bubble,” just as big as those in stock, bond, and real estate markets. Case in point: four years at Harvard University...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org