Switzerland fulfils two of the three criteria required to be considered a currency manipulator by the US, but it is unlikely to affect the SNB’s monetary policy stance.In the next few days, the U.S Department of Treasury will publish its semi-annual report on International Economic and Exchange Rate Policies. Switzerland is one of six countries on the department’s monitoring list, as it meets two of the three conditions established by the US Treasury to be deemed a ‘currency manipulator’. The country has a current account larger than 3.0% of GDP and interventions in the foreign exchange market exceed 2% of GDP over a 12-month period.But Switzerland does not meet the third condition, running a USD13.7 billion trade surplus with the US (according to the latest data), compared with a US

Topics:

Nadia Gharbi considers the following as important: International Economic and Exchange Rate Policies report, Macroview, SNB monetary policy, Swiss trade surplus, Trump’s currency manipulation criteria, U.S Treasury’s semi-annual report

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Switzerland fulfils two of the three criteria required to be considered a currency manipulator by the US, but it is unlikely to affect the SNB’s monetary policy stance.

In the next few days, the U.S Department of Treasury will publish its semi-annual report on International Economic and Exchange Rate Policies. Switzerland is one of six countries on the department’s monitoring list, as it meets two of the three conditions established by the US Treasury to be deemed a ‘currency manipulator’. The country has a current account larger than 3.0% of GDP and interventions in the foreign exchange market exceed 2% of GDP over a 12-month period.

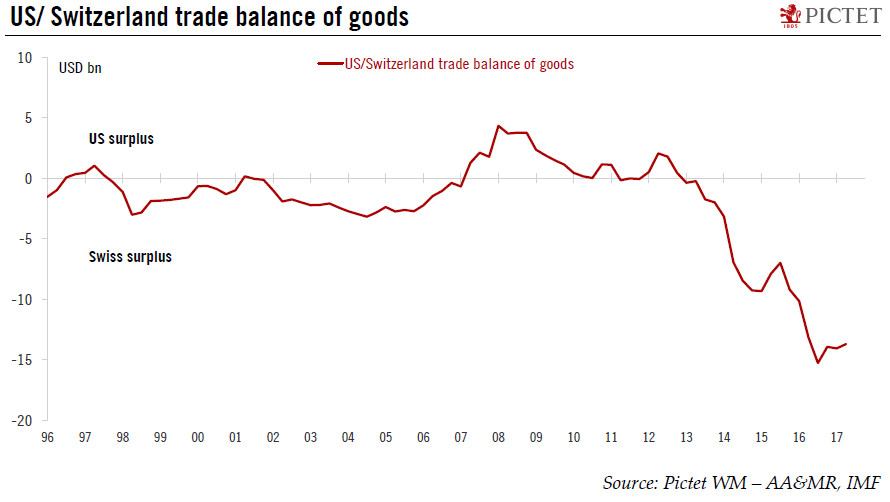

But Switzerland does not meet the third condition, running a USD13.7 billion trade surplus with the US (according to the latest data), compared with a US Treasury threshold of USD20 billion, although the Swiss trade surplus with the US has been growing significantly since 2014 (see Chart). The growth in the surplus might appear surprising when one thinks that during the same period the Swiss franc has appreciated against the dollar. One explanation can be found in what is traded. In particular, Switzerland’s growing chemical and pharmaceutical exports are proving relatively insensitive to currency fluctuations.

Even if the country is close to fulfilling all three criteria for being considered a currency manipulator, it is unlikely to affect the Swiss National Bank’s (SNB) monetary policy stance. Moreover, the US Treasury adopted a rather conciliatory view in its latest report, acknowledging the limits of Switzerland’s monetary policy options given the relatively small stock of domestic assets. In the near future, we expect the SNB to keep unchanged its two-pillar strategy.