Investec Switzerland. The Swiss Market Index, along with other European markets, fluctuated this week as central bank decisions dominated the landscape. © Jorg Hackemann | Dreamstime.com Equity markets advanced at the beginning of the week as chances of the Federal Reserve raising US interest rates later this month declined after a surprisingly weak report on the US service-sector earlier this week. The report followed data last week that showed cooling job growth in August and an unexpected pullback in monthly manufacturing activity. On Thursday stocks declined from near record levels, bond yields rose and the euro strengthened after Mario Draghi said European Central Bank policy makers didn’t discuss an extension to their quantitative easing program although the governing council did say they expect to keep the key ECB interest rates at present lows for an extended period of time. In Switzerland a report from the State Secretariat for Economic Affairs showed that economic momentum accelerated in the second quarter, hitting its fastest pace since 2014. Gross domestic product rose 0.6% in the three months through June after gaining a revised 0.3% in the prior quarter. According to the report, contributions to growth came from foreign trade and government consumption while household spending stagnated and investment in construction and equipment declined.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, SMI, Swiss market news

This could be interesting, too:

Investec writes Federal parliament approves abolition of imputed rent

Investec writes Abolition of imputed rent gets bogged down in complexity

Investec writes Swiss parliament accepts contentious budget

Investec writes Tourism one quarter of Switzerland’s traffic

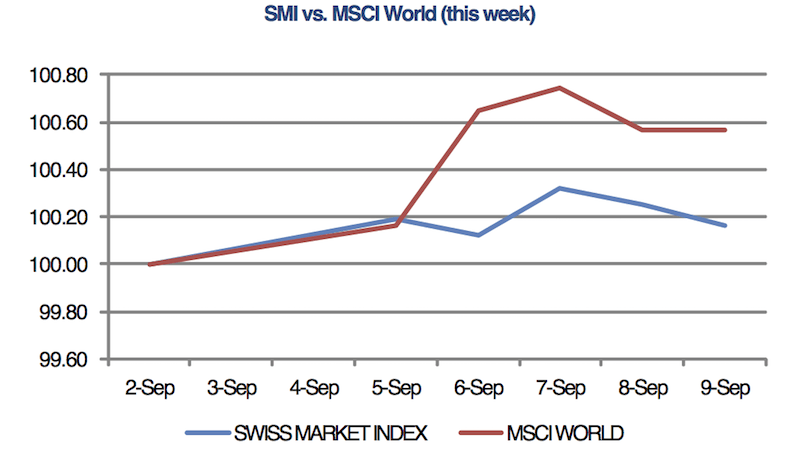

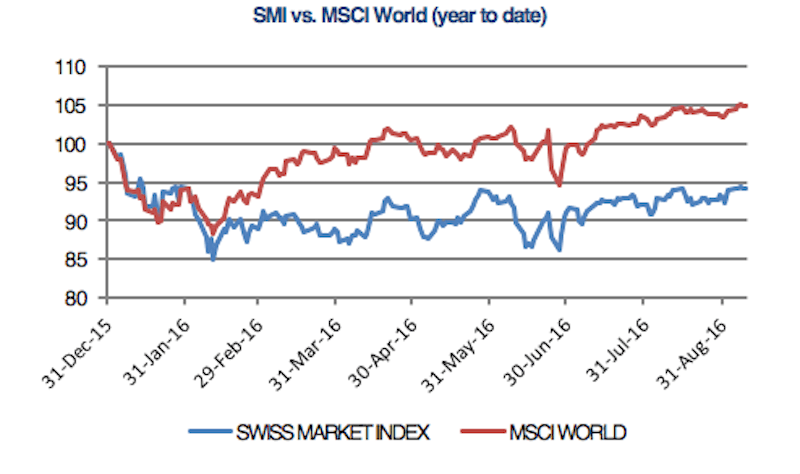

The Swiss Market Index, along with other European markets, fluctuated this week as central bank decisions dominated the landscape.

© Jorg Hackemann | Dreamstime.com

Equity markets advanced at the beginning of the week as chances of the Federal Reserve raising US interest rates later this month declined after a surprisingly weak report on the US service-sector earlier this week. The report followed data last week that showed cooling job growth in August and an unexpected pullback in monthly manufacturing activity.

On Thursday stocks declined from near record levels, bond yields rose and the euro strengthened after Mario Draghi said European Central Bank policy makers didn’t discuss an extension to their quantitative easing program although the governing council did say they expect to keep the key ECB interest rates at present lows for an extended period of time.

In Switzerland a report from the State Secretariat for Economic Affairs showed that economic momentum accelerated in the second quarter, hitting its fastest pace since 2014. Gross domestic product rose 0.6% in the three months through June after gaining a revised 0.3% in the prior quarter. According to the report, contributions to growth came from foreign trade and government consumption while household spending stagnated and investment in construction and equipment declined.

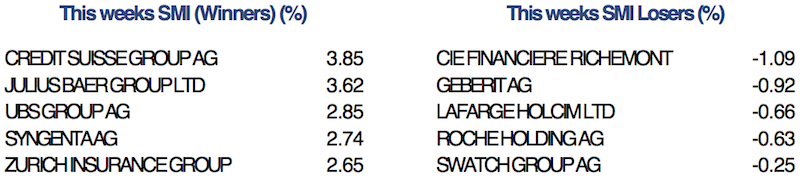

In company news, Zurich Insurance is amongst the SMI’s top performers this week after a broker stated that the company is well positioned to dominate the sustained period of very low interest rates in Europe. In other news, Syngenta Chief Executive Officer Erik Fyrwald continued a management reshuffle at the Swiss agrochemicals maker ahead of a planned takeover by China National Chemical Corp. The company announced two more executive changes coming just a day after the departure of the top finance chief.