(Disclosure: Some of the links below may be affiliate links) In 2020, many things have happened in the P2P Lending world. Two major platforms have disappeared. And with them, all the money of the investors.In this context, it is essential to talk rationally about P2P Lending. People need to realize the risks. But not all platforms are scams.I think that Mintos is the safest platform out there. It is the biggest platform and has been reliable since its creation in 2015.I know that P2P Lending is controversial. So, I want to insist on something: P2P Lending is very risky! I am not investing much money in it. I am just investing a small portion of what I consider my fun money.In this post, I am going to review Mintos, one of the major P2P Lending Platforms. Contents show My stance on P2P

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes Yardeni And The Long History Of Prediction Problems

Michael Lebowitz writes The MACD: A Guide To This Powerful Momentum Gauge

Lance Roberts writes Exuberance – Investors Have Rarely Been So Optimistic

Lance Roberts writes Exuberance – Investors Have Rarely Been So Optimistic

(Disclosure: Some of the links below may be affiliate links)

In 2020, many things have happened in the P2P Lending world. Two major platforms have disappeared. And with them, all the money of the investors.

In this context, it is essential to talk rationally about P2P Lending. People need to realize the risks. But not all platforms are scams.

I think that Mintos is the safest platform out there. It is the biggest platform and has been reliable since its creation in 2015.

I know that P2P Lending is controversial. So, I want to insist on something: P2P Lending is very risky! I am not investing much money in it. I am just investing a small portion of what I consider my fun money.

In this post, I am going to review Mintos, one of the major P2P Lending Platforms.

My stance on P2P Lending

I am not against P2P Lending. However, it is much riskier than most people realize. There are many possible risks:

- The borrower can default

- The loan originator can default

- The platform can default

In some cases, you can get some protection. For instance, you can protect yourself against borrower defaults by using a buyback guarantee and diversification. But it is difficult to protect yourself against the other two risks.

If the platform defaults, you will lose everything. And this happened several times in the history of P2P Lending. This business lacks regulation. Almost anybody can start such a platform, and with marketing and promises of high returns, many investors will come!

We have had two examples in early 2020. Kuetzal and Envestio were both scams. These two platforms disappeared, with the millions of their investors. These investors are unlikely to get their money back.

I am not saying every platform is a scam! But this is a genuine risk!

Now that this is out of the way let’s look at Mintos.

Mintos

Mintos is a P2P Lending platform with a four-party model. It means that loans do not come directly from the borrowers but come from loan originators. These loan originators are big platforms themselves than lend money and then use P2P Lending platforms to put investors and borrowers together. Mintos connects you with about 50 loan originators.

Mintos is from Latvia. It is the biggest P2P lending platform in Europe. They have funded more than 3 billion of loans. And they have more than 230’000 users. These numbers are pretty impressive!

The current annual average interest rate of the loans is about 12%. It is high even for P2P Lending. There are loans from 5.5% to 20%. When you see returns like this, you should expect high risks as well. You can invest in bonds in 12 different currencies, including EUR and USD. If you invest in other currencies than EUR, you will have an additional currency risk. I only invested in EUR loans. This currency risk is already enough of a risk for me since I rely on CHF.

Now, do not get fooled by these numbers: there are no guaranteed returns. If anybody offers you guaranteed returns, you need to run away! You may lose money with P2P Lending. Or you may get returns much lower than expected.

Loans are coming from 30 different countries. And there are also different kinds of loans such as personal loans, car loans, and mortgage loans.

Mintos has been profitable since 2017. It is an excellent sign of a P2P platform. Not many platforms can claim the same. Also, they started in 2015. For P2P lending, it is already a long time for a platform.

At Mintos, you will invest directly from the web interface. But they are currently working on a mobile application that will let you invest from your phone. The app could be interesting if you prefer your phone.

Mintos Fees

The great thing about Mintos is that there are no fees for investors. You will not pay any load fees, custody fees, or management fees. The borrowers pay the fees.

However, if you sell your loans on the secondary market (sell loans to other investors), you will pay a 0.85% fee on your loans. This may make it more difficult (more expensive) to liquidate your loans fast if you need the money. But it still a reasonable fee for the P2P lending world. And it is optional since you do not have to sell on the secondary market.

It is good because many platforms (especially in Switzerland) will charge you some fees. And sometimes the fees can eat your profits. In investing, you should always minimize fees.

How to create a Mintos Account

Just go to the Mintos website and start the procedure. It is straightforward to do that.

However, they will verify your identity during the process. So you will need a camera. You can use your phone or a webcam on your computer to do that. You cannot provide the documents electronically. You have to do the verification live.

Overall, it will take your less than 10 minutes to open a Mintos account.

How to invest with Mintos

There are several ways to invest with Mintos.

The first way is to invest directly in loans. You can browse through all available loans. You can filter loans by risk, currency, loan originator, and country. You can invest either in the primary market or the secondary market. The primary market is loans directly from borrowers. The secondary market is where investors sell back loans to other investors.

The second way to invest is with the Auto Invest feature. You can create rules that will select loans to invest in. Then, the platform will invest automatically in those loans. It is the way I have been investing in Mintos since the beginning. If you do that, make sure to select loans according to your risk profile.

The last way is the Invest & Access feature. This the most recent way to invest in Mintos. It is an entirely automated way of investing. It is very similar to a fund. You put some money into the fund, and it is directly invested in available loans. It is the easiest way to invest. It is also the way that you can get your money back in the easiest way. However, you can only get the money from loans that are not late. So you may have to wait 60 days for the buyback guarantee to act.

How to deposit money on Mintos?

In Europe, you will have to deposit EUR to your Mintos. If you have a EUR bank account, this is fine. But if you live in Switzerland, you will likely not have any. In that case, I recommend you use a platform like Revolut to transfer currency for free.

You should not do the transfer from your bank account. Otherwise, you will have to pay fees on the transfer.

How to get your money back?

If you have uninvested money at Mintos, you can always withdraw it. They will do a wire to your bank account.

But you cannot directly take the money out of loans. You can wait until they reach maturity. At this time, you can get the money. But this could take a year depending on the duration of your loans.

If you want to liquidate your portfolio, you can sell your loans on the secondary market. You may have to sell them at a discount if you have low-interest rates. But you could sell your entire portfolio quite fast with this technique. And then, you can transfer the resulting cash into your bank account.

Will the buyback guarantee protect you?

It is a common misconception that having a buyback guarantee protects you from everything. It only protects you from one risk: the borrower defaults. If the loan originator defaults, the buyback guarantee will not help you. And the same happens if the platform defaults.

It is still a good guarantee. But it will not protect you entirely.

At Mintos, not all loans have a buyback guarantee. So, if you invest directly in loans, you should still choose loans that have a buyback guarantee. If you invest through Invest & Access, this is already done for you.

How to reduce your risks?

There are several things you can do to reduce your risks when Investing with Mintos:

- You can choose to invest only in loans with a buyback guarantee. It will protect you against a borrower defaulting.

- You can also diversify against loan originators. If you spread your loans against many originators, you will reduce the risk of losing too much in case one originator defaults.

- You can select loans with low risk. There are loans with a rating from A to F.

Even if you do all these things, keep in mind that this is still risky.

If you want to reduce your risks further, you can also invest in several platforms. That way, if a platform defaults or is a scam, you will not lose your entire investment.

My Results with Mintos

We can take a look at my results with Mintos since I started investing:

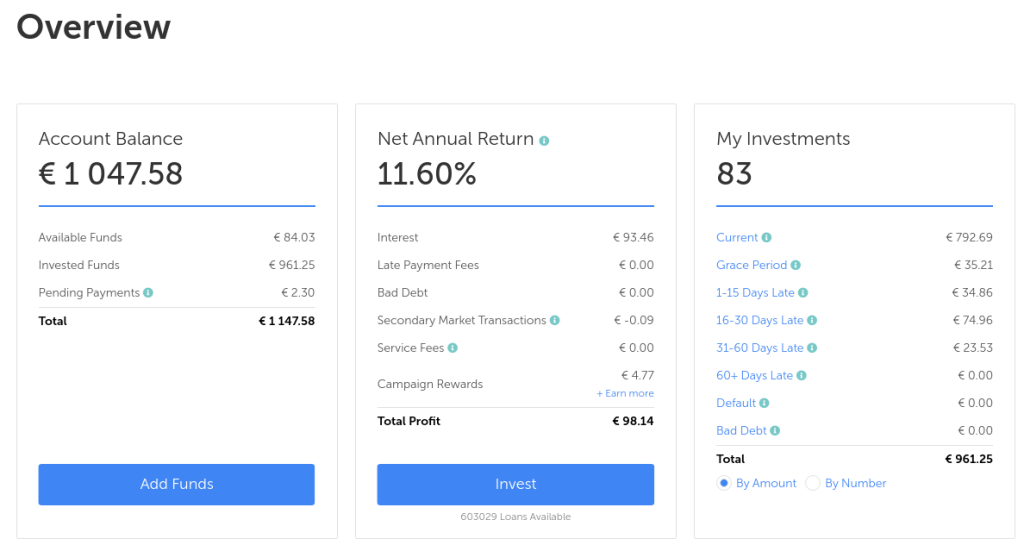

Overall, I got an annualized return of 11.60 %. I made 93 EUR. It is very little, but this is what I expected. And I think this is a good usage of my fun money.

The campaign rewards are that sometimes some loan originators are running cashback deals when you invest with them. I did not follow the deals, but I happened to invest during a campaign by chance.

And if you wonder: yes, I have an affiliate link about Mintos on this blog. And it made me a total of 32 EUR. If you wonder, I made a total of 32 EUR with Mintos on the blog.

Will this make a difference for my future? No!

I am not doing that for Financial Independence. I am using P2P Lending for several reasons:

- For fun! Passive investing is boring. It is interesting to try something new.

- For trying! Everybody is trying that, so it is interesting to know what the fuss is about.

So, if you want to focus entirely on Financial Independence, P2P Lending will probably not help you.

Mintos FAQ

Is investing with Mintos 100% safe?

No. Even with a buyback guarantee, the loan originators could default, and you would lose money. There is no such thing as a 100% safe investment. Now, Mintos is probably the most reliable of the P2P Lending platforms.

How much can you make investing in Mintos?

There are no guaranteed returns. However, the current average interest rate on Mintos is 12%. Your returns will depend on the risks you are taking on the loans.

Who can Invest with Mintos?

Anybody that is 18 years old at least and has a bank account in the European Union or Switzerland.

Conclusion

In the P2P Lending platforms, Mintos is the biggest player. This platform manages more than 3 billion euros. I believe this is the platform that offers the most options, and that makes the more sense. For me, it is the most reliable platform available.

I do not believe that you should use P2P Lending as your main investing instrument. However, I still think it is an interesting instrument for some of your fun money. I would not invest more than 1% or 2% of my net worth into P2P Lending.

Remember that even with buyback guarantees, there are a lot of risks in P2P Lending! Do not fall for the high-interest rates!

What about you? What do you think about Mintos and P2P Lending?