Investec Switzerland. The SMI is set to close modestly higher this week, although lagging behind gains of global equity markets. Stock markets around the world benefited from a substantial rebound in the price of crude oil this week which has been a key driver of investor sentiment recently. The limited exposure of the SMI to the oil and energy sector explains some of the indexes underperformance against the MSCI World lately. © Solarseven | Dreamstime.com This week’s rebound in the oil price was largely attributed to reports that OPEC and non-OPEC ministers are due to meet again next month to discuss potentially freezing current oil production levels. The previous agreement to reduce the current oil surplus, made just weeks ago, rapidly fell apart after Saudi Arabia said it won’t cut production because it doesn’t trust other producing countries to do the same. Next months rumored talks come after reports showed that US crude inventories remain at the highest levels in more than eight decades. In Switzerland, the UBS Consumption Indicator released this week showed that a measure of Swiss consumption extended its upward trend so far this year. The report showed that the rise in consumption was mainly led by improved business sentiment in the retail sector, lower oil prices and an increase in car registrations.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

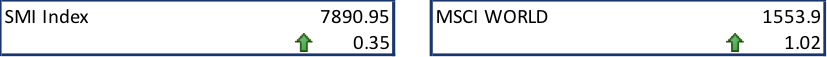

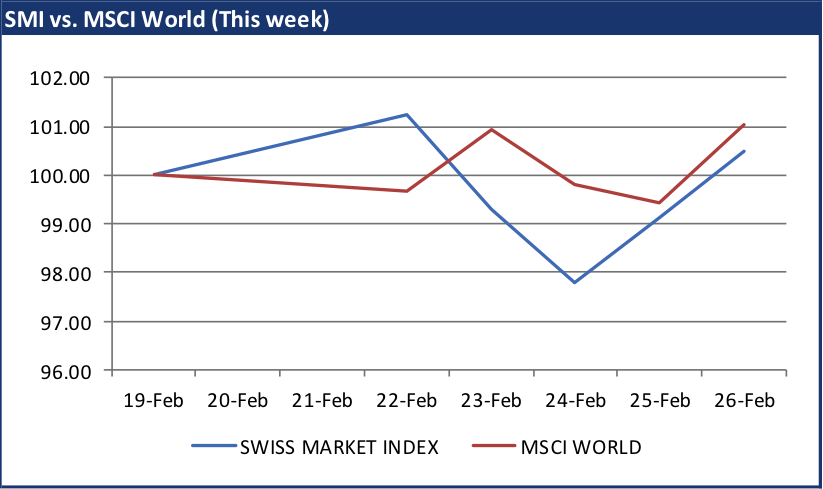

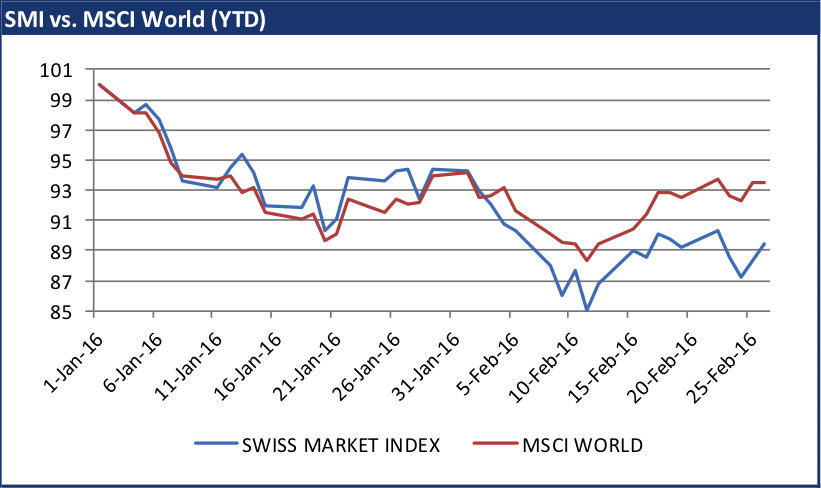

The SMI is set to close modestly higher this week, although lagging behind gains of global equity markets. Stock markets around the world benefited from a substantial rebound in the price of crude oil this week which has been a key driver of investor sentiment recently. The limited exposure of the SMI to the oil and energy sector explains some of the indexes underperformance against the MSCI World lately.

© Solarseven | Dreamstime.com

This week’s rebound in the oil price was largely attributed to reports that OPEC and non-OPEC ministers are due to meet again next month to discuss potentially freezing current oil production levels. The previous agreement to reduce the current oil surplus, made just weeks ago, rapidly fell apart after Saudi Arabia said it won’t cut production because it doesn’t trust other producing countries to do the same. Next months rumored talks come after reports showed that US crude inventories remain at the highest levels in more than eight decades.

In Switzerland, the UBS Consumption Indicator released this week showed that a measure of Swiss consumption extended its upward trend so far this year. The report showed that the rise in consumption was mainly led by improved business sentiment in the retail sector, lower oil prices and an increase in car registrations. However the report warned that unemployment could rise in the first half of this year in response to weaker GDP growth, consequently dampening private consumption later in 2016.

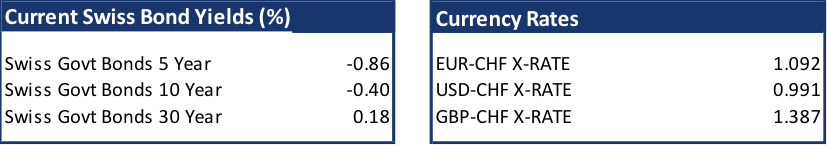

In other news, the Swiss National Bank (SNB) said that the negative interest rates haven’t yet caused cash hoarding. The SNB cut its deposit rate to a record low of minus 0.75% a year ago and has repeatedly pledged to intervene in currency markets to ensure monetary conditions remain adequate. Investors are now focusing on the European Central Bank (ECB) meeting on March 10 to see if the SNB will need to respond to any further ECB action.

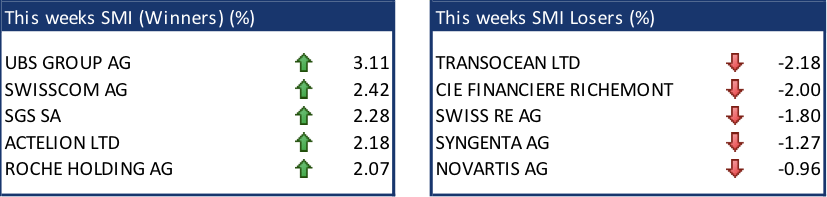

In company news, Transocean was unable to take advantage of the recovering oil price and is set to end the week as the SMIs biggest loser for the second time this month. Investors dumped the company’s shares again this week after Esso Exploration Angola Ltd said it is canceling its contract for a $367,000-a-day deep-water drilling rig. The rig entered into service in 2005 and was designed to operate in waters as deep as 7,500 feet.