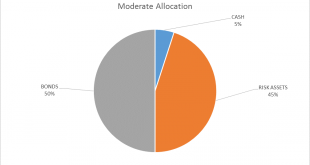

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash. Prediction is very difficult, especially about the future… Niels Bohr Every time I see that quote I think to myself, “but that...

Read More »Darwin Airline planes grounded

Prior to the grounding, the regional carrier offered flights from Lugano to Geneva and Rome (Keystone) Switzerland’s Darwin Airline, the Lugano-based regional carrier, was forced to halt all its flights on Tuesday after its licence was revoked by the Federal Office of Civil Aviation (FOCA) over financial problems. “The FOCA has announced the immediate withdrawal of the operating licence of the Darwin company (Adria...

Read More »Emerging Markets: What Changed

Summary Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook. The IMF approved a new $88 bln...

Read More »Swiss schools offer training for a life on the stage

At the beginning of 2009 a professional qualification for stage dancers was introduced in Switzerland. It's something that's been attracting international students to the country, and to this ballet school in Basel. (SRF, swissinfo.ch) The three-year "Federal Certificate of Proficiency" for stage dancers is offered in Switzerland at the Zurich Dance Academy, where it was first introduced; in Geneva at the Centre de Formation Professionnelle Arts Appliqués; and at Ballettschule Theater in...

Read More »FX Daily, December 01: Dollar Consolidates Weekly Gain, while Equities Ease to Start New Month

Swiss Franc The Euro has risen by 0.37% to 1.1705 CHF. EUR/CHF and USD/CHF, December 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another...

Read More »Great Graphic: US 2-year Yield Rises Above Australia for First Time since 2000

Summary: The US and Australian two-year interest rates have diverged. There is scope for a further widening of the spread. Directionally the correlation between the exchange rate and the rate differentials is strong, but not stable. Near-term technicals are supportive but the move above trendline resistance is needed to confirm. The steady increase in the US two-year yield while the market unwinds rate hike...

Read More »Amazon coming to Switzerland

© Calvin Leake | Dreamstime - Click to enlarge According to the newspaper Bilanz, Amazon has signed an agreement with Swiss post to provide rapid customs clearance. The head of postal customs, Felix Stierli, confirmed discussions with the company.A maximum customs clearance time of 3 hours will allow 24-hour delivery, one element of Amazon’s Prime offer. Once Prime is available, Swiss customers will be able to access...

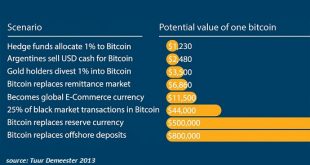

Read More »My Crazy $17,000 Target for Bitcoin Is Looking Less Crazy

The basis of this admittedly crazy forecast was simple: capital flows. I think we can all agree that bitcoin (BTC) is “interesting.” One of the primary reason that bitcoin (and cryptocurrency in general) is interesting is that nobody knows what will happen going forward. Unknowns and big swings up and down are characteristics of open markets.It’s impossible to forecast bitcoin’s future price because virtually all the...

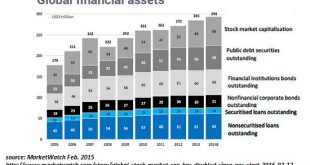

Read More »The Asymmetry of Bubbles: the Status Quo and Bitcoin

Shall we compare the damage that will be done when all these bubbles pop? Regardless of one’s own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the...

Read More »Japan: It isn’t What the Media Tell You

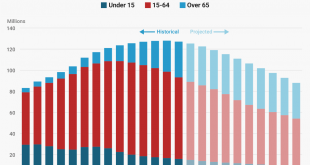

Known for Being Terrible For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics. Japan's Population by age, 1950 - 2065A chart of Japan’s much-bewailed demographic horror-show. - Click to enlarge Most people consider a declining population to be a bad thing due to the implications for assorted state-run pay-as-you-go Ponzi...

Read More » SNB & CHF

SNB & CHF