European investment opportunities remain, despite financial repression in the region.The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and low-rate environment indefinitely, presenting particular challenges for European investors.Given the current environment and the already low yield level reached by both European sovereign and credit markets, generating returns out of safe assets will be challenging for investors. We can expect negative

Topics:

Alexandre Tavazzi considers the following as important: ECB, European GDP, European inflation, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

European investment opportunities remain, despite financial repression in the region.

The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and low-rate environment indefinitely, presenting particular challenges for European investors.

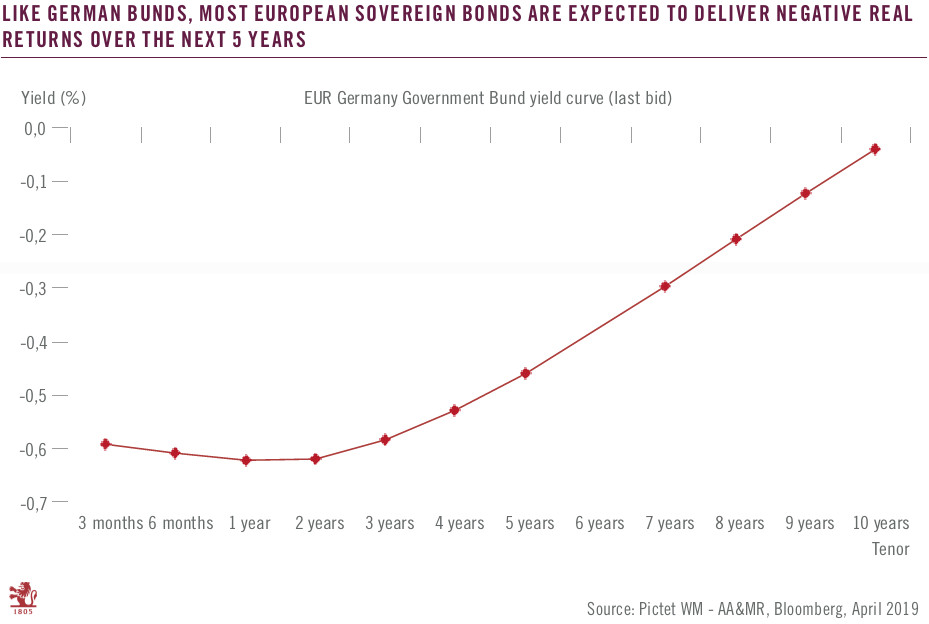

Given the current environment and the already low yield level reached by both European sovereign and credit markets, generating returns out of safe assets will be challenging for investors. We can expect negative returns for European investment grade and German sovereign bonds to persist over the next five years. Hence, European investors need to take a different path to generate some income out of their savings.