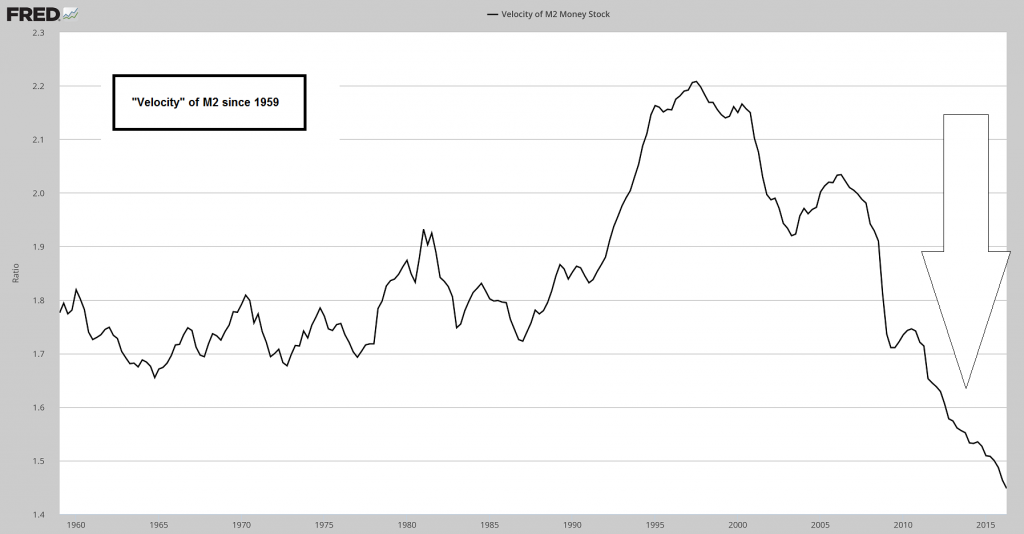

Alarmed Experts A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959. Some commentators are of the view that this points to a severe liquidity crunch, which could culminate in a massive stock market collapse and an economic disaster in the months ahead. Money velocity is widely considered “too slow”. But what does the formula really tell us? According to a popular thinking the idea of velocity is straightforward. It is held that over any interval of time, such as a year, a given amount of money can be used again and again to finance people’s purchases of goods and services. The money one person spends for goods and services at any given moment can be used later by the recipient of that money to purchase yet other goods and services. M2 velocity has declined to a new multi-decade low. This chart is basically saying: “A lot of money printing has failed to produce a lot of economic output”. Big surprise… ? – click to enlarge. A Famous Equation For example, during a year a particular ten-dollar bill might have been used as following: a baker John pays the ten-dollars to a tomato farmer George.

Topics:

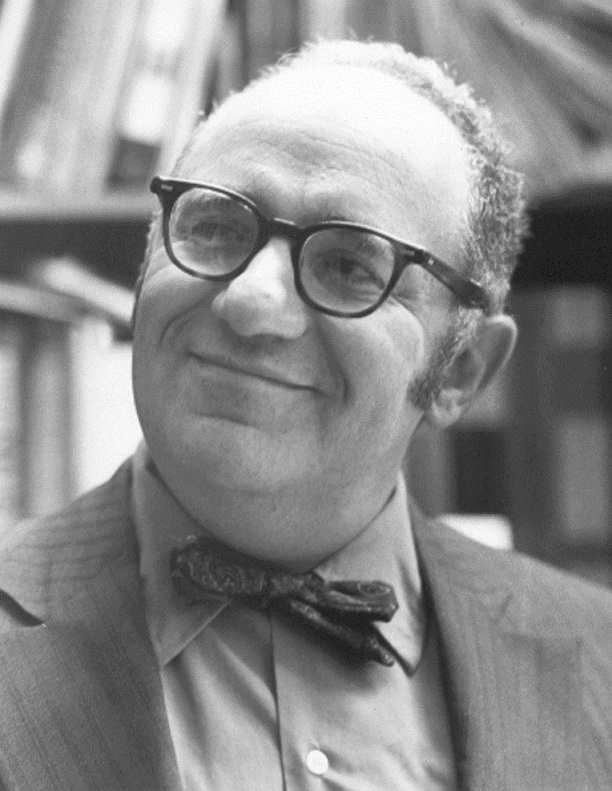

Frank Shostak considers the following as important: Central Banks, Debt and the Fallacies of Paper Money, Featured, Irving Fisher, Murray N. Rothbard, newslettersent, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Alarmed ExpertsA fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959. Some commentators are of the view that this points to a severe liquidity crunch, which could culminate in a massive stock market collapse and an economic disaster in the months ahead. |

|

According to a popular thinking the idea of velocity is straightforward. It is held that over any interval of time, such as a year, a given amount of money can be used again and again to finance people’s purchases of goods and services.The money one person spends for goods and services at any given moment can be used later by the recipient of that money to purchase yet other goods and services. |

|

A Famous EquationFor example, during a year a particular ten-dollar bill might have been used as following: a baker John pays the ten-dollars to a tomato farmer George. The tomato farmer uses the ten-dollar bill to buy potatoes from Bob who uses the ten dollar bill to buy sugar from Tom. The ten-dollars here served in three transactions. This means that the ten-dollar bill was used 3 times during the year, its velocity is therefore 3. A $10 bill, which is circulating with a velocity of ‘3’ financed $30 worth of transactions in that year. If there are $3000 billion worth of transactions in an economy during a particular year and there is an average money stock of $500 billion during that year, then each dollar of money is used on average 6 times during the year (since 6*$500 billion =$3000). The $500 billion of money is boosted by means of a velocity factor to become effectively $3000 billion. This implies that the velocity of money can boost the means of finance. From this it is established that

This expression can be summarized as

Where V stands for velocity, P stands for average prices, T stands for volume of transactions and M stands for the supply of money. This expression can be further rearranged by multiplying both sides of the equation by M. This in turn will give the famous equation of exchange

This equation states that money times velocity equals value of transactions. Many economists employ GDP instead of P*T thereby concluding that

The equation of exchange appears to offer a wealth of information regarding the state of the economy. For instance, if one were to assume a stable velocity, then for a given stock of money one can establish the value of GDP. Furthermore, information regarding the average price or the price level allows economists to establish the state of real output and its rate of growth. |

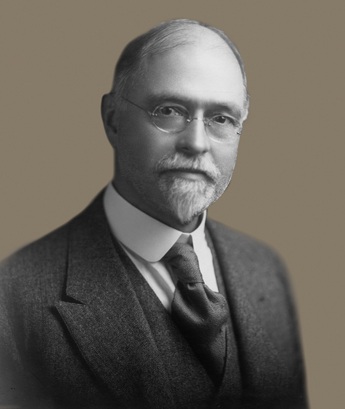

And here’s the man who came up with the equation of exchange: Irving Fisher (yes, of “permanent plateau” fame). He came up with a great many things that are used by governments and central banks as the basis for their meddling with the economy. Fisher and Keynes, the fathers of modern “macroeconomics”, both have propagated the simplistic and utterly fallacious idea that spending is what drives economic growth (hence the aimless, helpless and useless flailing about of modern-day central bankers). Photo via biografiasyvidas.com |

Does the Concept of Money Velocity Make Sense?From the equation of exchange it seems that money together with velocity is the source of funding for economic activities. Furthermore, from the equation of exchange it would appear that for a given stock of money an increase in velocity helps finance a greater value of transactions than money could have done by itself – obviously then that the decline in velocity should be seen as a great concern. As logical as it sounds, neither money nor velocity have anything to do with financing transactions. Here is why. Consider the following: a baker John sold 10 loaves of bread to a tomato farmer George for $10. Now, John exchanges the $10 to buy 5kg of potatoes from Bob the potato farmer. How did John pay for potatoes? He paid with the bread he produced. Observe that John the baker had financed the purchase of potatoes not with money but with bread. He paid for potatoes with his bread using money to facilitate the exchange. In other words money fulfills here the role of the medium of exchange and not the means of payment. The number of times money changed hands has no relevance whatsoever on the bakers’ capability to fund the purchase of potatoes. What matters here is that he possesses bread that can be exchanged by means of money for potatoes. |

|

| How can the fact that the same $10 bill is used in several transactions add anything to the means of funding?

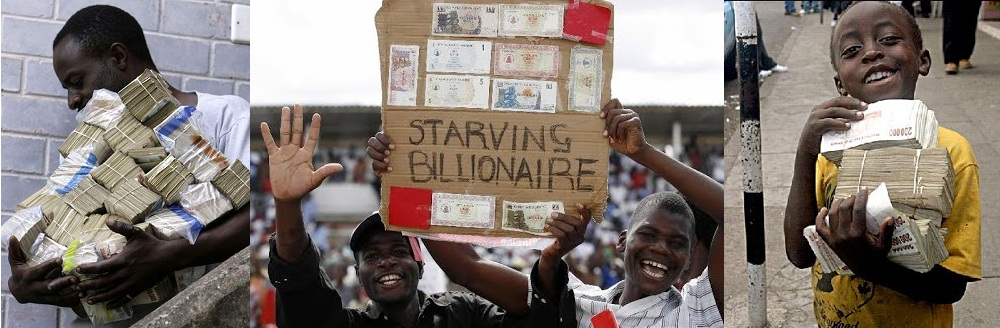

Imagine that money and velocity would have indeed been means of funding or means of payments. If this was so, then poverty world-wide could have been erased a long time ago. Moreover, since rising velocity is supposed to boost effective funding, then it would have been to everyone’s benefit to make sure that money circulates as fast as possible. This implies that any one who holds on to money should be classified as menace to society for he slows down the velocity of money and hence the creation of real wealth. |

|

Velocity Does Not Have an Independent ExistenceContrary to popular thinking velocity has not got a “life of its own.” It is not an independent entity — it is always the value of transactions P*T divided into money M, i.e., P*T/M. On this, Rothbard wrote in Man Economy and State:

(emphasis in the original) Since V is P*T/M, it follows that the equation of exchange is reduced to M*(P*T)/M = P*T, which is reduced to P*T = P*T, and this is not a very interesting truism. It is like stating that $10=$10 and this tautology conveys no new knowledge of economic facts. |

Conclusion

Contrary to popular thinking, the velocity of money doesn’t have a life of its own. It is not an independent entity and hence it cannot cause anything. We can then conclude that the fact that the so called velocity of money fell to the lowest level since 1959 doesn’t by itself suggest that the stock market and the economy are poised for massive collapses in the months ahead.

Chart by: St. Louis Federal Reserve Research

Chart and image captions by PT