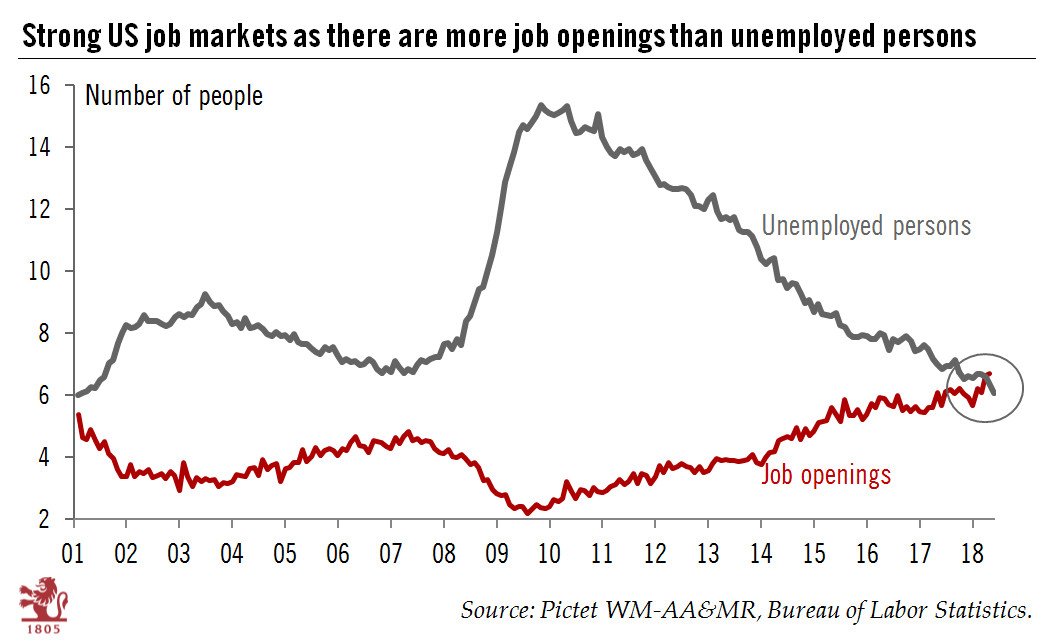

Growth in US jobs marches on: openings now exceed the numbers of unemployed.The US job market is going from strength to strength. The unemployment rate dropped to 3.8% in May, the lowest since April 2000. And another milestone has been reached as the number of job openings rose to 6.70 million in April, exceeding the number of unemployed people (6.1 million in May, 6.3 million in April)Job openings remain a good leading indicator for future US employment growth, and the ongoing momentum in that series (up 9.7% y-o-y in April) means a high likelihood that we will continue to see strong non-farm payrolls in coming months. Put differently, this also means the risk of a near-term US economic slowdown is low. In November 2007, a month before the recession, job openings had already started to

Topics:

Thomas Costerg considers the following as important: Macroview, us job creation, US job market, US job openings, US temporary hiring

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Growth in US jobs marches on: openings now exceed the numbers of unemployed.

The US job market is going from strength to strength. The unemployment rate dropped to 3.8% in May, the lowest since April 2000. And another milestone has been reached as the number of job openings rose to 6.70 million in April, exceeding the number of unemployed people (6.1 million in May, 6.3 million in April)

Job openings remain a good leading indicator for future US employment growth, and the ongoing momentum in that series (up 9.7% y-o-y in April) means a high likelihood that we will continue to see strong non-farm payrolls in coming months. Put differently, this also means the risk of a near-term US economic slowdown is low. In November 2007, a month before the recession, job openings had already started to turn (down 4.3% y-o-y). So the momentum in job openings means the recession risk remains at bay.

Furthermore, strong job openings are echoed by solid business surveys (including strong employment intentions) and strong hiring of temporary help services workers, another good leading indicator for job growth.

Is the US labour market so strong that it is on the verge of overheating? We would argue not, at least not yet. The number of ‘marginally attached to the workforce’, i.e. outside the labour force but wanting a job, remains above pre-global financial crisis levels, for instance. Also, there are structural factors keeping a lid on wage growth (which is still below 3% y-o-y), including key structural trends like automation, technology and globalisation.