The surprising fall in euro area core inflation in October was largely driven by one-off factors we expect will be partly reversed.This week’s final euro area HICP report has provided us and the ECB with greater clarity over the drivers of the surprisingly large fall in core HICP inflation, from 1.11% to 0.89% year-on-year in October. The drop was largely led by one-off moves in Germany (airfares, package holidays) and by education prices in Italy. Although the latter will weigh on the annual rate for 12 months, we expect at least half of the October drop to be reversed.Whether core inflation resumes its upward march from November and into 2018 will be absolutely critical to the ECB’s outlook. In the chart below, we have plotted our projections for euro area core HICP under three possible

Topics:

Frederik Ducrozet considers the following as important: euro area core inflation, euro area GDP, Europe chart of the week, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The surprising fall in euro area core inflation in October was largely driven by one-off factors we expect will be partly reversed.

This week’s final euro area HICP report has provided us and the ECB with greater clarity over the drivers of the surprisingly large fall in core HICP inflation, from 1.11% to 0.89% year-on-year in October. The drop was largely led by one-off moves in Germany (airfares, package holidays) and by education prices in Italy. Although the latter will weigh on the annual rate for 12 months, we expect at least half of the October drop to be reversed.

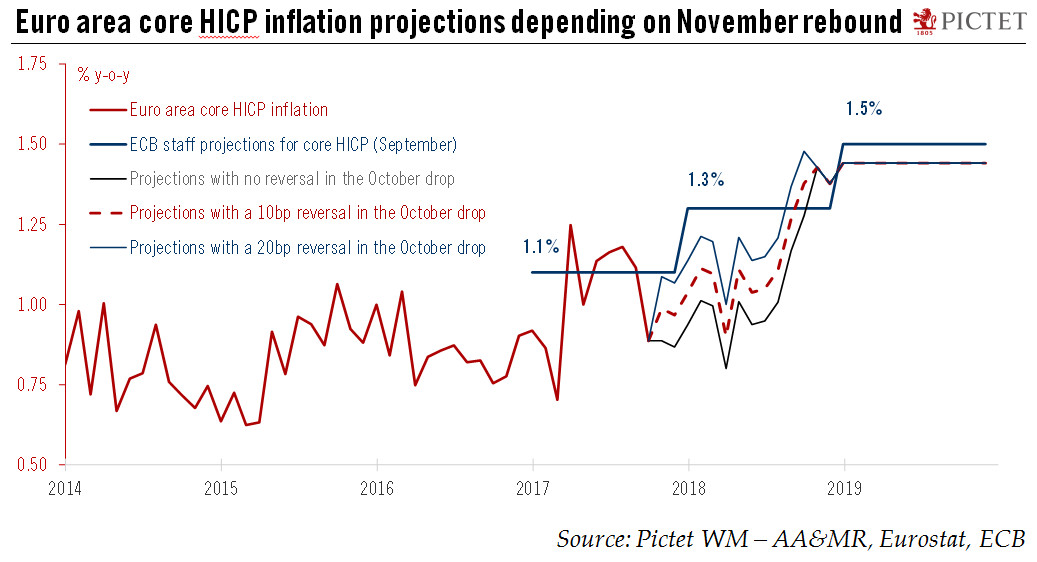

Whether core inflation resumes its upward march from November and into 2018 will be absolutely critical to the ECB’s outlook. In the chart below, we have plotted our projections for euro area core HICP under three possible scenarios, assuming a 0%, 0.1% or 0.2% rebound in the annual inflation rate in November, and using our current monthly forecast profile thereafter. It suggests that a large reversal in the October fall will be indeed required for core inflation to re-converge towards the ECB staff projections.

Of course, the ECB staff is likely to revise its GDP growth projections even higher in December, while keeping the implicit view that the Phillips curve still holds, however flat, non-linear and mis-specified. But our simulations suggest that ECB staff projections for core inflation may have to be revised down slightly in 2018, from 1.3% to 1.2%, despite reduced slack. Moreover, downward pressure on core prices could be amplified by the indirect effects of recent EUR appreciation. Such a modest downward revision to staff projections would not challenge the ECB’s broader normalisation strategy, in our view. Provided that a gradual, albeit self-sustained adjustment in underlying inflation continues, the ECB would still be in a position to terminate asset purchases by early 2019 as per our baseline.