While there are plenty of signs we are in the late stage of the business cycle, and while the Fed is tightening policy, we do not expect a recession in the US.The US economy is doing fine and we continue to expect solid growth in the coming quarters. The strength of corporate profits versus still-subdued unit labour costs is a sign of the robustness of the underlying US business cycle.One risk sometimes evoked is a sudden acceleration in inflation. But we forecast that core PCE inflation will remain close to 2% this year (our core PCE inflation forecast is 1.9%). In other words, we think core inflation is unlikely to spiral out of control. We therefore remain serene when it comes to inflation risk.The labour market is indeed tight, but we remain relaxed about the inflation risk for now.

Topics:

Thomas Costerg considers the following as important: Macroview, US economic forecast, US outlook, US recession risks

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While there are plenty of signs we are in the late stage of the business cycle, and while the Fed is tightening policy, we do not expect a recession in the US.

The US economy is doing fine and we continue to expect solid growth in the coming quarters. The strength of corporate profits versus still-subdued unit labour costs is a sign of the robustness of the underlying US business cycle.

One risk sometimes evoked is a sudden acceleration in inflation. But we forecast that core PCE inflation will remain close to 2% this year (our core PCE inflation forecast is 1.9%). In other words, we think core inflation is unlikely to spiral out of control. We therefore remain serene when it comes to inflation risk.

The labour market is indeed tight, but we remain relaxed about the inflation risk for now. Recent inflation and wage data support our view. Nor do we think the labour market is overheating, despite the low US unemployment rate. Temporary hiring and the rise in job openings, also suggest that the business cycle is in stellar shape, with little risk of a recession in the very near term.

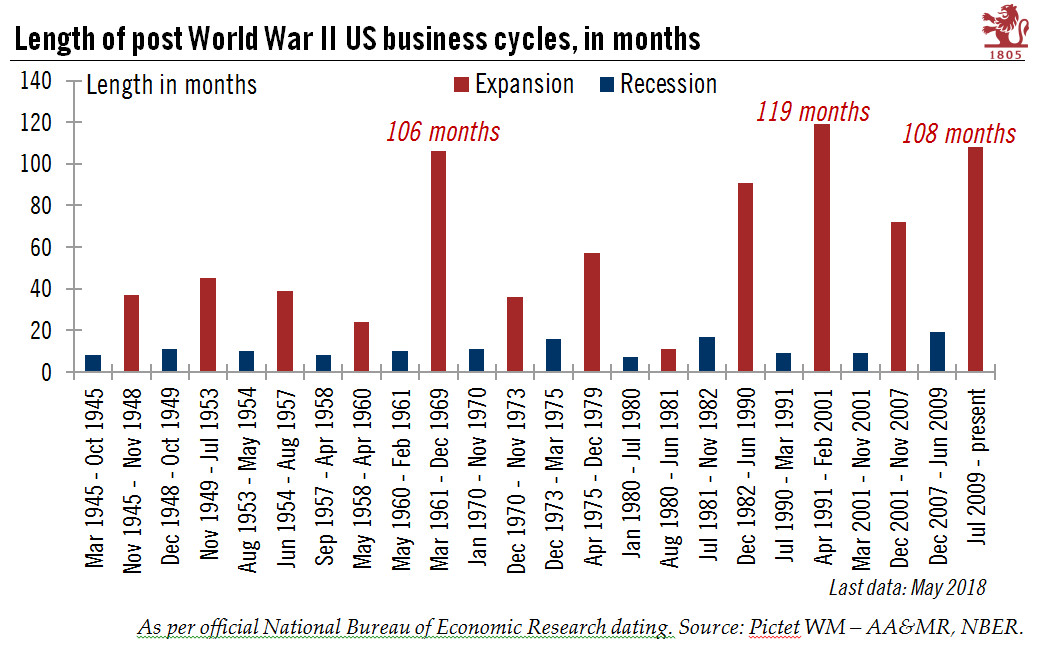

The length of the US business cycle is worth watching too. It is now 108 months since the US started the current phase of expansion in July 2009. This is the second-longest expansion since World War II. But as the adage goes, “expansions do not die of old age”.

While the Fed is raising rates, the Fed rate adjusted for core inflation is still close to zero at the moment. We see rate hikes remaining gradual, as the Fed is taking a cautious stance to ‘normalising’ policy. That should mean that real (inflation-adjusted) Fed interest rates will only be slightly positive in coming months; in other words we do not see the Fed as really standing in the way of the business cycle. Furthermore, bank lending surveys, such as the Fed’s senior loan officer survey, show underwriting conditions remain loose as well as a continued eagerness to lend to corporates.

The main threat to our growth scenario remains the risk of a ‘trade war’, especially if US rhetoric towards China escalates. This could reverberate on US business confidence and affect US corporate investment.

The situation on trade tariffs is still very fluid. We are not seeing the impact of the current trade ‘noise’ on US business confidence for now, but there could be some ramifications down the road if the US puts additional tariffs on Chinese goods. There could corporate investment, a key engine of growth. The reduced visibility on US trade policy means there is also less visibility and less certainty on our US growth forecast of 2.4% in 2019.