Le Matin. The National council thinks shops should stay open until 8pm across all of Switzerland. 115 members against 68 would like to see shop opening hours harmonised across the country. The proposal would mean that retailers across Switzerland would be allowed to open from 6am until 8pm from Monday to Friday and from 6am until 6pm on Saturdays. Public holidays would be exempted and cantons would be able to opt for longer opening hours if they chose to. A fight against cross-border...

Read More »Geneva’s Left wants 1% of salaries to pay for dentistry

20 Minutes. Geneva’s Ensemble à gauche and Socialist parties want to see compulsory dental care and presented a proposal to Geneva’s parliament in mid-February. On Monday Geneva’s labour party (Parti du travail) launched a cantonal initiative for the same thing. © Nejron | Dreamstime.com The plan would be funded by compulsory salary deductions of 1%. Half of this would be categorised as a payment by employers and half by employees. In many cases the full 1% would eventually be born by...

Read More »Swiss GDP pick-up beats forecast

Investec Switzerland. The Swiss economy returned to growth at the end of last year as it fought off the impact of a currency shock that had threatened to push the country into a recession. Gross domestic product rose 0.4 percent in the three months through December, after contracting 0.1 percent in the prior quarter, the State Secretariat for Economic Affairs in Bern said on Wednesday. That’s the strongest quarter in a year and beats the median economist estimate for a 0.1...

Read More »USA: The New Switzerland?

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html USA: The New Switzerland? Written by Jeff Thomas (CLICK FOR ORIGINAL) At one time, tax havens took great pride in calling themselves just that, since low-tax jurisdictions provide people with freedom from oppressive taxation. But, in recent decades, the...

Read More »The Global Run On Physical Cash Has Begun: Why It Pays To Panic First

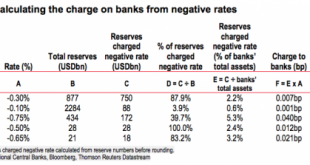

Back in August 2012, when negative interest rates were still merely viewed as sheer monetary lunacy instead of pervasive global monetary reality that has pushed over $6 trillion in global bonds into negative yield territory, the NY Fed mused hypothetically about negative rates and wrote "Be Careful What You Wish For" saying that "if rates go negative, the U.S. Treasury Department’s Bureau of Engraving and Printing will likely be called upon to print a lot more currency as individuals and...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »The SMI’s limited exposure to oil and energy left it trailing global gains

Investec Switzerland. The SMI is set to close modestly higher this week, although lagging behind gains of global equity markets. Stock markets around the world benefited from a substantial rebound in the price of crude oil this week which has been a key driver of investor sentiment recently. The limited exposure of the SMI to the oil and energy sector explains some of the indexes underperformance against the MSCI World lately. © Solarseven | Dreamstime.com This week’s...

Read More »Swiss franc rises on ‘Brexit’ angst

Brought to you by Investec Switzerland. Once again, Switzerland is getting saddled with unwanted currency appreciation due to other nations’ struggles. The franc posted its biggest gain since August against the euro as concern that the U.K. may exit the European Union dragged down the pound and with it the 19-nation shared currency. China’s decision to cut its daily yuan fixing by the most in six weeks also spurred demand for the safest assets. The franc jumped against all of its Group-of-10...

Read More »Why the new Swiss bank notes are set to become even more sought after

Swiss money is about to change. On 12 April 2016, the Swiss National Bank (SNB) will put a new 50-franc note into circulation. The new 20-franc note will be released the following year, and the other four denominations – 10, 100, 200 and 1,000, at half-yearly or yearly intervals after this date, with the last hitting the streets in 2019. © Peter Kim | Dreamstime.com The release of these new Swiss notes is the end of more than 10 years work. At the beginning of 2005, twelve designers were...

Read More »Swiss share market up despite continued decline in sentiment

Investec Switzerland. The SMI is set to close higher this week tracking gains of global equity markets. The SMI recovered almost a third of its year to date losses this week on higher oil prices, hopes of new Chinese economic stimulus and a lower than previously expected pace of US rate hikes. © Naiyanab | Dreamstime.com While turbulence in financial markets eased in this week, investors are still monitoring the global glut in crude oil and whether Chinese leaders will...

Read More » le News

le News