Investec Switzerland. The SMI is set to close higher this week tracking gains of global equity markets. The SMI recovered almost a third of its year to date losses this week on higher oil prices, hopes of new Chinese economic stimulus and a lower than previously expected pace of US rate hikes. © Naiyanab | Dreamstime.com While turbulence in financial markets eased in this week, investors are still monitoring the global glut in crude oil and whether Chinese leaders will take action should the slowdown of the nation’s economy accelerate. Another boost for investor sentiment came from the US on Wednesday after minutes from the January Federal Open Market Committee meeting showed that officials are likely to reduce their projected number of rate increases this year. The recent market turmoil along with declining inflation expectations gives the central bank scope to delay raising interest rates. In Switzerland, the ZEW-CS-Indicator for the economic sentiment has continued its decline in February 2016. Falling slightly by 2.9 points, the index now stands at minus 5.9 points. This suggests that the analysts surveyed tend to expect a decline in Swiss economic activity as outlook expectations for the Eurozone distinctly deteriorated. Other data released on Thursday showed that the Swiss trade surplus increased to a 3-month high of CHF 3.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

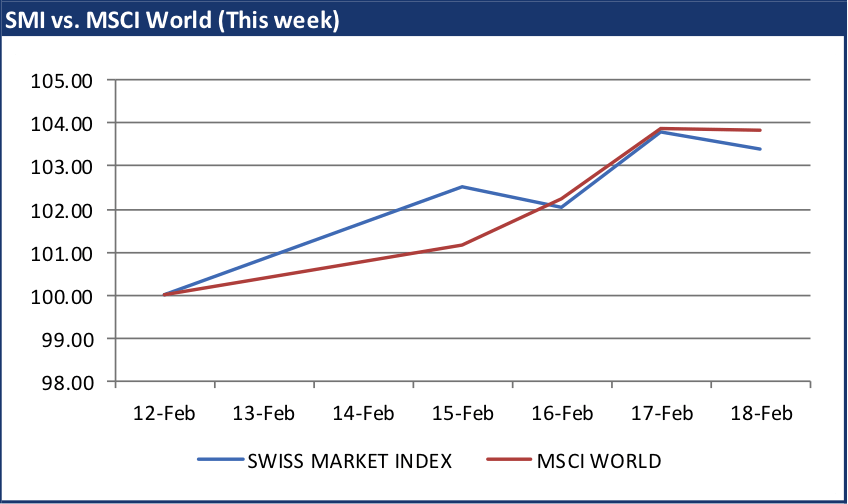

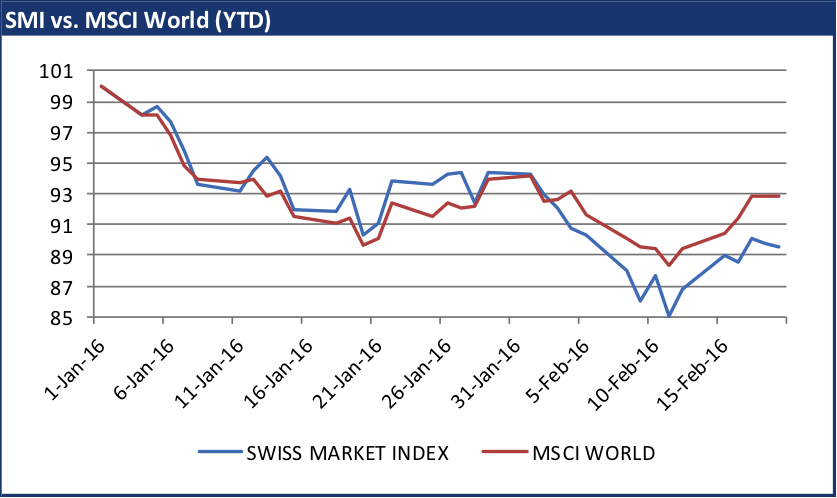

The SMI is set to close higher this week tracking gains of global equity markets. The SMI recovered almost a third of its year to date losses this week on higher oil prices, hopes of new Chinese economic stimulus and a lower than previously expected pace of US rate hikes.

© Naiyanab | Dreamstime.com

While turbulence in financial markets eased in this week, investors are still monitoring the global glut in crude oil and whether Chinese leaders will take action should the slowdown of the nation’s economy accelerate. Another boost for investor sentiment came from the US on Wednesday after minutes from the January Federal Open Market Committee meeting showed that officials are likely to reduce their projected number of rate increases this year. The recent market turmoil along with declining inflation expectations gives the central bank scope to delay raising interest rates.

In Switzerland, the ZEW-CS-Indicator for the economic sentiment has continued its decline in February 2016. Falling slightly by 2.9 points, the index now stands at minus 5.9 points. This suggests that the analysts surveyed tend to expect a decline in Swiss economic activity as outlook expectations for the Eurozone distinctly deteriorated.

Other data released on Thursday showed that the Swiss trade surplus increased to a 3-month high of CHF 3.5 billion in January from CHF 2.6 billion in December. Taking a look at the exports data on various continents on a year to year basis, goods exported to Asia and Latin America fell drastically in response to worsening global fears. A decline of 6% was recorded to Asia while exports to Latin America fell by 16%. However, exports to the US did not disappoint with a rise of 3%.

Another setback for investor sentiment came from the Swiss watch industry. Swiss watch exports slid for the seventh consecutive month in January as plummeting stocks and slowing economies damped demand for luxury timepieces in their main markets. The two biggest destinations for Swiss watch exports — Hong Kong and the US — were almost exclusively responsible for the global downturn.

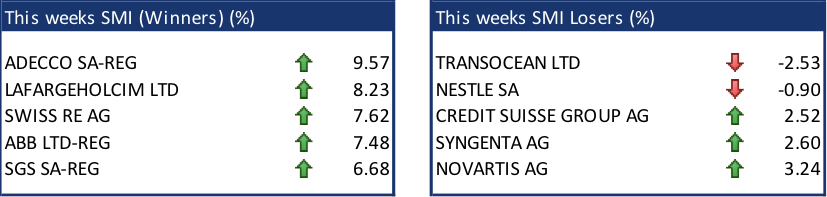

In company news, LafargeHolcim gained significantly this week after CEO Eric Olsen said the company is attracting strong interest for capacity it is being forced to sell in India following a merger that created the world’s largest cement maker. While India offers growth in demand for construction materials not seen in some other emerging markets, LafargeHolcim has ended up having to sell almost double the capacity initially anticipated for antitrust reasons.

Nestlé SA, on the other hand, dropped significantly on Thursday after forecast 2016 sales indicate that the company will miss its long-term growth target for a fourth year. This increases pressure on CEO Paul Bulcke to find new areas of growth as he enters the home stretch of his tenure. Revenue will increase at a similar rate to last year’s 4.2% on an organic basis as it becomes harder to raise prices.