Global growth, post-hurricane reconstruction and higher oil prices are all provided a boost to the US growth outlook. But uncertainty still hangs over tax cuts and the Fed.We are raising our US GDP forecast for 2017 (+0.1 percentage point to 2.3%) and 2018 (+0.3 point to 2.0%) on the back of stronger momentum in Q4 2017. Accelerating global growth is a tailwind for the US economy – as seen in the recent sharp pick up in exports, particularly to emerging markets. Reconstruction efforts in the southern US should also help support GDP in Q4.But the ‘big picture’ factors in our 2017-18 scenario remain unchanged still-tepid corporate investment, the probability of a limited fiscal boost, an ageing business cycle – remain in place, constraining our enthusiasm.Tax reform could be a boost to

Topics:

Thomas Costerg considers the following as important: Macroview, US Fed appointments, US growth forecast, US monetary policy, US tax cuts

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Global growth, post-hurricane reconstruction and higher oil prices are all provided a boost to the US growth outlook. But uncertainty still hangs over tax cuts and the Fed.

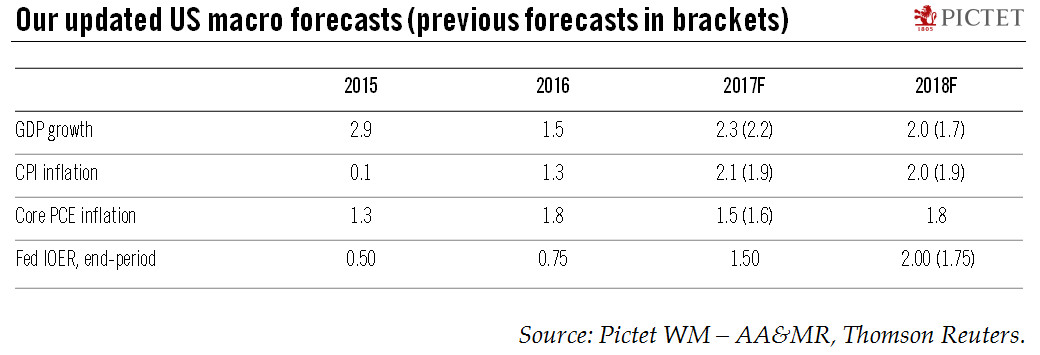

We are raising our US GDP forecast for 2017 (+0.1 percentage point to 2.3%) and 2018 (+0.3 point to 2.0%) on the back of stronger momentum in Q4 2017. Accelerating global growth is a tailwind for the US economy – as seen in the recent sharp pick up in exports, particularly to emerging markets. Reconstruction efforts in the southern US should also help support GDP in Q4.

But the ‘big picture’ factors in our 2017-18 scenario remain unchanged still-tepid corporate investment, the probability of a limited fiscal boost, an ageing business cycle – remain in place, constraining our enthusiasm.

Tax reform could be a boost to growth, but it is unlikely to have a huge effect on our growth outlook. If the reforms currently being discussed in Congress are enacted, we think the corporate tax cuts, in particular, will be spread out over time (we believe a couple of percent will be cut from the statutory rate over several years). But tax changes of any sort are far from certain.

Corporate tax cuts could help the investment picture, although they are unlikely to be a major game changer, in our view. We note that outside the energy sector, US corporates have remained prudent in their investment spending this year despite exceptionally favourable funding conditions.

Incoming Fed Chair Jerome Powell is widely expected to continue Janet Yellen’s gradual (and well telegraphed) monetary tightening. A risk to this view of mild Fed policy normalisation would be the delivery of bold one-off tax cuts, which could lead the Fed to become more hawkish and respond more aggressively to fiscal easing.

A key event to watch will be the replacement of New York Fed governor Bill Dudley, since the New York Fed president tends to have a large influence on Fed policy decisions. Overall, uncertainty around the Fed’s thinking remains elevated due to Trump’s ability to reshape the Board of Governors.

Still, better economic momentum leads us to add an additional rate hike to our scenario for 2018. We still see the Fed hiking in December and again in March, but we now foresee a last rate hike in June 2018, with the interest rate on excess reserves (IOER) then stabilising at 2.0% (up from 1.25% today). We are keeping our 2018 core PCE inflation forecast at 1.8%. Persistently sub-2% core inflation should mean Fed tightening will remain modest in 2018-19, in our view.