Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below earlier in the session, and leading to weakness across virtually all global risk assets. And since a stronger dollar means a weaker Yuan, more potential devaluation, greater capital outflows but most importantly lower commodity prices and key among them cheaper oil, now flirting with sliding below to the downside, which would lead to its first weekly decline, as lower oil means lower risk prices in general as per the very well-known correlation shown below... ... traders walking in today are greeted by something they have barely seen in the past month's bear market rally: a sea of red: not only are S&P500 futures down nearly 0.5% in today's illiquid session, but European shares have retreated for a fourth day, while raw-materials producers led declines among Asian equities as the Bloomberg Commodity Index slumped for a second day. Industrial commodities like iron ore fell for a third day, while gold has continued to drift lower.

Topics:

Tyler Durden considers the following as important: Australia, Bear Market, Bond, CDS, China, Continuing Claims, Copper, Credit Suisse, Crude, Crude Oil, Deutsche Bank, Equity Markets, European Union, fixed, General Electric, Glencore, Hong Kong, Initial Jobless Claims, Italy, Janet Yellen, Japan, Markit, Mortgage Loans, New Home Sales, Nikkei, None, PDVSA, Precious Metals, Primary Market, recovery, Shenzhen, SIFMA, Standard Chartered, Steve Liesman, Swiss Banks, Switzerland, Tata, Tobin Tax, United Kingdom, Volatility, Yen, Yuan

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Glencore schreibt im Halbjahr erneut einen Verlust

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all global risk assets.

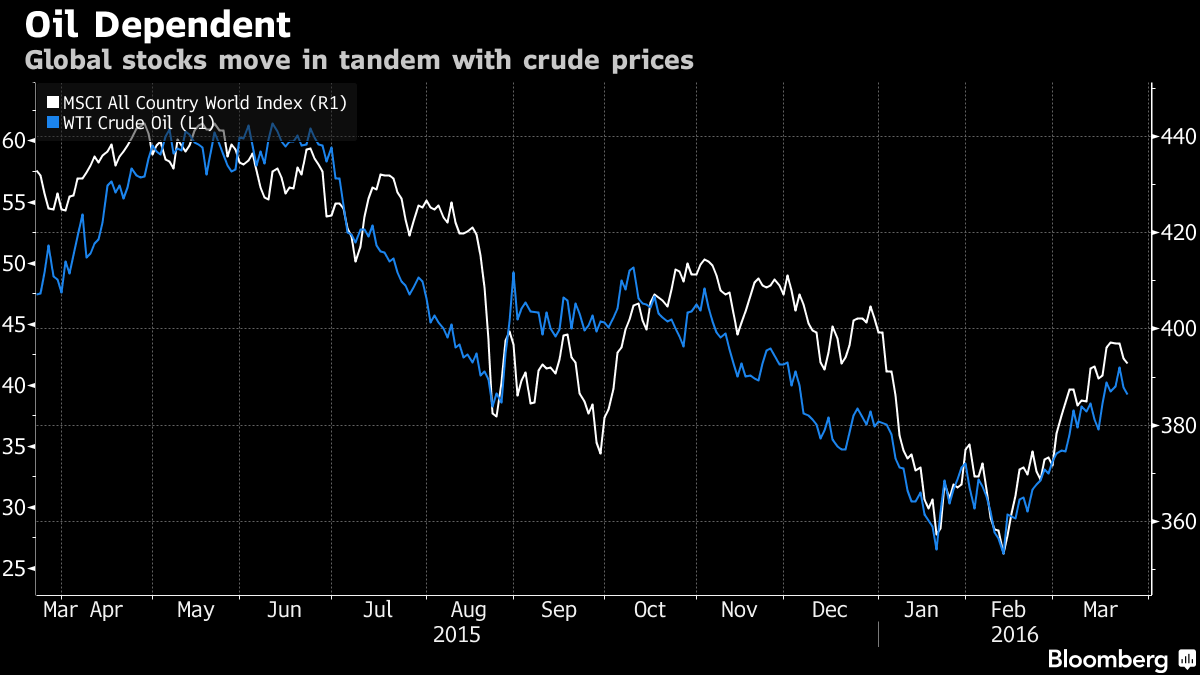

And since a stronger dollar means a weaker Yuan, more potential devaluation, greater capital outflows but most importantly lower commodity prices and key among them cheaper oil, now flirting with sliding below $39 to the downside, which would lead to its first weekly decline, as lower oil means lower risk prices in general as per the very well-known correlation shown below...

... traders walking in today are greeted by something they have barely seen in the past month's bear market rally: a sea of red: not only are S&P500 futures down nearly 0.5% in today's illiquid session, but European shares have retreated for a fourth day, while raw-materials producers led declines among Asian equities as the Bloomberg Commodity Index slumped for a second day. Industrial commodities like iron ore fell for a third day, while gold has continued to drift lower. Government bonds advanced in Australia and the euro area.

The reason for this resurgent dollar streanth is none other than the very confused Fed: after last week halving its projection for interest-rate rises this year to two - a shift that spurred global stock gains and depressed the dollar - various Fed officials have in the past few days talked up the possibility of an increase something that CNBC's Steve Liesman classified as a potential mutiny against a very confused Janet Yellen. As Bloomberg writes, Fed Bank of St. Louis President James Bullard on Wednesday joined a chorus of policy makers floating the possibility of a rate hike as soon as April, helping fuel a rebound in the greenback that’s unsettling the mostly dollar-denominated commodity market.

"Fed officials this week reminded the market that they still want to move forward with the rate hikes," Mark Lister, head of private wealth research at Craigs Investment Partners told Bloomberg.

"Investors have been looking for a reason to pull back and this is one" he added and sure enough, the MSCI All Country World Index fell 0.5% in early trading after sliding 0.8 percent on Wednesday. The Stoxx Europe 600 Index slid 0.8%, the MSCI Asia Pacific Index lost 1.1% and futures on the Standard & Poor’s 500 Index declined 0.5%.

Additionally, now that the broader market levitation appears to be over, we have seen numerous single-name slams overnight, such as the following:

- China Life Insurance Co., the nation’s largest insurer, dropped 3.9% in Hong Kong after reporting earnings that fell short of analyst estimates. PetroChina Co., the country’s biggest oil and gas producer, slumped 4.3% after reporting its lowest annual profit since 1999.

- Mitsui & Co. dropped 7.5 percent in Tokyo after the trading company forecast its first loss since it was founded in its modern form in 1947.

- Next -8.4%; cuts FY17 full price Next brand sales outlook

- Mitie -7.6%; says it sees FY profit in line, revenue below expectations

- Vallourec -5.4%; extends drop this week to ~15%

- Anglo American -5.1%; miners underperform today: ArcelorMittal -4.4%, Antofagasta (ANTO LN) -4%, Fresnillo (FRES LN) -3.9%, Rio Tinto (RIO LN) -3.7%;

Standard Chartered -4.3%; on track for worst weekly performance since early Jan. - Sacyr -3.6%; 4th straight decline, longest losing streak in >1 month

- Credit Suisse -3%; falls for a 2nd day after CEO said on conf call yday that bank will probably post 1Q loss

- Drillish -2.3%; CEO sudden departure is “not a welcome event”: Jefferies

- HSBC -1.5%; downgraded at BofAML on dividend risks

Absent a dramatic turnaround in the USD momentum we expect this negtive list to extend once the US market is open for trading for its last weekly session.

Top news stories include Starboard’s possible attempt to shake up board at Yahoo; Konecranes, Zoomlion bids for Terex, Nomura’s possible NorthAm job cuts.

Markets Snapshot

- S&P 500 futures down 0.4% to 2019

- Stoxx 600 down 1.1% to 336

- FTSE 100 down 1.1% to 6134

- DAX down 1.1% to 9916

- German 10Yr yield down 2bps to 0.17%

- Italian 10Yr yield down less than 1bp to 1.29%

- Spanish 10Yr yield up less than 1bp to 1.54%

- S&P GSCI Index down 0.8% to 326.7

- MSCI Asia Pacific down 1.1% to 127

- Nikkei 225 down 0.6% to 16892

- Hang Seng down 1.3% to 20346

- Shanghai Composite down 1.6% to 2961

- S&P/ASX 200 down 1.1% to 5084

- US 10-yr yield down 2bps to 1.86%

- Dollar Index up 0.24% to 96.28

- WTI Crude futures down 1.9% to $39.03

- Brent Futures down 1.4% to $39.89

- Gold spot down 0.3% to $1,217

- Silver spot down less than 0.1% to $15.25

Top Global News

- Starboard Will Seek to Replace Yahoo’s Entire Board: WSJ: Fund to announce it will seek replacement of entire Yahoo board with its own slate of directors, WSJ says, citing letter prepared by activist fund.

- Affymetrix to Enter Talks With Origin After Takeover Bid Boosted: Co. said it will enter talks with Origin Technologies after suitor boosted its offer to $17/share.

- Konecranes to Pursue Terex Merger Even as Zoomlion Raises Bid: Zoomlion raised its cash offer to $31/share, a dollar higher than an unsolicited bid it made in Jan., Terex said.

- Cabela’s Said to Open Books to Bass Pro Shops, Others: NYP: Co. opened its finances over past 2 weeks: NYP

- Nomura Said to Prepare North America Job Cuts Amid Trading Slump: Co. has been expanding in U.S. to boost fee business.

- Republicans in Bloomberg Poll Not Sold on Plan to Stop Trump: 63% of those who have voted in this year’s Republican primaries & caucuses, or plan to do so, back Trump’s view of nominating process.

- Debris Found in Mozambique Likely From MH370, Australia Says: Two pieces of aircraft debris washed up on coast of Mozambique “almost certainly” from missing MH370: Australia’s Transport Minister.

Looking at regional markets, we start in Asia, where stock trader lower across the board following similar price-action seen on Wall St. as weakness across commodities dampened sentiment. ASX 200 (-1.1%) and Nikkei 225 (-0.6%) were led lower from the open by losses in energy and basic materials after a large build in DoE crude inventories coupled with a firmer USD, which saw WTI break below USD 40/bbl and iron ore futures drop under USD 50/mt. However, Japanese markets then recovered off worst levels as JPY weakened post-Tokyo fix. Elsewhere, Shanghai Comp (-1.6%) fell following several disappointing earnings results and the resumption of short-selling operations by Chinese brokerages.10yr JGBs traded marginally lower amid relatively quiet trade and an overall cautious tone in the region, while the results of today's JPY 1.2trl BoJ's buying operations were noted to be weak in the long-end. BoJ Summary of Opinions from March 14th-15th meeting stated Japan's economy had continued its moderate recovery trend but exports and production have been weak. The summary also noted one member advocated that withdrawing NIRP is preferable, however another member stated that undoing NIRP is not an option.

Top Asian News

- Mitsubishi Books JPY450b Impairment, Expects Annual Loss: Bank expects a net loss of 150 billion yen in 12 months ending March 31.

- Five Fault Lines Show Japan Bond Market Close to Breaking Point: Inverted curve, rising volatility, thin trading among risks

- Malaysia Fund Spat With Central Bank Flares Over Zeti Comments: Bank Negara last year ordered 1MDB to repatriate $1.8b.

- Samsung Looks Beyond Smartphones With Plans to Buy AI Developers: Smartphone giant seeking to acquire software makers.

- Takata’s Stumble Spells 50% Share of Air-Bag Orders for Autoliv: Swedish-American Autoliv puts safety back into air bags.

- Billionaire Ruias’ Steel Arm Said to Draw Tata, JSW Interest:

In Europe, equities took the impetus from a relatively lacklustre lead from Asia heading into the Easter break. As such, stocks this morning have been led lower by the fall in financial and energy names, with large banking arms Deutsche Bank and Credit Suisse down over 3%, pushing the iTraxx sub fin index higher by over 6bps. Additionally, oil prices have extended on yesterday's losses with both WTI and Brent crude futures sub USD 40/bbl, coupled with a fallout in the base metals complex continuing to weigh on the likes of Glencore (-4.4%) and Antofagasta (-3.7%).

Elsewhere, the softness in equities allied with the resumption of credit spreads widening, has seen Bunds remain bid throughout much of the European morning, alongside no issuance in Europe's primary market providing leeway for German paper.

Top European News

- Italy’s Popolare to Buy BPM, Creating Third-Largest Bank: Banco Popolare investors will own 54% of combined lender, banks said in joint statement on Wednesday.

- Swiss Banks Land in Middle of Venezuelan Money-Laundering Probe: At request of U.S. authorities, Switzerland has agreed to turn over records from at least 18 banks involving PDVSA.

- British Pound’s $16b of Option Trades Envisage Drop to 1980s Lows: At least GBP11b wagered on options that would profit if sterling fell to or below $1.3502, after June 23 referendum, data compiled by Bloomberg show.

- Premier, Trying to Fend Off McCormick, Says Nissin to Take Stake: Japanese noodle maker agreed to buy a 17.3% stake.

In FX, the USD index is still dominating FX flow this morning, but is being influenced by focus on Cable, where Brexit fears and renewed hawkish expectations at the Fed make this a lead play at the moment. However, ahead of the Easter break, the threat of a short squeeze is possible, but we expect limited mileage. UK retail sales were a risk for GBP bears, but despite (net) better than expected, did little to generate a major surge. EUR/GBP now eyeing .8000, but stalling ahead of .7950 for now. Some temperance in the commodity currencies also, where AUD and CAD have been hit hard over the last 24 hours, but holding up against some notable levels of resistance. Oil still on the wane, but some reluctance for USD/CAD to test 1.3300 just yet. AUD/USD is finding fresh buyers from the mid .7400's, bottoming out at .7475 but in both cases, pressure remains. USD/JPY offers from 113.00 have contained trade here; domestic retail names said to be profit taking, but we suspect stocks market nerves will also attract sellers from here.

The ringgit dropped 1 percent, retreating from its highest close since August, as the slide in crude prices dimmed prospects for Malaysia, Asia’s only major net exporter of oil. Falling commodities prices also weighed on Australia’s dollar, which fell as much as 0.7 percent to a one-week low.

The yuan weakened 0.2 percent in offshore trading after the People’s Bank of China cut its daily reference rate for the currency by the most in two months. Pacific Investment Management Co. forecast the currency will weaken 7 percent over the next year, according to a report published Wednesday.

In commodities, WTI and Brent are both down on the day after yesterday's larger than expected DoE crude inventory build and firmer USD weighed on prices, Gold is down roughly half a percent after its largest weekly decline in 4 months. Iron ore sank as much as 5.8 percent to $49.90 a ton in Singapore. The price has swung wildly in March, ranging from $46.45 to $61.95, as investors sought to gauge conflicting economic signals from China against still-elevated port stockpiles and shifts in the U.S. currency.

“There hasn’t been much improvement in China’s economy and steel mills aren’t keen to purchase iron ore, especially after the price surge,” said Zhao Chaoyue, an analyst at China Merchants Futures Co. in Shenzhen. “The dollar also surged overnight, spurring a sell-off in commodities.”

The Bloomberg Commodity Index declined 0.4 percent, after a 2 percent slide on Wednesday that marked its steepest loss in two months. Gold fell as much as 0.7 percent to this month’s low of $1,212.24 an ounce. Copper slipped 0.3 percent in London and zinc dropped 2.3 percent.

On the US calendar today, in addition to the usual weekly jobless claims data we will also get durable goods orders data for February (-3.0% expected; +4.7% prior) which is expected to be soft following a pullback in aircraft orders. The numbers excluding transport are expected to be better (-0.3% expected) but still on the negative side. Today also sees the Mark-it flash services and composite PMI data for March. The former is expected to rise to 51.4 from 49.7 last.

Bulletin Headline Sumary from Bloomberg and RanSquawk

- Equities in Asia and Europe have spent the day in the red, with energy, material and banking names continuing to weigh on indices amid light newsflow ahead of Easter weekend

- Commodity linked currencies remain under pressure, while GBP trades flat despite a higher than expected retail sales reading

- Highlights today include US initial jobs claims, durable goods orders, manufacturing PM! and comments from Fed's Bullard as well as ECB's Knot

- Treasuries higher in overnight trading, global equity markets, U.S. stock futures drop along with oil; fixed income market closes at 2pm ET today, futures trading floors at 1pm ET, U.S. markets closed tomorrow, according to SIFMA.

- Royal Dutch Shell Plc and Siemens AG bond yields have dropped below zero, highlighting how ECB stimulus is contorting the region’s credit markets

- Mario Draghi and Haruhiko Kuroda have handed a big gift to U.S. companies like Coca-Cola Co. and General Electric Co.: piles of money from European and Japanese investors

- Nomura plans to cut jobs in North America, people with knowledge of the matter said, following competitors from Credit Suisse Group AG to Deutsche Bank AG in trimming operations amid a trading slump

- Credit Suisse CEO Tidjane Thiam dropped a bombshell on investors: Caught off guard by a buildup of illiquid trading positions, the bank will probably post a second straight quarterly loss as it unwinds the trades

- Thiam received $4.7 million for his first six months on the job, when he mapped out a strategy for the Swiss bank that he has since been forced to accelerate

- Congress sent a message to financial regulators in 2010: No more pay that encourages Wall Street to take extra-large risks. Since 2011, the average bonus at New York securities firms has climbed 31 percent

- As Britain ponders its future in the European Union, investors are betting an amount almost the size of Iceland’s economy on the pound falling to levels last seen in the 1980s

- A research unit of China’s central bank branch in Shenzhen asked commercial banks in the city to strengthen risk- control practices on household mortgage loans as property prices have soared

- More than a decade of profit gains at China’s largest banks probably came to an end last year, and the pain may deepen in 2016 as a surge in bad loans threatens their ability to maintain dividends

- Opposition to free trade is a unifying concept even in a deeply divided electorate, with almost two-thirds of Americans favoring more restrictions on imported goods instead of fewer

- $6.25b priced yesterday, WTD to $15b, MTD $144.805b, YTD $439.055b; $1.7b HY priced yesterday, MTD 22 deals for $13.965b, YTD 47 deals for $28.82b

- Sovereign 10Y bond yields mostly steady; European, Asian equity markets lower; U.S. equity-index futures drop. WTI crude oil, gold and copper fall

US Event Calendar

- 8:15am: Fed’s Bullard speaks in New York

- 8:30am: Initial Jobless Claims, March 19, est. 269k (prior 265k)

- Continuing Claims, March 12, est. 2.235m (prior 2.235m)

- 8:30am: Durable Goods Orders, Feb. P, est. -3% (prior 4.7%)

- Durables Ex Transportation, Feb P, est. -0.3% (prior 1.7%)

- Cap Goods Orders Non-def Ex Air, Feb P, est. -0.5% (prior 3.4%)

- Cap Goods Ship Non-def Ex Air, Feb P, est. 0.3% (prior -0.4%)

- 9:45am: Markit US Services PMI, March P, est. 51.4 (prior 49.7)

- Markit US Composite PMI, March P (prior 50)

- 9:45am: Bloomberg Consumer Comfort, March 20 (prior 44.3)

- 11:00am: Kansas City Fed Mfg Activity, March (prior -12)

DB concludes the overnight wrap

Weaker sentiment prevailed over markets yesterday as risk asset performance generally sputtered. Equity markets across the globe traded broadly lower on the day. Despite a healthy start to the European session with the Stoxx 600 up as much as 0.6% in early trading, the index eventually ended the day marginally down (-0.07%). The Stoxx 600 has now fallen every day so far this week, although the total losses have been fairly modest (-0.48%). The fall in US equities yesterday was more pronounced with the S&P 500 down -0.64%. The losses were led by the energy (-2.10%) and materials (-1.23%) sectors that followed the slide in oil prices and other commodities (more on this later).

Looking at our screens this morning the risk off sentiment continues to weigh on markets this morning. Chinese equities have see-sawed through early trading with the CSI300 and Shanghai Comp down -0.71% and -0.65% respectively as we go to print while the Hang Seng is down -1.19%. The Nikkei had erased earlier losses but is back in negative territory as we go to print (-0.36%).

Zooming in on China, we have an update from our Chief China Economist Zhiwei Zhang discussing the latest news on China’s capital outflows. The report highlights the key talking points from the transcript of the SAFE news conference in March, such as the reduced intensity of capital outflows and some official perspectives on capital control measures and a potential Tobin tax.

In terms of credit markets CDS indices were generally wider in both Europe and the US. iTraxx Main and Crossover widened by 1bp and 8bps respectively while CDX IG and HY widened by around 1bp and 10bps respectively. Looking at the cash market we saw EUR credit edge tighter once again however the tone in the USD market was softer with HY spreads widening by around 10bps. The losses in HY were led by the Oil & Gas and Basic Materials sectors as commodities, including oil, saw material falls yesterday. With risk assets generally selling off government bond yields fell with 10yr US Treasury and Bund yields falling 6bps and 2bps respectively.

The rally in commodities ran out of steam as the asset class suffered losses across the risk spectrum. Gold (-2.28%) experienced one of its largest single day sell-offs in the past four weeks, while other precious metals such as silver (-3.87%) also posted large drops. Industrial metals such as copper (-2.36%) have also dipped. There was a large sell off in crude (-4%, back below $40/bbl), its worst day since 11 February when it hit its lows for the year, after a report from the EIA noted that US crude inventories rose by 9.36mn barrels (vs. 2.53mn barrels expected) last week to push supplies to their highest levels in more than eight decades.

A stronger US dollar (+0.43%) also contributed to the drag on commodities. The dollar index has now gained for four consecutive days (its longest winning streak in a month) following a chorus of hawkish Fedspeak over this week (including Bullard yesterday) suggesting that a rate hike could be possible as early as April. Policy makers appear to be delivering mixed signals as these comments conflict with the dovish nature of FOMC statement released only a week ago.

There is little to report on the data front from yesterday, with the only numbers of note being new home sales in the US which came in marginally above expectations at 512k (vs. 510 expected; 494k previous). Our US Economist Joe Lavorgna does however downplay the importance of this series as it tends to be highly volatile.

Turning the page over to today’s calendar, it’s once again a quiet day in Europe. The only numbers of note should be the retail sales data due for the United Kingdom (+3.9% YoY expected; +5.2% prior) and Italy (+0.6% YoY prior). We should also see the ECB publish its Economic Bulletin.

It is bit busier over in the US. In addition to the usual weekly jobless claims data we will also get durable goods orders data for February (-3.0% expected; +4.7% prior) which is expected to be soft following a pullback in aircraft orders. The numbers excluding transport are expected to be better (-0.3% expected) but still on the negative side. Today also sees the Mark-it flash services and composite PMI data for March. The former is expected to rise to 51.4 from 49.7 last.