The Q1 figure confirms our expectations of 1.8% growth this year, despite some clouds on the horizon Read the full report here Euro area GDP rose by 0.6% quarter on quarter (q-o-q) in Q1, in line with our above-consensus forecast. Evidence from high-frequency data suggests that domestic demand was the main engine of growth once again, supported by a strong rebound in both household consumption and corporate investment spending. We believe that momentum from this source still has legs: labour market conditions are improving, credit flows are picking up, and the policy mix remains ultra-supportive, mostly (albeit not only) thanks to the ECB. We maintain our projection for euro area GDP growth of +1.8% in 2016. However, some near-term caution remains warranted for two main reasons: first, official estimates of German and Italian Q1 GDP are not available yet and, second, some business surveys point to a loss of momentum in Q2. Meanwhile, the boost from lower oil prices and a weaker currency are fading, the external environment is challenging, and political risks remain elevated in a number of European countries. French GDP growth surprised to the upside, at +0.5% in Q1. The pace of expansion in Q1 leaves the French economy on course for its strongest performance in five years in 2016. The French government’s official forecast of 1.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro area growth, euro area political uncertainties, French growth, Macroview, Q1 eurozone growth, Spanish growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The Q1 figure confirms our expectations of 1.8% growth this year, despite some clouds on the horizon

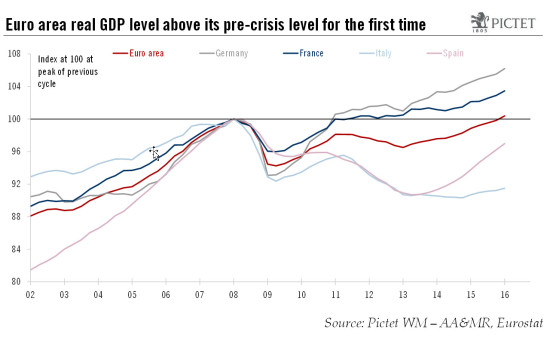

Euro area GDP rose by 0.6% quarter on quarter (q-o-q) in Q1, in line with our above-consensus forecast. Evidence from high-frequency data suggests that domestic demand was the main engine of growth once again, supported by a strong rebound in both household consumption and corporate investment spending. We believe that momentum from this source still has legs: labour market conditions are improving, credit flows are picking up, and the policy mix remains ultra-supportive, mostly (albeit not only) thanks to the ECB. We maintain our projection for euro area GDP growth of +1.8% in 2016.

However, some near-term caution remains warranted for two main reasons: first, official estimates of German and Italian Q1 GDP are not available yet and, second, some business surveys point to a loss of momentum in Q2. Meanwhile, the boost from lower oil prices and a weaker currency are fading, the external environment is challenging, and political risks remain elevated in a number of European countries.

French GDP growth surprised to the upside, at +0.5% in Q1. The pace of expansion in Q1 leaves the French economy on course for its strongest performance in five years in 2016. The French government’s official forecast of 1.5% GDP growth this year remains realistic, and is possibly even slightly conservative.

The Spanish economy continued to outperform the other large euro area economies, with estimated GDP growth of 0.8% q-o-q in Q1, beating consensus expectations. The Spanish economy is likely to continue to behave better than the rest of the euro area, posting GDP growth of around 2.7% in 2016 as a whole. However, the balance of risks surrounding our baseline scenario has worsened recently due to political uncertainties. These uncertainties could stretch beyond June, when new legislative elections could be held. Spanish public finances also remain a source of concern, and it is becoming increasingly likely that Spain will not meet its deficit target this year either.