Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency. The Swiss

Topics:

Swiss National Bank considers the following as important: Featured, newslettersent, SNB, SNB Press Releases, Switzerland inflation

This could be interesting, too:

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

investrends.ch writes Die Zurückhaltung der SNB wird mehrheitlich begrüsst

investrends.ch writes Schweizer Inflation fällt etwas stärker als gedacht

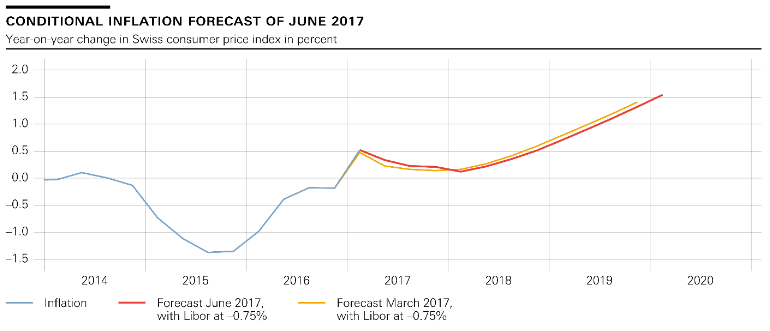

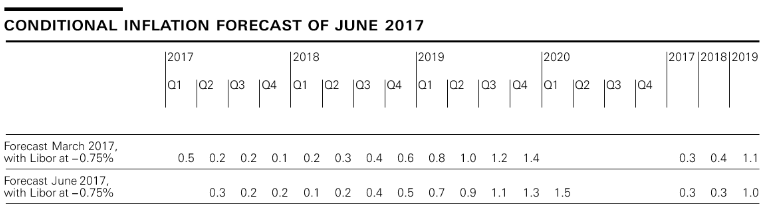

Swiss National Bank leaves expansionary monetary policy unchangedThe Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency. The Swiss franc is still significantly overvalued. The new conditional inflation forecast differs little from that of March. The SNB continues to anticipate an inflation rate of 0.3% for the current year. For 2018, the forecast has fallen slightly to 0.3%, from 0.4% in the previous quarter. For 2019, it now expects inflation of 1.0%, compared to 1.1% last quarter. The conditional inflation forecast is based on the assumption that the three-month Libor remains at–0.75% over the entire forecast horizon. In line with the SNB’s expectations, the global economy has strengthened further. Owing to the economic growth, the labour market situation in advanced economies has improved in recent quarters. Despite positive developments in the real economy, inflation remains modest in most advance d economies. Against this background, monetary policy in Japan and the euro area, in particular, is likely to remain very expansionary. In the US, monetary conditions are expected to gradually normalise. In its new baseline scenario for the global economy, the SNB anticipates that economic developments will remain favourable. The cautiously optimistic baseline scenario continues to be subject to considerable downside risks; this is due to political uncerta inty and structural problems in a number of advanced economies |

SNB Switzerland Conditional Inflation Forecast(see more posts on Switzerland inflation, ) |

| According to initial quarterly estimates of the national accounts, positive stimuli from abroad were again only partially transmitted to the Swiss economy in the first quarter of 2017. Although GDP growth firmed somewhat, it still remained subdued at an annualised 1.1%, having already been weak in the second half of 2016. However, available economic indicators point to slightly more robust economic momentum. For 2017, the SNB continues to expect growth of roughly 1.5%.

In the first quarter, growth in mortgage lending remained constant at a relatively low level, and momentum in residential real estate prices continued at a measured pace. At the same time, owing to developments in fundamentals and the generally subdued activity on the mortgage and residential real estate markets, imbalances have fallen slightly in recent quarters. Nevertheless, they are still just as pronounced as they were in 2014, when the sectoral countercyclical capital buffer was set at 2%. The SNB will continue to monitor developments on these markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer. |

Switzerland Inflation and Inflation Forecast(see more posts on Switzerland inflation, ) |

Tags: Featured,newslettersent,Switzerland inflation