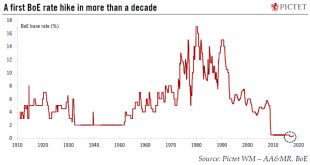

After a much-anticipated 25bp rate hike, further normalisation of policy will be conditional on progress in Brexit talks.The Bank of England (BoE) has raised rates for the first time in over a decade, while it hinted at a “limited and gradual” tightening cycle. Meanwhile, the assessment of the supply-side was downgraded once again amid “considerable risks” to the economic outlook. A 25bp rate hike alone is unlikely to have a material impact on the economy, beyond a small increase in the...

Read More »Adios bankers, hello robots?

Published: Thursday November 02 2017Olivier Capt says that technology will transform the wealth management industry, leading to higher client engagement, better advice and superior service.Winston Churchill once said: ‘Out of intense complexities, intense simplicities emerge.’ This is exactly what technology is driving today. Intense simplification is at work in all industries and customers now purchase, book, compare and select without relying on intermediaries.Humans are known to be lazy...

Read More »Limited scope for further drop in euro against the dollar

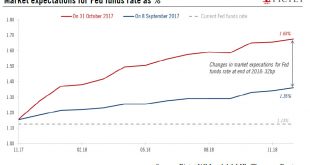

The USD has recovered against the euro of late, but the greenback could soon run out of steam.The US dollar has appreciated against the euro since 8 September and is getting close to our short-term forecast of USD1.15 per EUR. This recovery has been mainly driven by supportive US data, monetary policy divergence and hopes of tax reform.In the short term, robust US economic activity, a Fed that is still in rate-hiking mode and the still broadly negative sentiment surrounding the US dollar (as...

Read More »Signs that US rental boom could slow

After a sharp rise in the construction of rental units, vacancy rates are rising, and slowing rent growth could weigh on inflation metrics.The US has witnessed a striking boom in the construction of rental residential units in recent years. This can in part be explained by the rising allure of downtown living among millennials and ageing baby boomers alike. The boom can also be explained by the lingering effects of the subprime crisis, and the restrained access to mortgage credit that has...

Read More »Investing in a new sustainable economy

Published: Wednesday November 01 2017The former UN climate chief who presided over the negotiations that led to the 2015 Paris agreement on global warming is now urging investors, businesses and policymakers to grab ‘the opportunity of the century’ and invest in an economy-wide transition to a low carbon world.Words like ‘2020’, ‘milestones’ and ‘optimism’ which are scribbled on the windows-cum-whiteboard in Christiana Figueres’ reception room give some clues into the thinking of the former...

Read More »Euro area: solid growth, but inflation still under par

GDP figures confirming a strong and steady expansion have yet to turn up in core inflation data.According to preliminary Eurostat estimates, euro area real GDP increased by 0.6% q-o-q in Q3, slowing marginally from an upwardly-revised 0.7% in Q2. A breakdown by expenditure components will not be released until 14 November, but domestic demand was likely the key driver in the euro area’s solid momentum.At a country level, France and Spain are the first of the big four euro area economies to...

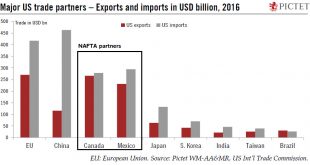

Read More »NAFTA update — Calling Trump’s bluff

We see little risk of NAFTA falling apart in the near term, but question marks remain about the US’s commitment to free trade in the longer term.NAFTA renegotiation talks, which have hit a wall as a result of the US’s blatantly mercantilist and protectionist approach, will resume in mid-November in Mexico against the backdrop of some heavy-handed anti-dumping initiatives by the US authorities, with the slapping of punitive trade tariffs on some Canada-manufactured airplanes in October still...

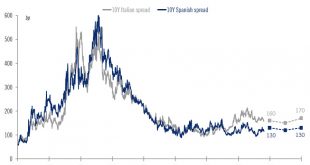

Read More »Italian and Spanish bonds relatively immune to politics

While political risks have fallen marginally in Italy, political tensions have intensified in Spain. But, as things stand, we do not think that political risk in either country will lead to a systemic crisis.Italy and Spain have been at the centre of market attention again in recent weeks. Italian politics have livened up as we move towards the general election next spring 2018, while the threat of Catalan independence has placed the spotlight on Spain. But we expect only a slight widening...

Read More »Passive investing threatens the sustainability of our capital markets

Published: Tuesday October 31 2017Renaud de Planta argues that if the majority of investors embrace index funds, they are likely to lead to less efficient markets and weaker corporate governance.To its growing band of proponents, passive investing is looked on as a panacea. Equity tracker funds, we’re told, will rid the financial market of toxic elements and restore it to full health.At first glance, it’s a persuasive argument. Poorly performing and expensive active managers have lingered...

Read More »Downward pressure on Swiss franc could fade in 2018

While its persistent weakness leads us to change our short-term forecast for the franc, our outlook for the currency next year remains unchanged.The Swiss franc remains weak, notably against the euro, despite geopolitical tensions, elevated political uncertainty in Spain and some euro weakness relative to the US dollar. This means that the unattractiveness of the franc (based on its high valuation and low yield) outweighs its defensive features.In the short term, given interest rates...

Read More » Perspectives Pictet

Perspectives Pictet