Over the last couple of years, the main challenge to EU cohesion has been Brexit, with the media sharply focused on the negotiations and all relevant developments. Since the release of the draft withdrawal agreement, largely perceived as a victory for the EU, those who support the European project and believe in a strong leadership from Brussels have projected confidence and optimism for the future. According to these voices, the divisions caused by the rise of nationalism and populism in the past years are healing, the relationship between member states is normalizing, while a future of stability and harmony awaits. However, such a vision might prove naive, as it discounts a much greater risk to the EU than Brexit ever was: the political and economic powder keg that is Italy. The

Topics:

Claudio Grass considers the following as important: Finance, Gold, Monetary, Politics

This could be interesting, too:

Investec writes Federal parliament approves abolition of imputed rent

Investec writes Health and health insurance remain top concern for Swiss

Investec writes Reversal of higher retirement age for Swiss women rejected by top court

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Over the last couple of years, the main challenge to EU cohesion has been Brexit, with the media sharply focused on the negotiations and all relevant developments. Since the release of the draft withdrawal agreement, largely perceived as a victory for the EU, those who support the European project and believe in a strong leadership from Brussels have projected confidence and optimism for the future. According to these voices, the divisions caused by the rise of nationalism and populism in the past years are healing, the relationship between member states is normalizing, while a future of stability and harmony awaits.

However, such a vision might prove naive, as it discounts a much greater risk to the EU than Brexit ever was: the political and economic powder keg that is Italy.

The budget fight

For over three months, Italy’s 2019 budget plans and the resulting friction with Brussels have made been making headlines and bringing to the surface numerous concerns over the country’s economic stability and relationship with the EU. The Italian government, aiming to honor its heavily populist pre-election promises, has presented a budget that is sharply at odds with the plans and goals of EU officials. Hailed by the Italian coalition government as a budget that will “end poverty”, the plan includes (among various other spending programs and tax cuts), a lower retirement age and a state-guaranteed basic income of €780. In order to finance its ambitious spending spree, the new Italian government plans to increase the budget deficit to 2.4% of GDP, a number that EU officials found very difficult to reconcile with, especially since the previous government’s plans only required a 0.8% deficit. Given Italy’s extreme national debt levels, Eurozone officials saw a clear threat of future instability in the new government’s plan that could easily spread throughout the bloc.

In October, the tensions culminated in an unprecedented move by the EU Commission: Italy’s draft budget was rejected and revisions were mandated. Italy defiantly announced it would stick to its plans, and in response, the Commission said that significant fines and sanctions against the country were “warranted”. The fines that the Commission threatened could amount to 0.5% of Italy’s GDP, while additional disciplinary measures could include a freeze on development funds. At this stage, a last-minute compromise solution could be hammered out in order to avoid the sanctions, however, the entire incident has heavily bruised the already strained relationship between Italy and the EU.

A history of friction

While the rejection of the Italian budget by the Commission was seen by many as an unusually aggressive step, it is useful to remember that this was not the first time that the new coalition government has been strong armed by Brussels into towing the line. In June, when the new government was still in negotiations to fill its key posts, Paolo Savona emerged as the first choice for finance minister. A professor of economics with experience at the Bank of Italy, Savona was summarily railroaded by pressure from the EU, as his positions were hardly in line with the European project and even less so with the common currency, which he described as “a German cage”. The nascent government quickly conceded and instead made him minister of European Affairs, placing a much less controversial candidate as finance minister.

However, it is important to note that the two parties that the Italian government consists of together won over 50% of the vote in this year’s election. The most outspoken member of the government, Matteo Salvini, leader of the nationalist Lega party, Deputy Prime Minister and Minister of the Interior, has repeatedly expressed his opposition to the Euro which he called “a crime against humanity” and to EU overreach, as he said only last month that “people like Juncker and Moscovici have ruined Europe and our country”. Going a step further and moving from mere discontent with the status quo to actionable plans, the coalition also made clear that, should the EU push them too far and attempt to micromanage their policies, they will not follow the surrender paradigm of Greece, even if that means turmoil in the markets. Instead, they will drop the Euro and adopt a parallel currency; a move also known as ‘Plan B’.

A ticking time bomb

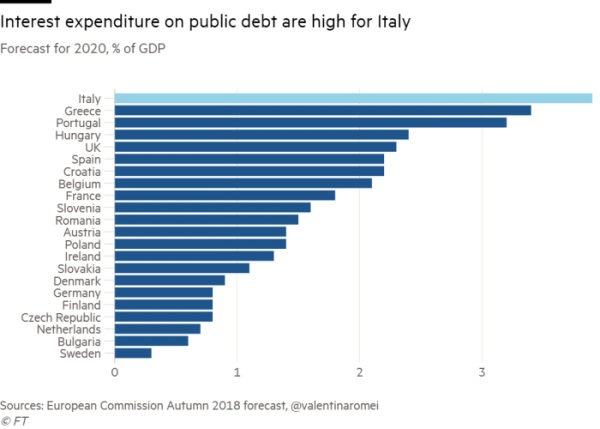

Italy is the third-largest economy in the Eurozone, but it carries the second largest debt-to-GDP, only surpassed by Greece. At 131% of its entire economic output, Italy’s debt stands at over €2.3 trillion. The country last year spent 3.7% of its GDP just on interest payments, a figure that is projected to rise to 3.9% by 2020.

To make matters worse, economic growth has also essentially flat lined. The government’s projections foresee a 1.5% growth for 2019, a sharp contrast with Morgan Stanley’s latest forecast of just 0.5%. These figures might sound dismal, but they are consistent with Italy’s growth record in recent years. Since 2008, the country has gone through a triple-dip recession, from which it has yet to recover. Today’s GDP per capita, inflation- adjusted, is lower than in 2000.

Furthermore, the country is facing a severe demographic problem, that is bound to exacerbate its debt crisis. A report by Italy’s national institute of statistics revealed that the country’s birth rate once again declined in 2017. This persistent downward trend of recent years raises significant concerns, as, after Japan, Italy is the world’s second-oldest country in terms of elderly people as a ratio of the total population.

Also, Italian banks are still a major weak link. Overall, European banks have amassed about €944 billion in bad and non-performing loans that clog up their balance sheets. Italian banks are at the top of the list, holding the lion’s share of this bad debt, with €224.2 billion ($255.9B) weighing down the country’s banking sector.

It is thus clear that, apart from the political friction and the rift with the EU, Italy’s problems are multifaceted, compounded over decades and run very deep, posing a real systemic risk not just to the country itself but also to the entire bloc. Anemic growth, an ailing banking sector, skyrocketing national debt, unfavorable demographic trends and increasing financing costs form a toxic combination that can seriously destabilize the Eurozone.

“Too big to save”

Last time Italy found itself near bankruptcy, it was saved by the ECB’s decision to launch into a decade of money-printing, heavy intervention and massive government bond purchases.

However, the ECB is now set to stop and reverse the measures that facilitated this favorable environment that supported the entire European economy after the last recession. This might prove catastrophic for Italy. Rising interest rates will make the debt near-impossible to service without impacting major spending programs and government services. Without external, systemic and extensive support, the country is bound to struggle heavily over the next years. Unlike Greece, Italy will be a far greater challenge to bail out and the failure to do so will have far grimmer implications.

While the economic problems have a slow-burning fuse and will inevitably lead to a serious crisis eventually, it’s the political troubles that might actually speed up that process. The recent tensions have drawn attention to the capacity that Brussels actually has in interfering with national policies and member state affairs. It has also served, to many, as evidence of how far it is willing to go and to exercise these powers, should a member state refuse to tow the line.

On top of this, issues such as the increasingly wide divide with the EU over migration have also heightened the public’s discontent. The real, on-the-ground implications of the multifaceted challenges that burden Italy have taken a toll on the average citizen’s life and this is strongly reflected in their views and outlook on the future. According to a study released in August by Ipsos and the More in Common initiative, only 16% of Italians believe that globalization has had a positive impact on the economy, while 73% say that traditional parties and politicians do not care about people like them. As more and more voters are attracted to the extremes of the political spectrum, the rift between Left and Right keeps growing.

It might not be yet clear exactly what kind of move by the EU the Italian government would interpret as “a step too far” and cause them to make good on their warning to launch their Plan B. However, what we can tell for sure, is that the European project, the common currency and the Brussels bureaucracy will definitely not be able to sustain the blow of another exit, especially if it’s Italy that decides to leave.

That being said, it should also be obvious that the systemic problems that existed since 2008 have not disappeared; on the contrary, they just became worse. Although we can’t predict the future, we can certainly prepare for it. Therefore, I would like to close with a quote from Prof. Dr. Anthony C. Sutton who once said:

“Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort.”

Claudio Grass, Hünenberg See, Switzerland

www.claudiograss.ch

This article has been published in the Newsroom of pro aurum, the leading precious metals company in Europe with an independent subsidiary in Switzerland. All rights remain with the author and pro aurum.

Bildrechte: iStock.com/nevarpp