Investec Switzerland. The SMI finished this Easter week 1.10% lower, tracking losses on global equity markets (-0.71%) following the terrorist attacks in Brussels on Wednesday. Stock markets lost momentum after the attacks as investors failed to find fresh catalysts to keep the five-week long equity rally going. Zaventem airport Brussels – © Bombaert | Dreamstime.com Commodity prices also fell this week and the US dollar strengthened on the back of higher US oil inventories and “hawkish” comments from Federal Reserve officials. According to officials, the current low joblessness rate in the US may force policy makers to raise rates faster than expected. The oil price fell below 40$ a barrel after the US government revealed a sixth straight weekly climb in crude oil inventories and three times higher than the market expected. In Switzerland, the expectations of economic growth (ZEW Credit Suisse Survey) rose by 8.4 points in March 2016 to a reading of 2.5 points. Despite the slight positive balance, the majority of the analysts expect economic growth in Switzerland to remain unchanged. In February, Switzerland’s trade surplus increased significantly, supported by strong pharmaceutical exports.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

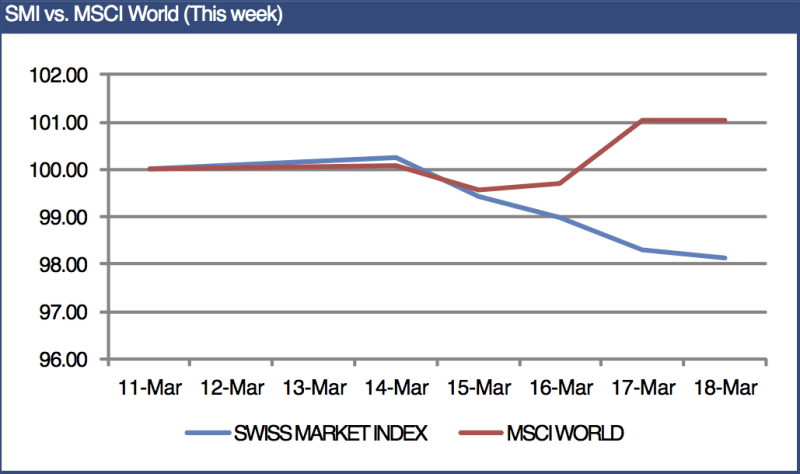

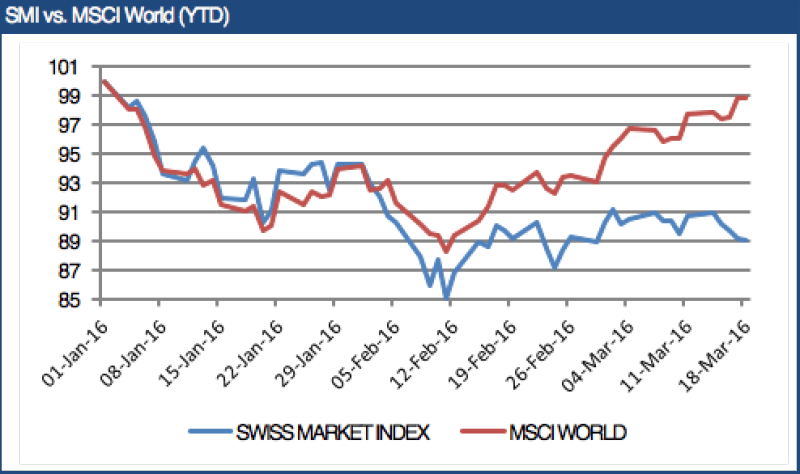

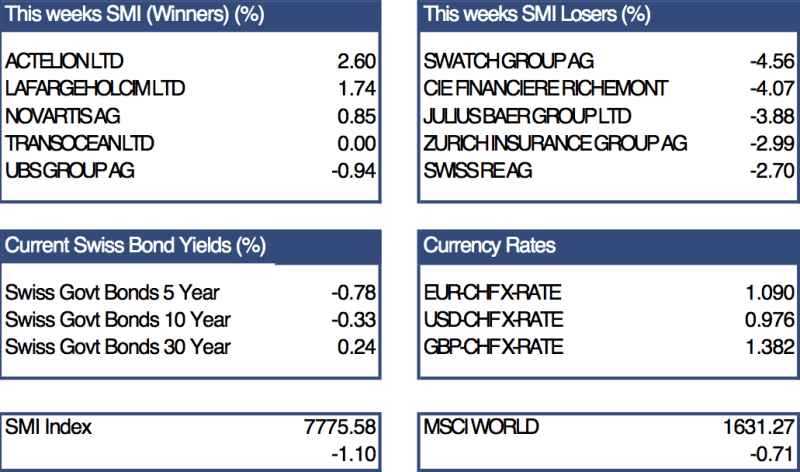

The SMI finished this Easter week 1.10% lower, tracking losses on global equity markets (-0.71%) following the terrorist attacks in Brussels on Wednesday. Stock markets lost momentum after the attacks as investors failed to find fresh catalysts to keep the five-week long equity rally going.

Zaventem airport Brussels – © Bombaert | Dreamstime.com

Commodity prices also fell this week and the US dollar strengthened on the back of higher US oil inventories and “hawkish” comments from Federal Reserve officials. According to officials, the current low joblessness rate in the US may force policy makers to raise rates faster than expected. The oil price fell below 40$ a barrel after the US government revealed a sixth straight weekly climb in crude oil inventories and three times higher than the market expected.

In Switzerland, the expectations of economic growth (ZEW Credit Suisse Survey) rose by 8.4 points in March 2016 to a reading of 2.5 points. Despite the slight positive balance, the majority of the analysts expect economic growth in Switzerland to remain unchanged. In February, Switzerland’s trade surplus increased significantly, supported by strong pharmaceutical exports. However, the trade report also showed that Swiss watch exports fell again as shipments to Hong Kong extended a one-year rut as demand for expensive timepieces from Asia continues to slow.

In other news, the Swiss National Bank’s annual report published on Thursday showed that the central bank spent 86.1 billion francs on currency intervention last year. The vast majority of foreign currency purchases were made in January 2015, after the bank abruptly ended its CHF cap to the EUR.

In company news, Credit Suisse Group AG Chief Executive Officer Tidjane Thiam disappointed investors this week by announcing that the bank had been caught off guard by a buildup of illiquid trading positions. He added that the bank will probably post a second straight quarterly loss as it unwinds the trades.