In one of the eBooks that CEPR published in 2022 several authors draw first conclusions. From the introduction by Jonathan Portes: The analyses in this eBook are very much a preliminary and incomplete account of the economic impacts of Brexit. In some cases, they raise as many questions as they answer.For example, why have UK imports of EU goods fallen so sharply, while UK exports are much less affected, when (in contrast to the EU) the UK has not yet introduced the full panoply of...

Read More »The Bank of England’s “Future of Finance Report”

Huw van Steenis’ summarizes his report as follows (my emphasis): A new economy is emerging driven by changes in technology, demographics and the environment. The UK is also undergoing several major transitions that finance has to respond to. What this means for finance Finance is likely to undergo intense change over the coming decade. The shift to digitally-enabled services and firms is already profound and appears to be accelerating. The shift from banks to market-based finance is...

Read More »The Bank of England Welcomes Fintech

In the FT, Chris Giles, Caroline Binham, and Delphine Strauss report about plans of the Bank of England to let fintech companies bank at Threadneedle Street and thereby offer payments systems on a level playing field with commercial banks. The editorial board of the FT welcomes the plans; it seems to have in mind not only competition but also “synthetic” CBDC: By offering fintech companies access to the BoE’s vaults, the governor may inject much-needed competition into the sector. What...

Read More »For The First Time Ever, The “1%” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank’s infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past year, suggests that the lower...

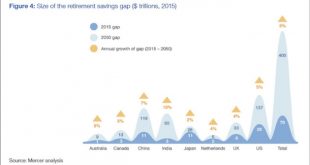

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Brexit and Its Consequences

Beware of excessive optimism: It would be risky to assume that the Swiss financial center will automatically benefit from Brexit. The situation according to Urs Rohner, chairman of Credit Suisse Group. In the aftermath of the Brexit vote in summer 2016, experts' views on its short- to medium-term...

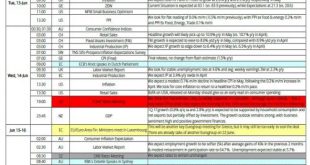

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »UK Election: More Political Volatility

Pound weakness underlines the Conservative Party failing to secure the expected Brexit mandate. Exit polls from the UK general election point to the Conservatives winning just 316 seats, down from their pre-election 330 seats. The Labour Party could win 265 seats, up from 231 before the election....

Read More »Government Debt with State Contingent Coupons

On VoxEU, Myrvin Anthony, Narcissa Balta, Tom Best, Sanaa Nadeem, and Eriko Togo discuss the history of government debt with state contingent coupons and offer some lessons. In the mid-19th century, the Confederate states issued cotton-linked bonds In the late 1970s, Mexico issued oil-linked bonds In the 2000s, Turkey issued revenue-indexed bonds Since 2014, Uruguay issues nominal wage-issued bonds Some other examples (figure taken from the column): Obviously, confidence in data quality...

Read More »Brexit and Third-Country Treaties

In the FT, Paul McClean reports that according to FT estimates and as a consequence of Brexit, the UK will have to negotiate more than 700 treaties with third countries. More than 160 countries need to be dealt with; Switzerland, the US and Norway stand out. Some negotiations have to be concluded very soon: … the EU-US Open Skies accord for airlines, were agreed when the forces of liberalisation were at their peak. The political mood has hardened considerably since then. … The timing is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org