The US economy is increasingly reliant on activity in Texas, itself very dependent to oil.Texas, the second state by GDP after California, but better endowed than the latter with oil resources, has become a major driver of US growth, especially since the energy boom of the 2010s. What we’ve learned with the ups and downs of oil prices over the past few years is that high oil prices are great for Texas and therefore positive for the US economy, in spite of the hit to the individual US driver’s wallet. The risk, however, is that the US economy is becoming increasingly dependent on Texas oil, and that may expose it to some downside risk in the case of an unexpected slump in oil prices.The increasing reliance on Texas’ economy can be seen in its growing share of US GDP, expanding from 7.4% in

Topics:

Thomas Costerg considers the following as important: Macroview, Texas oil production, US economy, US GDP growth, US oil production

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The US economy is increasingly reliant on activity in Texas, itself very dependent to oil.

Texas, the second state by GDP after California, but better endowed than the latter with oil resources, has become a major driver of US growth, especially since the energy boom of the 2010s. What we’ve learned with the ups and downs of oil prices over the past few years is that high oil prices are great for Texas and therefore positive for the US economy, in spite of the hit to the individual US driver’s wallet. The risk, however, is that the US economy is becoming increasingly dependent on Texas oil, and that may expose it to some downside risk in the case of an unexpected slump in oil prices.

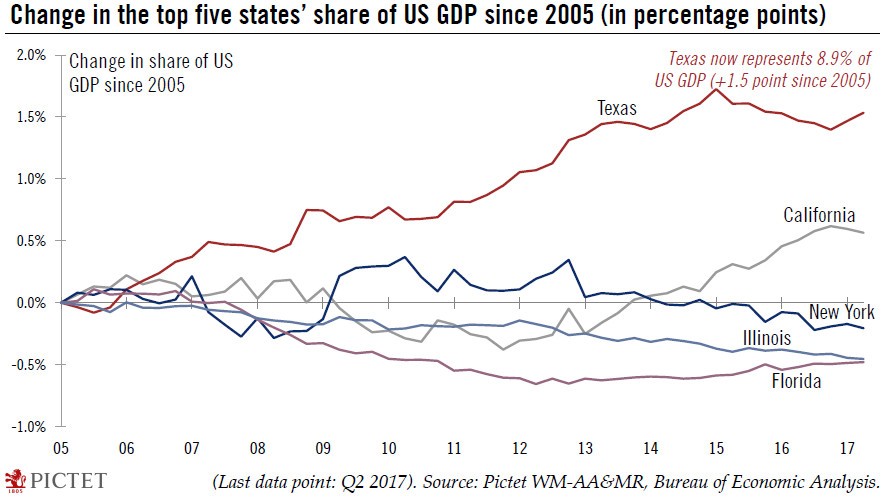

The increasing reliance on Texas’ economy can be seen in its growing share of US GDP, expanding from 7.4% in Q1 2005 to 8.9% in Q2 2017 (latest data available). Over the same period, California, supported by Silicon Valley’s ‘boom’, grew its share by ‘only’ 0.6 percentage point, to 13.9% of US GDP. By comparison, the share of Illinois and Florida each dropped 0.5 percentage point over the same period (to 4.1%, and 4.9% respectively). New York’s share dropped 0.2 percentage point to 7.6% of US GDP (see chart). California, Texas, New York, Florida and Illinois are the five biggest states by GDP.

Texas grew an annualised 3.2% per year between 2005 and Q2 2017, double the nationwide growth rate over the same period (1.5%), and more than California (1.9%). Texas’ oil production tripled between 2010 and 2015. Texas has shown particularly solid growth so far this year, helping to explain the recent sharp improvement in US activity. Texas’ GDP was up 2.9% y-o-y in Q2 2017, outperforming the US (2.2%) and California (2.6%).