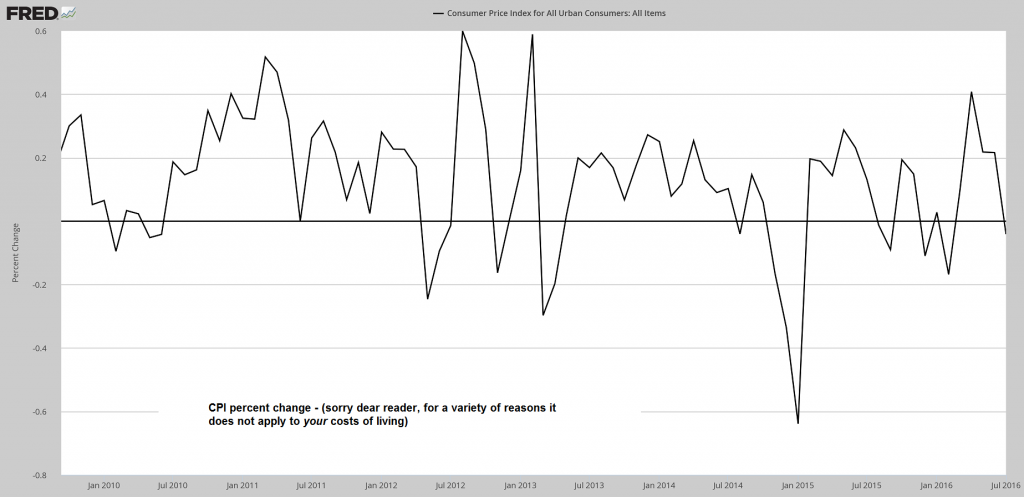

No CPI Change Several ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. Reportedly, energy prices went down, food prices were unchanged, and all other items slightly increased. So when the official number crunchers tallied them all up, the subtractions washed out with the additions. Thus, the reported CPI came in at exactly 0.0 percent. This number is strictly scientific, of course. Independent teams of research grunts could easily replicate it with precision. No guess work. No fudge factors. All seasonal adjustments and hedonic regression estimates would align with complete accuracy. CPI change rate – clearly, there’s not enough money printing just yet… – click to enlarge. All kidding aside, what does a CPI reading of 0.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

No CPI ChangeSeveral ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. Reportedly, energy prices went down, food prices were unchanged, and all other items slightly increased. So when the official number crunchers tallied them all up, the subtractions washed out with the additions. Thus, the reported CPI came in at exactly 0.0 percent. This number is strictly scientific, of course. Independent teams of research grunts could easily replicate it with precision. No guess work. No fudge factors. All seasonal adjustments and hedonic regression estimates would align with complete accuracy. |

|

| All kidding aside, what does a CPI reading of 0.0 mean? What does it tell us? How can we use this information to our advantage? Should we short treasuries and go long gold? Should we acquire bags of pre-1965 junk silver coins? Should we buy an extra bag of rice and an additional roll of toilet paper to stock in the pantry?

Or, to the contrary, should we short gold and go long treasuries? Should we convert our savings into certificates of deposit? Should we stash cash in our mattress and allow for the deflationary spiral to make our money more valuable? |

|

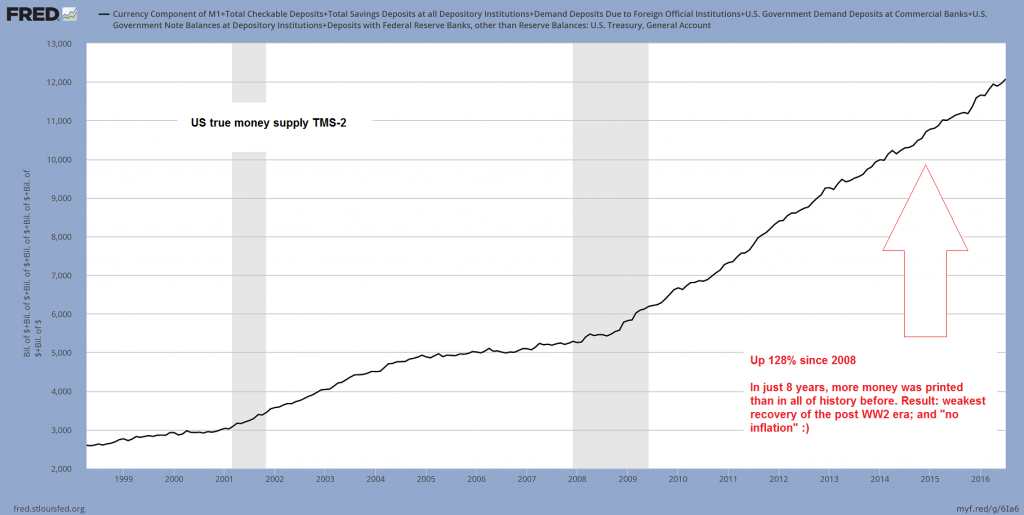

All Sorts of ‘Flations’Theoretically, we should be able to use the CPI as a measure of an investment’s purchasing power of goods and services. We should be able to benchmark if our investments are keeping pace with inflation. We should be able to discern the real rate of return as opposed to the nominal rate of return. In reality, the CPI is so distorted and disfigured it doesn’t really tell us much that’s useful. Empirical experience and common sense are much better indicators of inflation and deflation. What’s more, you don’t have to assign a number to it. Does your paycheck go as far as it did before? Do you pay more for health insurance with a higher deductible than before? What about the cost of daycare or college tuition for your kids? By all accounts, there are all sorts of ‘flations’ going on. Asset price inflation is sky high. Yet wages are stagnating. All the while, money supply is inflating. In fact, according Federal Reserve Economic Data, M2 Money Stock, which includes cash and checking deposits plus savings deposits, money market securities, mutual funds and other time deposits, has increased by nearly 100 percent over the last decade. Yet, over this same time, the U.S. population has only increased 8 percent. Similarly, world population has increased about 11 percent over the last decade. Obviously, something has drifted a bit out of line. |

US True Money TMS-2It is even worse when looking at the broad true money supply TMS-2 (which excludes non-money items included in M2, but includes money excluded from M2). As of July, it has increased by 128% since 2008. In other words, far more money has been created ex nihilo since just 2008 than in all of preceding US history under the current dollar standard. Someone must have gotten richer, right? |

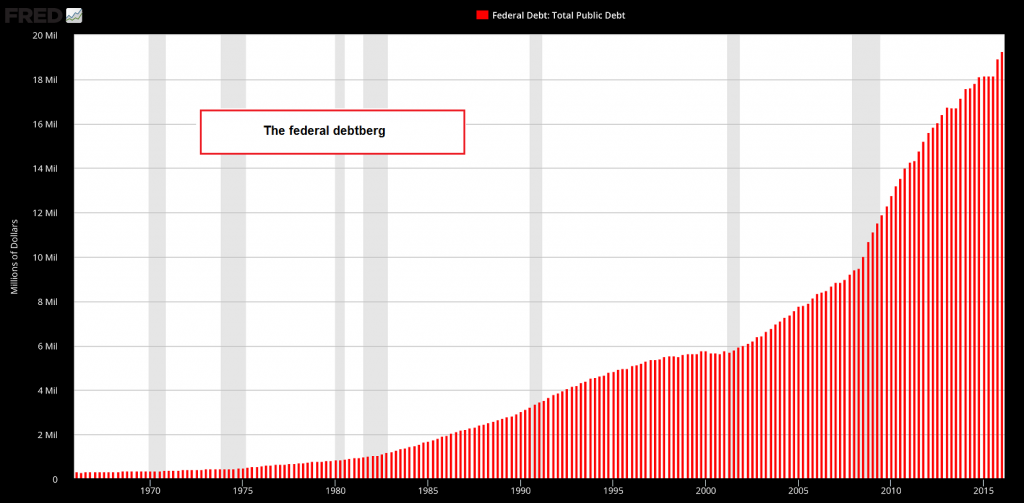

Yarns, Mysteries, and the CPISomehow, even with money supply inflation rapidly outpacing population growth, consumer prices are holding steady. Make of it what you will. The point is, the veracity of the CPI report is suspicious… regardless of the fact that one can get a really good laptop for only $500. No big deal on the surface. For there are many things in life that don’t quite add up the way they should. For example, there are plenty of tall fishing tales of the great big catch that sank the boat. There’s also the time Paul Bunyan ate 50 pancakes in a single minute. Also, don’t forget the miraculous suicide of Vincent Foster. Like the CPI, these are things that cannot be reconciled. They are yarns or mysteries. They all smell like rotting tomatoes. Our grouse with the CPI is that policy makers give it real credence. They make real decisions that have real consequences for millions of people – including you – because of it. The CPI is tied to the incomes of the millions of American retirees that receive Social Security benefits. The higher the CPI, the more money the federal government must spend on these income payments to keep pace with the cost of living. Remember, the U.S. national debt is over $19 trillion. If the CPI is low, the federal government spends less on cost of living adjustments (COLA). In 2016, Social Security beneficiaries received no COLA. However, this is but one example of the misuse of suspect CPI readings. Another example is the Federal Reserve’s zealous fixation on consumer price inflation, and their objective of 2 percent inflation, as they go about setting the price of money. |

The Federal Debtberg(see more posts on government debt) The federal debtberg (excl. unfunded liabilities), aptly colored in red. The economy may not have grown much lately, but this thing sure has. In essence it has gone parabolic under the Obamanoid (not that it would have made any difference if someone else had been in charge). |

S&P 500 WeeklyHere’s an example from the July 26-27 Federal Open Market Committee meeting minutes, which was released on Wednesday.

Meanwhile, the stock market’s consuming the Fed’s monetary gas at full throttle. No doubt, it’s just a matter of time until the market conflagrates into the unremitting destruction of a Southern California wildfire. |

Charts by: St. Louis Federal Reserve Research, StockCharts

Chart and image captions by PT