- Click to enlarge I joined Alix Steel and David Westin on the Bloomberg set earlier today. Click here for the link. In the roughly 2.5 minute clip, we talk about the US and and the monetary cycle in Europe. In the US, Q4 was another quarter of above trend growth. The Atlanta Fed says the economy is tracking 2.7%, while the NY Fed puts it at 4.0%. To my way of thinking about the situation, many observers seem to be...

Read More »Number of unemployed in Switzerland drops by 4 percents

There were more vacancies advertised at the unemployment office than the year before (Keystone) The Swiss unemployment rate fell from 3.3% in 2016 to 3.2% in 2017, according to figures released by the State Secretariat for Economic Affairs (SECO) on Tuesday. In terms of actual numbers, 143,142 people were registered as unemployed, a decrease of 6,175 compared with the year before. The fall was particularly marked in the...

Read More »Gold Prices Rise To $1,326/oz as China U.S. Treasury Buying Report Creates Volatility

– Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying – Equities fell sharply on the report as did Treasurys and the U.S. dollar – Chinese officials think U.S. debt is becoming less attractive compared to other assets – Trade tensions could provide a reason to slow down or halt U.S. debt purchases – U.S. dollar vulnerable as China remains biggest buyer of U.S. sovereign debt – Currency wars to...

Read More »Yes, But at What Cost?

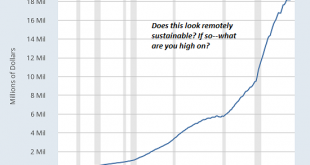

This is how our entire status quo maintains the illusion of normalcy: by avoiding a full accounting of the costs. The economy’s going great–but at what cost? “Normalcy” has been restored, but at what cost? Profits are soaring, but at what cost? Our pain is being reduced–but at what cost? The status quo delights in celebrating gains, but the costs required to generate those gains are ignored for one simple reason: the...

Read More »UBS-Präsident Axel Weber wird sein blaues Wunder erleben – mit der Zahlungsunfähigkeit der SNB

- Click to enlarge Axel Weber hat zwei Seelen in seiner Brust: eine als Ex-Notenbanker, eine als UBS-Präsident. Als Präsident der Deutschen Bundesbank hatte der Deutsche Weber gesagt, es gäbe keine Einlösungsverpflichtung der Deutschen Bundesbank für eine Banknote. „Wirtschaftlich gesehen sind unsere Banknoten eine Verbindlichkeit des Eurosystems. Dabei handelt es sich aber eher um eine abstrakte Verpflichtung. Wer...

Read More »FX Daily, January 10: Yen Short Squeeze Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00....

Read More »Trade Unions Call for Fewer Hours, More Gender Equality

Employees should also benefit from increased productivity, say trade unions. Pictured here is the dishwasher assembly line at the V-ZUG factory in Zug, Switzerland. (© KEYSTONE / GAETAN BALLY) The Swiss Trade Union Federation is demanding shorter work weeks, compensation for pension losses and enforcement of equal pay for men and women. At its annual media conference in Bern on Thursday, the Swiss Trade Union...

Read More »10 Reasons Why You Should Add To Your Gold Holdings

10 Reasons Why You Should Add To Your Gold Holdings – Gold currently undervalued– Since 2000, the gold price has beaten the S&P 500 Index– A ‘a once-in-a-decade opportunity’ as gold-to-S&P 500 ratio is at its lowest point in 10 years.– Reached ‘peak gold’ as exploration budgets continue to tighten– $80 trillion sits in global equities, a ‘ticking time bomb’ – Gold remains an appealing diversifier in the current...

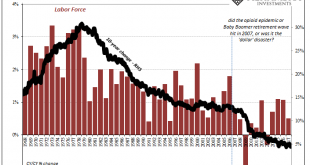

Read More »The Reluctant Labor Force Is Reluctant For A Reason (and it’s not booming growth)

In 2017, the BLS estimates that just 861k Americans were added to the official labor force, the denominator, of course, for the unemployment rate. That’s out of an increase of 1.4 million in the Civilian Non-Institutional Population, the overall prospective pool of workers. Both of those rises were about half the rate experienced in 2016. While population growth slowed last year, it produced, apparently, an almost...

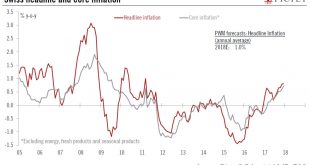

Read More »Switzerland: Inflation at a seven-year high

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) rose slightly from 0.6% y-o-y in November to...

Read More » SNB & CHF

SNB & CHF