With the putative M5S-League government publishing its final common programme, we take a look at the road ahead for the Italian economy and for Italian government debt.We expect negative noise surrounding the Italian budget to intensify initially, but believe that negotiations with Brussels will result in compromises eventually, including dilution of the incoming Italian government’s fiscal easing measures. The biggest risks lie with the proposed rolling-back of the pension reforms, in our view.Italian spreads are likely to remain under widening pressure in the near term. However, the new government has put at risk our central scenario of a slight widening of Italian spreads to 160 bp by year-end, with a higher risk of overshoot to 200 bp depending on the actual policy measures

Topics:

Team Asset Allocation and Macro Research considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With the putative M5S-League government publishing its final common programme, we take a look at the road ahead for the Italian economy and for Italian government debt.

We expect negative noise surrounding the Italian budget to intensify initially, but believe that negotiations with Brussels will result in compromises eventually, including dilution of the incoming Italian government’s fiscal easing measures. The biggest risks lie with the proposed rolling-back of the pension reforms, in our view.

Italian spreads are likely to remain under widening pressure in the near term. However, the new government has put at risk our central scenario of a slight widening of Italian spreads to 160 bp by year-end, with a higher risk of overshoot to 200 bp depending on the actual policy measures implemented. Italy’s fiscal policy has been restrictive since 2011, leading to an improvement of its debt sustainability. In our central scenario, we expect the new government to become more lavish in its spending plans, but also to keep negotiating with the European Commission.

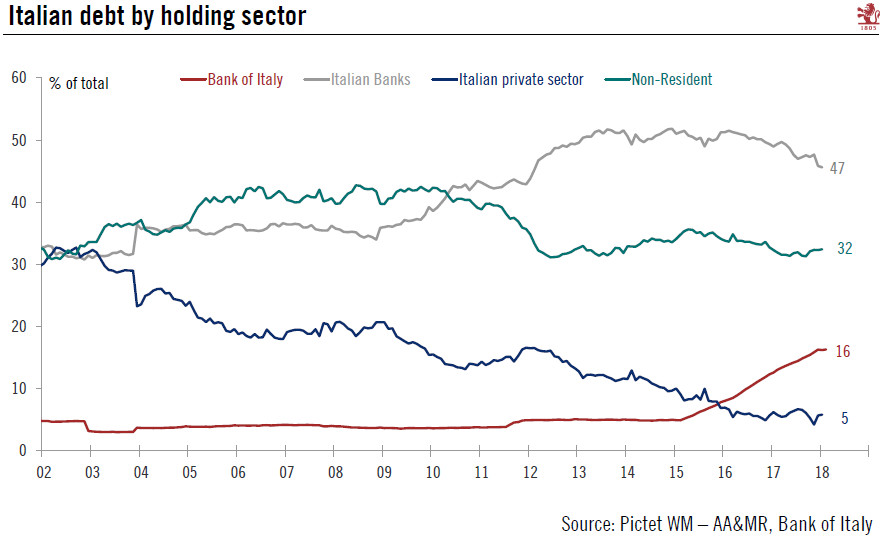

However, a sharp deterioration in the economic and fiscal outlook would raise the risk of a ratings downgrade and increase the pressure on BTPs. Italian debt is already considered to be of lower quality than Spanish debt, since the latter has been regularly upgraded in recent months. This explains why the spread for Spanish government bonds over Bunds is much lower. Italy still benefits from investment-grade ratings from the four main rating agencies, but they have all warned that fiscal profligacy on the part of the new government could lead to a downgrade. This is not part of our main scenario, but such a threat could fuel further widening pressure on Italian spreads over the coming months.

On a brighter note, the difference between the situation today and the 2011 sovereign debt crisis, when markets questioned Italian debt sustainability, cannot be stressed often enough. Macro-financial fundamentals have nearly all improved since then. The main risk we see with a M5S-League government is that Italy’s growth potential fails to improve, leaving long-term challenges intact.

But at this stage, we see no reason to change our annual real GDP forecast of 1.4% for Italy in 2018. Although downside risks have arguably increased since the start of the year, this is true for the euro area as a whole and not specifically for Italy.