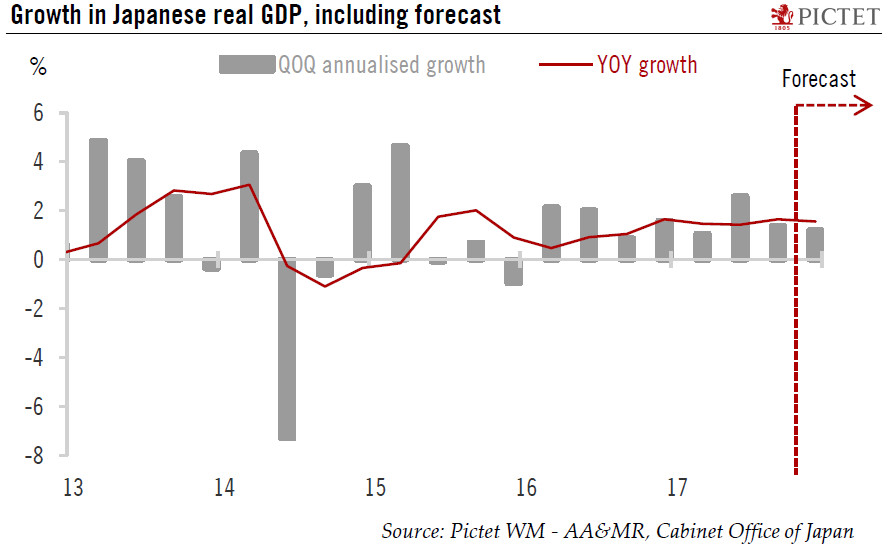

The latest GDP data confirm the economy is expanding steadily. While we have slightly lowered our growth forecast for this year, our 2018 forecast remains unchanged.Japanese GDP for Q3 came in at JPY545.8 trillion annualised, rising 1.4% q-o-q and 1.7% y-o-y in real terms.The data are broadly consistent with our view of a moderate deceleration of the Japanese economy in H2 after a strong Q2. The positive growth in Q3 marks the seventh consecutive quarter of economic expansion in Japan, the longest since early 2001.Exports were the main driver of growth in Q3, while household consumption slowed. Despite the softness in Q3, however, we expect household consumption to remain fairly robust.The recovery in fixed investment has been fairly slow, but corporate capex may improve in the months

Topics:

Dong Chen considers the following as important: Japan economy, Japan Q3 GDP, Japanese growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest GDP data confirm the economy is expanding steadily. While we have slightly lowered our growth forecast for this year, our 2018 forecast remains unchanged.

Japanese GDP for Q3 came in at JPY545.8 trillion annualised, rising 1.4% q-o-q and 1.7% y-o-y in real terms.

The data are broadly consistent with our view of a moderate deceleration of the Japanese economy in H2 after a strong Q2. The positive growth in Q3 marks the seventh consecutive quarter of economic expansion in Japan, the longest since early 2001.

Exports were the main driver of growth in Q3, while household consumption slowed. Despite the softness in Q3, however, we expect household consumption to remain fairly robust.

The recovery in fixed investment has been fairly slow, but corporate capex may improve in the months ahead. Fixed-capital formation was a drag on headline growth in Q3 after having been a positive contributor for five quarters.

Meanwhile, the growth in nominal GDP continues to rebound, rising by 1.7% y-o-y in Q3, compared to 1.1% in Q2 and 0.6% in Q1. The rise in nominal growth was mainly driven by the rise in the GDP deflator.

All in all, we expect strengthening global demand to continue to provide support to the export sector going forward, while domestic demand may see some softness in the near term as consumption and investment slow down. However, given a tight labour market and gradually rising incomes, domestic consumption may continue to recover after the soft patch seen in Q3. Corporate capex, especially in services, will likely see further improvement going forward.

With the latest data release, our full-year GDP forecast for Japan in 2017 is revised downward slightly to 1.5% from 1.6%, while our forecast for 2018 remains unchanged at 1.2%.