The CIO Office’s view of the week ahead.When the Apollo 11 mission landed on the moon 50 years ago, the 13-minute descent was “rampant with unknowns” according to Neil Armstrong. Today, central bankers are on their own outer space mission, navigating unchartered monetary policy territory. As they wait for interest rates to land, investors await terra firma in markets. The dovishness that swept across all major central banks is now spreading to emerging markets (EM). Last week, the central banks of India, South Korea, South Africa and Indonesia all eased monetary policy, while those of Brazil, Turkey and Russia have set strong expectations that they will follow suit. This echoing of the Federal Reserve’s (Fed) easing is a positive for our positions in EM local currency debt, which

Read More »Articles by Alexandre Tavazzi

Is Europe turning Japanese?

May 3, 2019European investment opportunities remain, despite financial repression in the region.

The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and low-rate environment indefinitely, presenting particular challenges for European investors.

Given the current environment and the already low yield level reached by both European sovereign and credit markets, generating returns out of

Is Europe turning Japanese?

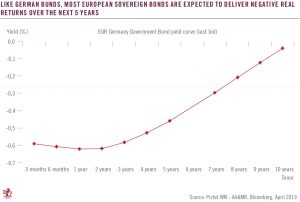

April 30, 2019European investment opportunities remain, despite financial repression in the region.The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and low-rate environment indefinitely, presenting particular challenges for European investors.Given the current environment and the already low yield level reached by both European sovereign and credit markets, generating returns out of safe assets will be challenging for investors. We can expect negative

Read More »Weekly View—Eyes on guidance

April 15, 2019The CIO office’s view of the week aheadLast week delivered encouraging news on the outlook for global trade as improved Chinese exports and credit figures were seen as signs that the global trade slowdown would soon turn. On the back of March’s rebound in Chinese purchasing manager indices (PMIs), this means that as well as good news for the global trade outlook, the world’s second-largest economy may report better-than-expected Q1 2019 GDP this week.Last week, the European Central Bank (ECB) left its assessment of the growth and inflation outlook largely unchanged from its March meeting. Draghi mentioned that pricing for its latest round of long-term loans to banks, TLTRO III, will be unveiled at “one of the forthcoming meetings”, probably in June with new staff projections. The key

Read More »Weekly View – Cautious steps forward

April 1, 2019The CIO office’s view of the week ahead.Good news came from the world’s second-largest economy after China’s manufacturing sector resumed growth in March, following three consecutive months of contraction. Employment in the sector also grew and new export orders even managed to move back into expansion territory, despite continued uncertainty around the outcome of trade talks between China and the US. We read these indicators as encouraging signs that the Chinese government’s fiscal stimulus is starting to bear fruit, which is good news for the global economy, especially emerging markets.The week ahead will be an eventful one on both sides of the Atlantic. In the US, the latest manufacturing and jobs data will be released, providing more colour as to the health of the US economy. Despite

Read More »Weekly View – Temporary relief

November 5, 2018The CIO office’s view of the week ahead.Several factors halted the equity sell-off last week. Investors continued to take a jaundiced eye of some corporate guidance, but Q3 earnings growth has finally turned out as good as in previous quarters (around 25% year on year for the S&P 500). The sky has seemed to brighten on other fronts too. Most conspicuously, oil prices have fallen and president Trump has floated the idea that tensions with China might be easing. Investors should probably apply the same scepticism as they have to corporate earnings, but the hint of détente on the trade front proved a catalyst for equities, however fleeting. In truth, the de-rating of stocks had probably gone too far. While earnings growth is set to fall, the decline in price-earnings ratios goes beyond even

Read More »Weekly View – new headwinds

August 6, 2018The CIO office’s view of the week ahead.Apple made headlines for being the first company to reach a market capitalisation of USD 1 trillion. This milestone highlights two key points about the technology sector, in particular the FAANGs (Facebook, Apple, Amazon, Netflix, Google) which dominate it. Apple and Amazon’s continued success stems from their highly diversified business, which makes them less dependent on narrow revenue sources. Meanwhile, advertising-driven Facebook and Google and subscription-based Netflix have trailed behind. This shows that the FAANGs should not be considered as a single homogeneous group, but rather have business models that are impacted by various cycles, with those with more diversified businesses being less vulnerable to these variabilities. The second

Read More »Equity markets: is it time to move out of Growth stocks and into Value ones?

October 26, 2015Growth investing has been very profitable in the US equity market since 2009, outperforming Value investing by 55% since April 2009.

A great period for Growth investing Since equity markets bottomed out in March 2009, the Growth style (as measured, for the purposes of this Flash Note, by the MSCI US Growth index ) has handsomely outperformed the Value style (MSCI US Value Index). Price-wise, the performance gap worked out at 55% for the period from April 2009 to end-September 2015, its widest for the past 15 years. In this Flash Note, we have investigated the sources for such disparities in performance and assessed whether factors leading to it might be reversing. To some readers, the debate about Value and Growth might sound theoretical, but it has some very practical implications. As GDP and earnings growth rates have been downgraded since the start of the year, Growth investing has attracted a lot of interest. Hence, any change for the better in the global environment could lead to a reversal in the trend established over the last 6 years.

The rebound in US equity prices that started in March 2009 has seen a spectacular outperformance by companies whose earnings have been growing at rates above-average compared with those for their industry or the overall market.

Read More »