Summary:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain constructive on equities, which are being underpinned in particular by robust earnings growth.However, there are signs of pressure, especially in forex markets, and occasional spikes in volatility are likely, notably as a result of geopolitical risk. It is worth considering risk mitigation for portfolios put options on equity indices are one way to protect some of the downside.US tax cuts could provide a significant boost to 2018 earnings growth and US equities, but the legislative process is likely to dilute and delay the plans that have been outlined.Low correlations and a pick-up in disruptive M&A mean a good environment for active management.CommoditiesWhile a temporary surge in oil prices

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain constructive on equities, which are being underpinned in particular by robust earnings growth.However, there are signs of pressure, especially in forex markets, and occasional spikes in volatility are likely, notably as a result of geopolitical risk. It is worth considering risk mitigation for portfolios put options on equity indices are one way to protect some of the downside.US tax cuts could provide a significant boost to 2018 earnings growth and US equities, but the legislative process is likely to dilute and delay the plans that have been outlined.Low correlations and a pick-up in disruptive M&A mean a good environment for active management.CommoditiesWhile a temporary surge in oil prices

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s latest positioning in fast-evolving markets.

- We remain constructive on equities, which are being underpinned in particular by robust earnings growth.

- However, there are signs of pressure, especially in forex markets, and occasional spikes in volatility are likely, notably as a result of geopolitical risk. It is worth considering risk mitigation for portfolios put options on equity indices are one way to protect some of the downside.

- US tax cuts could provide a significant boost to 2018 earnings growth and US equities, but the legislative process is likely to dilute and delay the plans that have been outlined.

- Low correlations and a pick-up in disruptive M&A mean a good environment for active management.

Commodities

- While a temporary surge in oil prices is possible, for instance on geopolitical risk, we see limited upward pressure based on fundamentals. We estimate an equilibrium price over the next 12 months of USD55–58 per barrel for WTI, close to current levels.

Equities

- October was another good month for equities, and we remain generally bullish on euro area and Japanese equities. We are more neutral on richly valued US equities, although that would change if there are positive surprises on tax reform.

- We are neutral on tech stocks, bullish on prospects for financials and materials in both Europe and the US, and have moved to a more bullish stance on industrials and energy in Europe.

Currencies

- We see limited further downside for the EUR against the USD. We continue to expect a gradual weakening of the dollar in 2018, and estimate an EUR/USD rate of USD1.24 for end-2018.

- US 10-year Treasuries should yield around 2.6% by end-2018. Our end-2017 target for 10-year German Bunds is 0.70%, and we expect a further gradual increase in 2018.

- As we still expect yields to rise, we would stay underweight core sovereign bonds and short duration.

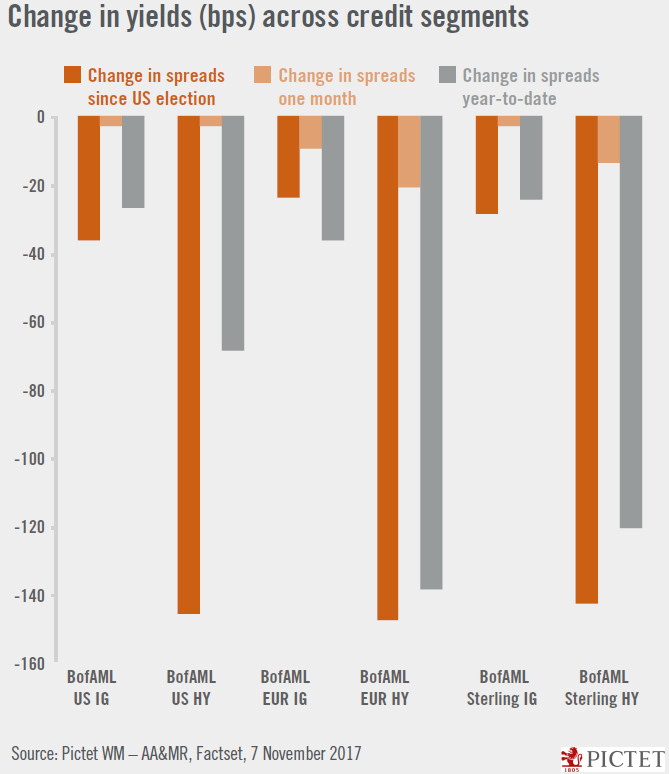

- We continue to see opportunities in credit. However, tight spreads on high yield leave little room for disappointment. Spreads are also tight on investment grade, but this is compensated by the carry, which remains reasonable.

Alternatives

- Our outlook for Hedge Funds remains positive, as monetary and political developments should work in favour of most strategies.

- Valuations, competition and capital inflows remain high in Private Equity, but there are still good opportunities for attractive returns.

- We continue to see value in real estate investing.