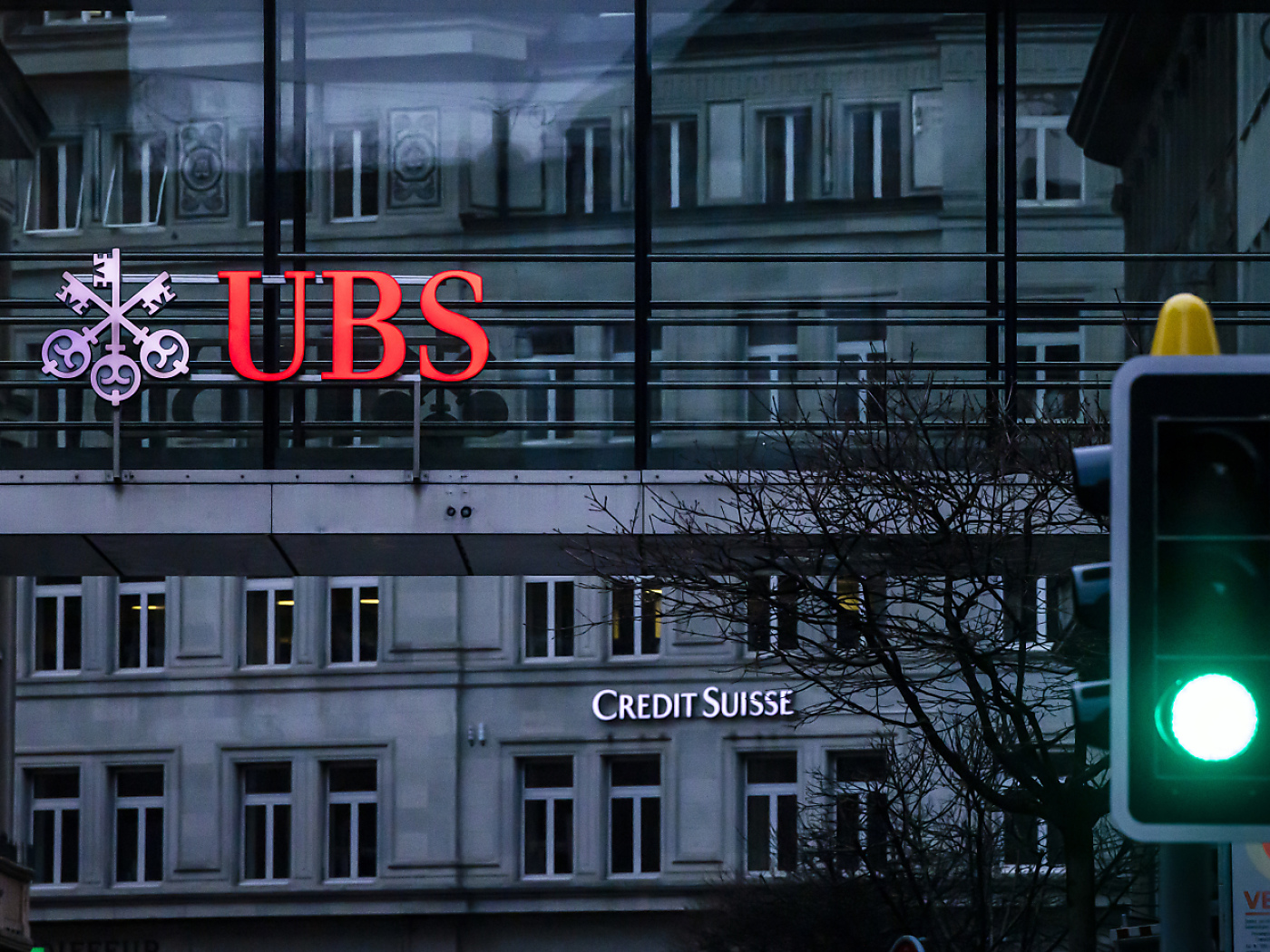

The Mozambique scandal concerns loans to Mozambique arranged by Credit Suisse a decade ago, which were taken out without the knowledge of the local parliament and the International Monetary Fund. Keystone / Georgios Kefalas Listen to the article Listening the article Toggle language selector

Topics:

Swissinfo considers the following as important: 3) Swiss Markets and News, 3.) Swissinfo Business and Economy, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

The Office of the Attorney General of Switzerland has received documents from former Credit Suisse companies relating to the Mozambique debt scandal. The Appeals Chamber has rejected an appeal by the financial institutions taken over by UBS.

+Get the most important news from Switzerland in your inbox

In September 2023, the Office of the Attorney General of Switzerland (OAG) opened proceedings against persons unknown on suspicion of money laundering in connection with the Mozambique scandal. The case concerns omissions or actions by unknown employees of the Credit Suisse Group.

The starting point is a payment of $7.86 million (CHF9.06 million) into a company account at one of the Credit Suisse companies. This is the result of a decision published on Wednesday by the Appeals Chamber of the Federal Criminal Court.

More

More

UBS reaches ‘tuna bond’ settlement with Mozambique

The money of allegedly criminal origin is said to have been paid to the Ministry of Economy and Finance of Mozambique. The circumstances surrounding the subsequent closure of the account are also being investigated. This took place without a suspicious activity report being submitted to the Money Laundering Reporting Office.

No business secrets

The OAG refused to seal the documents requested by Credit Suisse. The Board of Appeal confirmed that there was no valid reason for this. It does not accept the bank’s argument of commercial secrets.

It writes that banks are obliged to keep the requested information available to support the judiciary in the prosecution of money laundering offenses.

The Mozambique scandal concerns loans to Mozambique arranged by Credit Suisse a decade ago, which were taken out without the knowledge of the local parliament and the International Monetary Fund. The money was intended to pay for the construction of a tuna fishing fleet, for example. In the process, bribes were paid on a large scale.

Last year, UBS reached an out-of-court settlement in the legal dispute between the acquired Credit Suisse and the state of Mozambique.

Translated from German by DeepL/jdp

This news story has been written and carefully fact-checked by an external editorial team. At SWI swissinfo.ch we select the most relevant news for an international audience and use automatic translation tools such as DeepL to translate it into English. Providing you with automatically translated news gives us the time to write more in-depth articles.

If you want to know more about how we work, have a look here, if you want to learn more about how we use technology, click here, and if you have feedback on this news story please write to [email protected].

Tags: Featured,newsletter