The authorities are growing more tolerant of lower headline growth, which is already showing early signs of declining.The latest Chinese economic data for October indicate the moderate deceleration in growth already seen in Q3 is extending into Q4. Both exports and domestic demand have slowed, particularly in terms of fixed-asset investment. National fiscal spending has shown signs of slowing, and central government has cut off support for some regional infrastructure projects on concerns of excessive local fiscal burdens. This may suggest that the idea of quality growth over quantity, a principle that President Xi emphasised during the 19th Party Congress, is already being applied.On the external front, the decline in export growth was mainly caused by a slowdown in exports to the US. We

Topics:

Dong Chen considers the following as important: China economy, China growth deceleration, China growth forecast, Chinese quality growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The authorities are growing more tolerant of lower headline growth, which is already showing early signs of declining.

The latest Chinese economic data for October indicate the moderate deceleration in growth already seen in Q3 is extending into Q4. Both exports and domestic demand have slowed, particularly in terms of fixed-asset investment. National fiscal spending has shown signs of slowing, and central government has cut off support for some regional infrastructure projects on concerns of excessive local fiscal burdens. This may suggest that the idea of quality growth over quantity, a principle that President Xi emphasised during the 19th Party Congress, is already being applied.

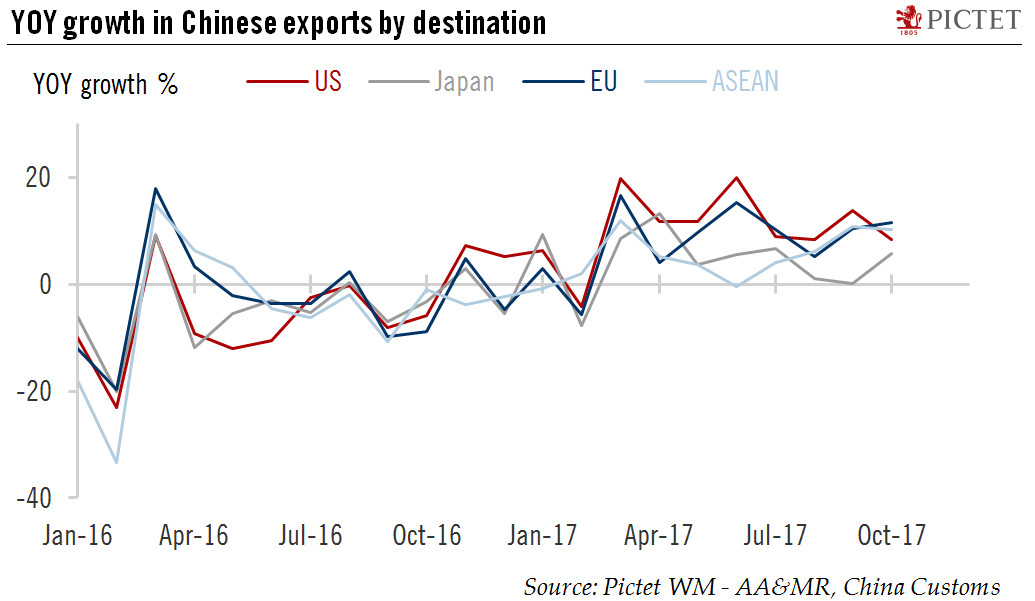

On the external front, the decline in export growth was mainly caused by a slowdown in exports to the US. We expect solid global demand to continue to provide support to the Chinese export sector going forward, but the growth rate may moderate further, as recent currency strengthening poses headwinds.

Although the upgrade in consumption upgrade by the Chinese middle class remains a major theme, Consumption growth declined moderately in October, with online sales continuing to outperform by a big margin.

All in all, while the Chinese government has traditionally maintained a “stop-and-go” approach to managing growth, we suspect this time could be a bit different. The recent data releases do not change our full-year GDP forecast of 6.8% for 2017 and 6.3% for 2018. However, there are signs showing the government’s tolerance for lower growth may be increasing after the Party Congress.