We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »RMR: Special Guest – Charles Hugh Smith – Of Two Minds (02/19/2018)

Charles and "V" discuss the 13 indictments that show absolutely the stupidity of the Mueller investigation, the opportunity ahead with blockchain, cryptocurrency and why it's important to take advantage now. We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. Please subscribe for the latest shows daily! http://www.roguemoney.net...

Read More »FX Daily, February 19: Monday Market Update

Swiss Franc The Euro has risen by 0.09% to 1.152 CHF. EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed in uneventful turnover. Of note, the dollar selling seen in Asia last week slacken today and the greenback moved above the pre-weekend highs seen in the US. It is the first time in eight sessions, the dollar...

Read More »Switzerland tops latest financial secrecy index

While Switzerland isn’t the most financially secretive nation in the Tax Justice Network’s recently published report, its combination of size and secrecy pushed it into first place, the worst rank in the Financial Secrecy Index 2018. Size is factored in because it measures the damage a nation’s financial secrecy has on the world, says The Tax Justice Network. © Kevkhiev Yury _ Dreamstime.com - Click to enlarge The...

Read More »Is The Gold Price Heading Higher? IG TV Interview GoldCore

Is The Gold Price Heading Higher? IG TV Interview GoldCore Research Director at GoldCore, Mark O’Byrne talks to IG TV’s Victoria Scholar about the outlook for the gold price. In this interview, Mark O’Byrne, research director at Goldcore, says the fact that the gold price did not spike during last week’s equity sell-off was to be expected. He said even at the height of the global financial crisis, amid the collapse in...

Read More »US IP On The Other Side of Harvey and Irma

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017). US Industrial Production, Jan 1995 - 2018(see more posts on U.S. Industrial...

Read More »Emerging Markets: Week Ahead Preview

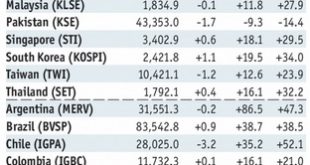

Stock Markets EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally. Stock Markets Emerging Markets, February 14. Thailand Thailand reports Q4 GDP Monday, with growth...

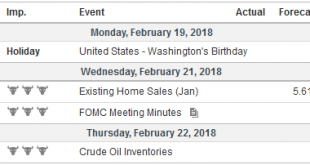

Read More »FX Weekly Preview: Four Key Numbers in the Week Ahead

The US markets are closed on Monday, and many parts of Asia will continue to celebrate the Lunar New Year. The economic schedule is fairly light, and market psychology appears fragile after the dramatic activity in equities and what appears to be shifting macro-relationships. To help navigate the challenging investment climate, we identify four “numbers” that can illuminate the path ahead. The equity market is center...

Read More »Forget fish and chips, this is raclette, London-style

Switzerland’s famous cheese dish is going down a treat in London, whether in “revisited” form on the Camden Market or in a more classic style on the Borough Market. Valais’ “national dish” is providing inspiration in the UK. (RTS/swissinfo.ch) Switzerland’s famous cheese dish is going down a treat in London, whether in “revisited” form on the Camden Market or in a more classic style on the Borough Market. Valais’ “national dish” is providing inspiration in the UK. --- swissinfo.ch is the...

Read More »Ticket cheats in Switzerland soon to be listed in a national register

Tickets cannot be bought on public transport in Switzerland. Passengers are required to have a ticket before boarding. Those caught on public transport without one will soon have their names put into a national register. This will ensure progressively higher fines are issued to repeat offenders. ©_SBB_CFF_FFS - Click to enlarge The new database will be rolled out from April 2019, reported RTS. By the end of 2019, the...

Read More » SNB & CHF

SNB & CHF