Here’s the latest sign that the massively fraudulent ICO market is headed for a collapse. Tezos’s investors are still waiting to learn when they can expect to receive the digital tokens that they paid a premium for during the company’s record-setting crowdsale. But as reports of abuse, internal strife and outright embezzlement have surfaced in the press, three groups of angry investors have filed class action lawsuits...

Read More »Study shows Swiss soils are suffering

Soil formation is a very slow process: it takes between 10 and 30 years, depending on the area, for the thickness of a layer of earth to grow by 1 millimetre. (Keystone) - Click to enlarge A first nationwide report on the health of Swiss soils has shown that virtually all are polluted and that the resource is not being put to sustainable use. The report, published Thursday by the Federal Office for the...

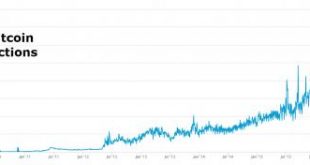

Read More »What Gives Cryptocurrencies Their Value

The value of cryptocurrencies like bitcoin, just like any other kind of money, comes fundamentally from what you can do with it. As a follow up to What Backs Bitcoin, I want to dig into that value. The idea, which comes from Austrian economist Carl Menger, is that just as a shovel’s value comes from its ability to dig, a currency’s value comes from its ability to help you do two things: transactions and savings. Think...

Read More »The Complete Idiot’s Guide to Being an Idiot

Style Over Substance There are many things that could be said about the GOP tax bill. But one thing is certain. It has been a great show. Obviously, the time for real solutions to the debt problem that’s ailing the United States came and went many decades ago. Instead of addressing the Country’s mounting insolvency, lawmakers chose expediency without exception. They kicked the can from yesterday to today....

Read More »Weekly Technical Analysis: 04/12/2017 – USD/CHF, GBP/USD, EUR/GBP, GBP/JPY, GBP/CAD

USD/CHF The USDCHF pair tested the correctional bearish channel’s resistance that appears on the chart and kept its stability below it, accompanied by witnessing clear negative signals through stochastic, which supprots the chances of bouncing bearishly to resume the bearish bias in the upcoming sessions, waiting to test 0.9800 level. Therefore, we suggest witnessing negative trading on the intraday and short term...

Read More »FX Daily, December 04: US Dollar Marked Higher After Senate Passes Tax Reform

Swiss Franc The Euro has risen by 0.46% to 1.1652 CHF. EUR/CHF and USD/CHF, December 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar opened higher in Asia and retained those gains through the European morning. The greenback has recouped most of the pre-weekend losses recorded in the wake of the indictment of a fourth former Trump Administration official...

Read More »UBS launches world’s first performance-based healthcare investment

Rajasthan has one of the highest maternal and newborn mortality rates in India (Keystone) - Click to enlarge The Zurich-based UBS Optimus Foundation has announced the launch of the first Development Impact Bond (DIB) in the field of healthcare. If successful, it could save over 10,000 lives in India. The foundation, which is the philanthropic arm of the Swiss bank UBS, will invest a total of $3.5 million...

Read More »Low Cost Gold In The Age Of QE, AI, Trump and War

Key topics in the video: – A bullion dealers view on ‘What will drive the markets in 2018?’– QE, inflation, Fed rates, debt bomb, China, populism, EU cohesion, Brexit, digital disruption, cashless society, demographics, Trump (war), Artificial intelligence (AI)– Solve global debt crisis with humongous amount of debt!?– Inflation – U.S. health insurance has increased 13% per annum since – How Artificial Intelligence...

Read More »The Bondo landslide: 3 months on

How do the people affected by a landslide that destroyed a Swiss village remember the events now? Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos...

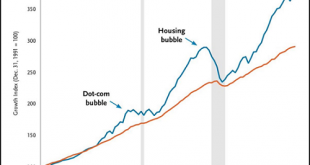

Read More »Stock Market 2018: The Tao vs. Central Banks

The central banks claim omnipotent financial powers, and their comeuppance is overdue. I will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations...

Read More » SNB & CHF

SNB & CHF