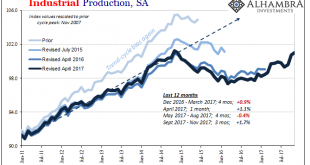

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017. For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months. Combining April 2017 with October, IP advanced by 2.2% leaving the other 10 to...

Read More »ALERT: Cheering For Bitcoin, Gold And Silver Report December 2017 Keith Weiner

Please click above to subscribe to my channel Thanks for ing! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist News Greg Mannarino Rob Kirby Reluctant.

Read More »Keith Weiner: Bitcoin Hyper Deflation Cheering for Bitcoin ALERT

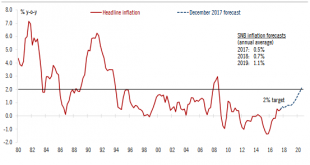

Increasingly optimistic on Swiss outlook

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between – 1.25% and-0.25% and the interest rate on sight deposits at a record low of – 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency...

Read More »Reindeer? No, postmen on skis!

The Swiss Post may soon be using drones to deliver Christmas packages in isolated areas, but 60 years ago, postmen used a good old analogue method: skis. Modern postmen have more to fear from aggressive dogs than sporting injuries. But last century, postmen in mountain areas of Switzerland risked breaking their necks to get the Christmas packages to their destinations on time. In this footage from the archives of Swiss Public Television, RTS, you can see how the post office in Einsiedeln...

Read More »Lawsuit seeks freezing of Tezos Foundation assets

Dark clouds loom over Tezos in California courts (Keystone) - Click to enlarge A fourth Tezos lawsuit filed in the United States has called on Californian courts to freeze an estimated $1 billion (CHF990 million) of investor assets sitting in a Swiss-based foundation. Law firm Block & Leviton argues that the recent departure of a Tezos Foundation director and the apparent replacement of the entity’s...

Read More »Swiss tourism – sharp rises and falls from some countries over the summer

© Martinmark | Dreamstime - Click to enlarge The number of visitors to Switzerland rose 6% this summer, but this headline figure hides some steep rises and falls. From May to October 2017, 11 million people holidayed in Switzerland, 644,000 more than the over same period in 2016. Swiss made up close to half the total (4.9 million), followed by Germans (950k), Americans (663k), Chinese (659k), British (396k), French...

Read More »Regulating Cryptocurrencies–and Why It Matters

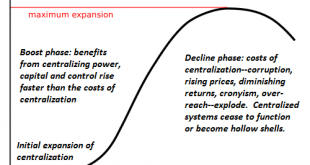

Nations that attempt to limit cryptocurrencies’ ability to solve these problems will find that protecting high costs and systemic friction will grind their economies into dust. There’s a great deal of confusion right now about the regulation of cryptocurrencies such as bitcoin. Many observers seem to confuse “regulation” and “banning bitcoin,” as if regulation amounts to outlawing bitcoin. Further confusing things is...

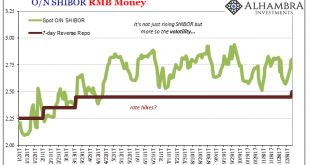

Read More »Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the...

Read More »How the Asset Bubble Could End – Part 1

Another Shoeshine Boy Moment We recently pondered the markets while trying out our brand-new electric soup-cooling spoon (see below). We are pondering the markets quite often lately, because we believe tail risk has grown by leaps and bounds and we may be quite close to an important juncture, i.e., the kind of pivot that can generate both a lot of excitement and a lot of regret all around. Provided one manages to...

Read More » SNB & CHF

SNB & CHF