The rise in the US deficit may sap support for Trump’s ambitious plans to cut taxes.US fiscal year 2017, which ended on September 30, did not end on a high note. The deficit rose to 3.5% of GDP, edging up 0.3 percentage point from fiscal year 2016. This deterioration stands in stark contrast to the overall improvement in the US economy. GDP growth remains above potential, and unemployment has been on a downward trend throughout the year.What is particularly puzzling, if not worrying, is the...

Read More »Broad-based rebound in euro area credit demand

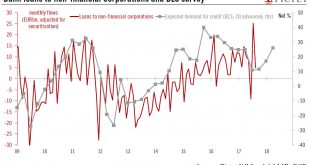

The latest ECB's lending survey shows credit conditions remain loose for the private sector, paving the way for cautious ECB policy normalisation.The ECB’s October Bank Lending Survey (BLS) indicated that credit standards were broadly unchanged in Q3, while some modest easing was expected in Q4. The brightest spot is loan demand, which is expected to rebound for all types of loans moving forward.Net demand for bank loans to enterprises increased further in Q3, in line with banks’...

Read More »Small dip in headline PMI hides robust domestic momentum

The euro area composite PMI index fell slightly in October, consistent with our forecast of a moderate slowdown in activity in Q4.The euro area composite flash PMI declined to 55.9 in October, from 56.7 in September, below consensus expectations, led by a drop in the services sector which offset an increase in manufacturing. However, survey details were fairly strong, especially in terms of job creation.In Germany, the survey points to robust private sector growth. The PMI index decreased,...

Read More »Economist Ducrozet Says ECB Could Still Surprise Markets

Oct.23 -- Frederik Ducrozet, Pictet Wealth Management senior economist, discusses his predictions for ECB policy with Bloomberg's Mark Barton on "Bloomberg Markets: European Close."

Read More »Economist Ducrozet Says ECB Could Still Surprise Markets

Oct.23 -- Frederik Ducrozet, Pictet Wealth Management senior economist, discusses his predictions for ECB policy with Bloomberg's Mark Barton on "Bloomberg Markets: European Close."

Read More »Little market reaction to escalating Catalan dispute

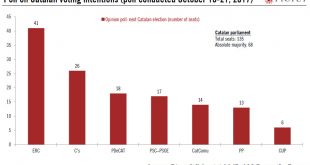

While markets have remained stoic about evolving political situation in the region, prolonged uncertainty could have an impact.The response given by the Catalan President Carles Puigdemont to the Spanish government’s ultimatum last week did not provide the clarity the central government was seeking on whether or not the Catalan parliament would formally declare independence.As a result, the central government therefore has decided to invoke Article 155 of the Spanish constitution, for the...

Read More »How investors can help tackle the world’s biggest problems

Published: Monday October 23 2017Mattias Ljungman, co-founder and partner at venture capital firm Atomico, says that whatever Donald Trump may want you to think, he and politicians like him are not the decisive change-makers of our age. It is clear that governments cannot solve our greatest problems on their own. Many of the challenges the world faces today have been on the agenda for years. Two of the greatest – climate change and the provision of adequate and manageable healthcare – have...

Read More »Central banks and a sustainable recovery

Published: Friday October 20 2017Mervyn King, Governor of the Bank of England between 2003 and 2013, discusses monetary policy since the financial crisis and what comes next with Cesar Perez Ruiz, Chief Investment Officer of Pictet Wealth Management.You once said that central banks need to be ‘as boring as possible’. Is that still the case today?Central banks should respond to developments in the economy as predictably as possible, so the news should not be about debates within a policy...

Read More »Still a long road to US tax overhaul

The Senate budget resolution this week was a positive step, but we remain cautious about the scope of any tax cuts eventually enacted.The US Senate this week approved a budget resolution, which effectively allows it to side-step Democrats’ opposition to start formulating tax cuts. The bottom line is that the Senate vote increases the odds of some tax cuts actually happening, but we think that the road to the finish line will be bumpy and that any tax cuts, if enacted, could be modest. There...

Read More »Euro construction momentum could remain strong

The acceleration in construction activity is boosting capital expenditure and supporting the euro area’s cyclical upturn.Since the beginning of the year, euro area capital expenditure has picked up noticeably. The acceleration has been mainly driven by the construction sector (which accounts for almost 50% of total capital expenditure), while business equipment has continued to expand strongly. Construction activity is still 19% below its pre-crisis (2008) level, and has room to improve....

Read More » Perspectives Pictet

Perspectives Pictet