Please click above to subscribe to my channel Thanks for ing! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist . Please Click Below to SUBSCRIBE for More Special Reports Videos Thanks for ing!

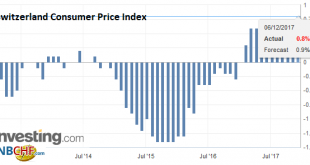

Read More »Swiss Consumer Price Index in November 2017: Up +0.8 percent against 2016, -0.1 percent against last month

The consumer price index (CPI) fell by 0.1% in November 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year. Switzerland Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to enlarge Swiss Consumer Price Index in November 2017 German Text...

Read More »Tourist accommodation during the 2017 summer season: Big increase in overnight stays in hotel

Neuchâtel, 05.12.2017 (FSO) – The hotel sector registered 21.3 million overnight stays in Switzerland during the summer tourist season (from May to October 2017). This represents an increase of 5.9% (+1.2 million overnight stays) compared with the same period a year earlier. With a total of 12.1 million overnight stays, foreign demand rose by 7.3% (+823,000). Domestic visitors registered a 4.0% increase (+356,000) with...

Read More »FX Daily, December 06: Equity Slump Continues, Lifts Bonds, Bolsters Yen

Swiss Franc The Euro has fallen by -0.03% to 1.167 CHF. EUR/CHF and USD/CHF, December 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The swoon in equities, perhaps sparked by a rotation spurred by potential US tax changes, is continuing today. It is providing a risk-off mood, which is expressed in the foreign exchange market as a stronger yen. The most compelling...

Read More »SWISS expands Zurich flights, fears airport restrictions

Thomas Klühr, the Chief Executive Officer of Swiss International Airlines, says a lower-value Swiss franc, lower fuel costs, more demand and more efficient aircraft helped boost his airline's profits in 2017. (Keystone) - Click to enlarge Switzerland’s national airline has enjoyed a profitable year and expects continued success, but its chief executive says restrictions at Zurich Airport are making it...

Read More »What’s the Point? Precious Metals Supply and Demand Report

Beginning of Post: See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Questions and Answers A reader emailed us, to ask a few pointed questions. Paraphrasing, they are: Who cares if dollars are calculated in gold or gold is calculated in dollars? People care only if their purchasing power has grown. What is the basis good for? Is it just mathematical play for gold...

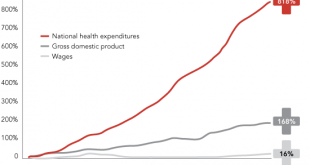

Read More »The Cost Basis of our Economy is Spiraling Out of Control

What will it take to radically reduce the cost basis of our economy? If we had to choose one “big picture” reason why the vast majority of households are losing ground, it would either be the stagnation of income or the spiraling out of control cost basis of our economy, that is, the essential foundational expenses of households, government and enterprise. Clearly, both rising costs and stagnating income cause...

Read More »FX Daily, December 05: Sterling Sold on Negotiating Snafu, Aussie Bounces on Retail Sales and RBA

Swiss Franc The Euro has fallen by 0.05% to 1.1678 CHF. EUR/CHF and USD/CHF, December 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is confined to narrow ranges against the euro and yen, straddling unchanged levels in the Asian session and the European morning. The action in elsewhere. The British pound is the weakest of the majors, paring 0.4% against...

Read More »Frustrated Investors File Lawsuits Against World’s Largest ICO

Here’s the latest sign that the massively fraudulent ICO market is headed for a collapse. Tezos’s investors are still waiting to learn when they can expect to receive the digital tokens that they paid a premium for during the company’s record-setting crowdsale. But as reports of abuse, internal strife and outright embezzlement have surfaced in the press, three groups of angry investors have filed class action lawsuits...

Read More »Study shows Swiss soils are suffering

Soil formation is a very slow process: it takes between 10 and 30 years, depending on the area, for the thickness of a layer of earth to grow by 1 millimetre. (Keystone) - Click to enlarge A first nationwide report on the health of Swiss soils has shown that virtually all are polluted and that the resource is not being put to sustainable use. The report, published Thursday by the Federal Office for the...

Read More » SNB & CHF

SNB & CHF