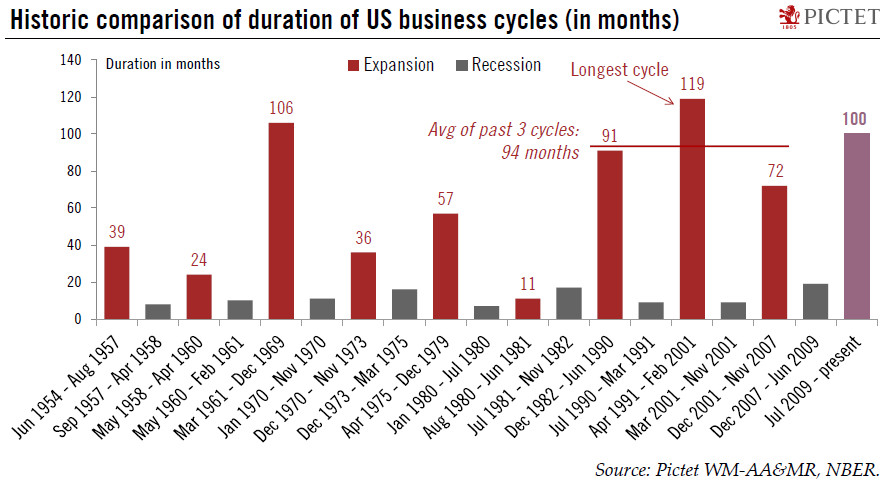

The US expansion has crossed the 100-month mark. But while it has aged, the economy still has legs.The US expansion, which started in July 2009, just crossed its 100-month mark, making it – for now – the third longest in the National Bureau of Economic Research database, which stretches back to 1854. The longest growth was 119 months between April 1991 and February 2001.The exceptional length of this expansion, already well above the 94-month average for the three previous growth cycles, raises the question of whether it will soon reach its expiry date. Our own view is that, while the US business cycle is ageing and we expect some slowdown in momentum next year, we are still some way from contraction.One key concept our Asset Allocation & Macro Research team emphasises is the ‘density’ of

Topics:

Thomas Costerg considers the following as important: Macroview, US business cycles, US economy, US expansion

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The US expansion has crossed the 100-month mark. But while it has aged, the economy still has legs.

The US expansion, which started in July 2009, just crossed its 100-month mark, making it – for now – the third longest in the National Bureau of Economic Research database, which stretches back to 1854. The longest growth was 119 months between April 1991 and February 2001.

The exceptional length of this expansion, already well above the 94-month average for the three previous growth cycles, raises the question of whether it will soon reach its expiry date. Our own view is that, while the US business cycle is ageing and we expect some slowdown in momentum next year, we are still some way from contraction.

One key concept our Asset Allocation & Macro Research team emphasises is the ‘density’ of an expansion, i.e. its length multiplied by its vigour. Vigour has been critically lacking in the current cycle, with average annual growth of only 2.2%, versus 2.8% for the previous expansion (2001-2007) and 3.8% in the 1990s. But slow may mean longer. Economic indicators suggest that the expansionary phase of this business cycle still has some fuel: initial jobless claims remain near historical lows, job openings continue to nudge up, and temporary employment (a key favourite of ours to track the cycle’s dynamics) remains on a strong upward trend.

To be sure, the US business cycle is ageing and must be watched closely as the peak is clearly passed. Job growth and car sales, for instance, are both decelerating. There is also deterioration in credit metrics, such as the rampant increase in household debt default rates (although from low levels). A significant tightening in credit conditions remains the biggest risk.