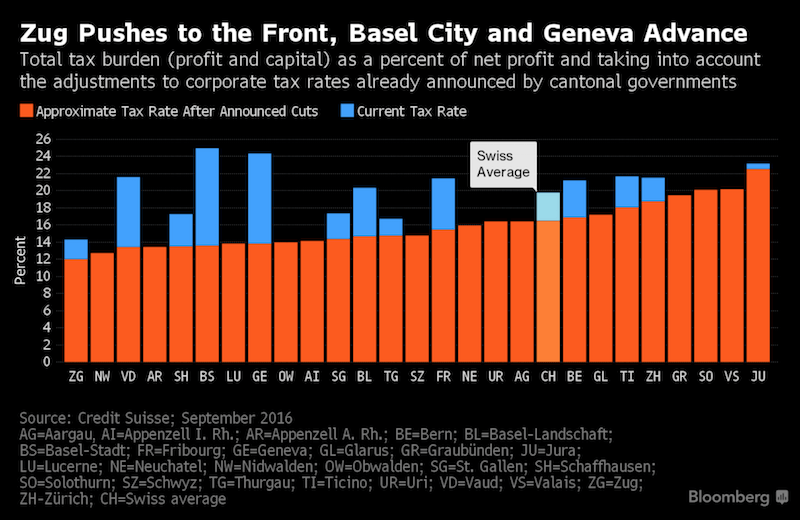

Basel to overtake Zurich Basel City will leapfrog Zurich to become Switzerland’s second-most attractive location for businesses by 2020 as Swiss cantons cut corporate tax to bolster their appeal, according to Credit Suisse Group AG. Basel, home of Roche Holding AG and Novartis AG, will move up two places in the ranking of 26 cantons over the next four years, given a plan to reduce its tax rate to 13 percent from 22.18 percent, Credit Suisse said in a study published on Thursday. The placing of the French-speaking cantons of Geneva and Vaud is set improve the most after similar tax cuts, while Zug will cement its top spot with plans to introduce the country’s lowest rate of 12 percent. © Petr Gnuskin | Dreamstime.com – click to enlarge. Swiss Corporate Tax Rates Swiss cantons are cutting their corporate tax rates in the face of European Union pressure to scrap preferential fiscal deals for foreign companies. That will give Basel and Geneva an edge over mountainous cantons that lack large pools of highly qualified labor and easy access to airports, which are also parameters used by Credit Suisse to construct its locational quality ranking. “Most cantons will reduce their corporate profit tax rates in order to offset the elimination of tax privileges,” Credit Suisse said.

Topics:

Investec considers the following as important: Featured, newslettersent, Swiss Markets News

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Basel to overtake ZurichBasel City will leapfrog Zurich to become Switzerland’s second-most attractive location for businesses by 2020 as Swiss cantons cut corporate tax to bolster their appeal, according to Credit Suisse Group AG. Basel, home of Roche Holding AG and Novartis AG, will move up two places in the ranking of 26 cantons over the next four years, given a plan to reduce its tax rate to 13 percent from 22.18 percent, Credit Suisse said in a study published on Thursday. The placing of the French-speaking cantons of Geneva and Vaud is set improve the most after similar tax cuts, while Zug will cement its top spot with plans to introduce the country’s lowest rate of 12 percent. |

|

Swiss Corporate Tax RatesSwiss cantons are cutting their corporate tax rates in the face of European Union pressure to scrap preferential fiscal deals for foreign companies. That will give Basel and Geneva an edge over mountainous cantons that lack large pools of highly qualified labor and easy access to airports, which are also parameters used by Credit Suisse to construct its locational quality ranking. “Most cantons will reduce their corporate profit tax rates in order to offset the elimination of tax privileges,” Credit Suisse said. “Cantons with little to offer besides a low tax rate will lose relative attractiveness.” Other highlights from the study:

|

By Albertina Torsoli (Bloomberg)