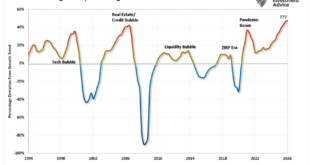

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

Read More »CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

Read More »Estimates By Analysts Have Gone Parabolic

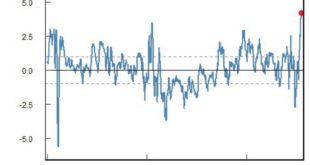

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing exuberance on Wall Street. As noted last week, correlations between all asset classes, whether international or emerging markets, gold or bitcoin, have all gone to one. Unsurprisingly, rationalizations justify illogic when too much money is chasing too few assets. Therefore, it should not be...

Read More »Bull Bear Report – Technical Update

I could not produce our weekly Bull Bear Report this past weekend as I presented at Michael Campbell's Moneytalks Conference in Vancouver. However, I wanted to use today's technical update to review some of the statistical analysis we produce each week in that commentary. Such is mainly the case given last Monday's "tariff" shock and Friday's employment report. (Subscribe for free to the weekly Bull Bear Report.) It was a second volatile week of trading, which was...

Read More »Episode 5 of The M3 Report with Steve St. Angelo

Is the energy crisis something that can be resolved? Was it always inevitable? Will renewable energy make it all OK? Are Western financial policies to blame? All this and more in today’s The M3 Report! If you’re not already subscribed to GoldCoreTV then click here right now to make sure you’re all set to watch the fifth episode of our flagship show. [embedded content] Featuring Mr. Energy himself Steve St. Angelo as well as a short explanation from Brent Johnson on...

Read More »Long Term Gold Price Prediction

What do the weather and the markets have in common? Quite a bit says this week’s guest! Kevin Wadsworth is a meteorologist-turned-chart analyst who has a lot of interesting insight and predictions into market movements and the price of gold. Kevin joins GoldCore TV host Dave Russell to discuss how he applies his 35 years of experience and methodology to financial markets. He takes us through the range of outcomes he sees for the economy, the US Dollar and precious...

Read More »How Long Will Inflation Last 2022

What if we told you that you could predict the future? For today’s guest, this is certainly the case when it comes to future market events. He hasn’t got a crystal ball, instead, he has nearly 300 years of historical analysis and models that have led him to the conclusion that markets operate in clear, predictable cycles. For Charles Nenner there is little point in trying to explain why something happened because it did happen and it will happen again. Charles Nenner...

Read More »Gold Price Today – Gareth Soloway

Dave Russell of GoldCore TV welcomes back Gareth Soloway of InTheMoneyStocks.com where we ask if the bull market for stocks is back and if $2,500 on gold is still on the cards for 2022? What role does the inversion of the yield curve play in signaling a US recession? [embedded content] [embedded content] You Might Also Like Gold Gives You Personal Sovereignty 2022-03-09 Dave Lukas of Misfit...

Read More »The Black Friday Stock Market Crash – Gareth Soloway

Black Friday 2021 saw the largest stock market sell-off since 1931. Is this the start of a bigger crash, has the trend changed or is this just a one-time blip? We ask Gareth Soloway of InTheMoneyStocks.com what his charts are suggesting and why he is so bullish on gold [embedded content] Make sure you don’t miss a single episode… Subscribe to our YouTube channel [embedded content] You Might Also Like...

Read More »All Inflation Is Transitory. The Fed Will Be Late Again.

In this issue of “All Inflation Is Transitory, The Fed WIll Be Late Again.“ Market Review And Update All Inflation Is Temporary The Fed Should Be Hiking Now Portfolio Positioning #MacroView: No. Bonds Aren’t Overvalued. Sector & Market Analysis 401k Plan Manager Follow Us On: Twitter, Facebook, Linked-In, Sound Cloud, Seeking Alpha Catch Up On What You Missed Last Week Market Review & Update Last week, we said: “The market is trading well into...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org