Gold Protects As Cashless Society Threatens Vulnerable – Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’– Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash– Cash usage in Sweden falling both as share of GDP and in nominal terms– Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona– Cashless is not a disincentive for illegal drug trade, Guardian finds– Gold in safe jurisdictions will protect against raids on cash and wealth The total value of cash payments in Sweden is just 2% of GDP. Two-thirds of people rarely use cash and even homeless Big Issue sellers are accepting cards. These are the statistics

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Jane L. Johnson writes Why It’s Time To Abolish the Department of Education

Filip Lagaart writes US Dollar rallies on Trump tariff threats against BRICS, French political turmoil

Nachrichten Ticker - www.finanzen.ch writes Bitcoin auf dem Weg zur 100’000 US-Dollar-Marke: Ein Plus für andere Cyberdevisen?

Mises Institute writes A Chance to Double Your Gift!

Gold Protects As Cashless Society Threatens Vulnerable

– Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’

– Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash

– Cash usage in Sweden falling both as share of GDP and in nominal terms

– Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona

– Cashless is not a disincentive for illegal drug trade, Guardian finds

– Gold in safe jurisdictions will protect against raids on cash and wealth

| The total value of cash payments in Sweden is just 2% of GDP. Two-thirds of people rarely use cash and even homeless Big Issue sellers are accepting cards. These are the statistics of Sweden’s cashless society. A country, which is often touted as the most cashless on earth, is in part proud of these numbers but also wonders if it might be too much too soon.

A campaign, called Kontantupproret (“the cash insurgency), demands that the future of money should be a democratic decision, not left just to banks and businesses. Many believe that the cashless society is leaving the old, unbanked and vulnerable behind. The concerns are so great that a parliamentary review has been launched and central bank, Riksbank, is planning on launching a study into the unintended consequences of the cashlesss society, this summer. “If this development with cash disappearing happens too fast, it can be difficult to maintain the infrastructure” for handling cash, said Mats Dillen, the head of the parliamentary review. ““One may get into a negative spiral which can threaten the cash infrastructure,” Dillen said. Banks are now so loathed to work with cash that Riksbank Governor Stefan Ingves has said they may consider forcing banks to provide cash to customers. But this is tricky when the wider economy is no longer set up to accept it. As we have highlighted before, going cashless may make sense to many businesses in terms of keeping costs down but it makes the most sense to the government and banks who gain full oversight and access to your money once it can only be kept in digital form. This cashless dream is likely to turn into a nightmare. Not only for the vulnerable but also for anyone who likes to have the final say on what happens to their wealth. |

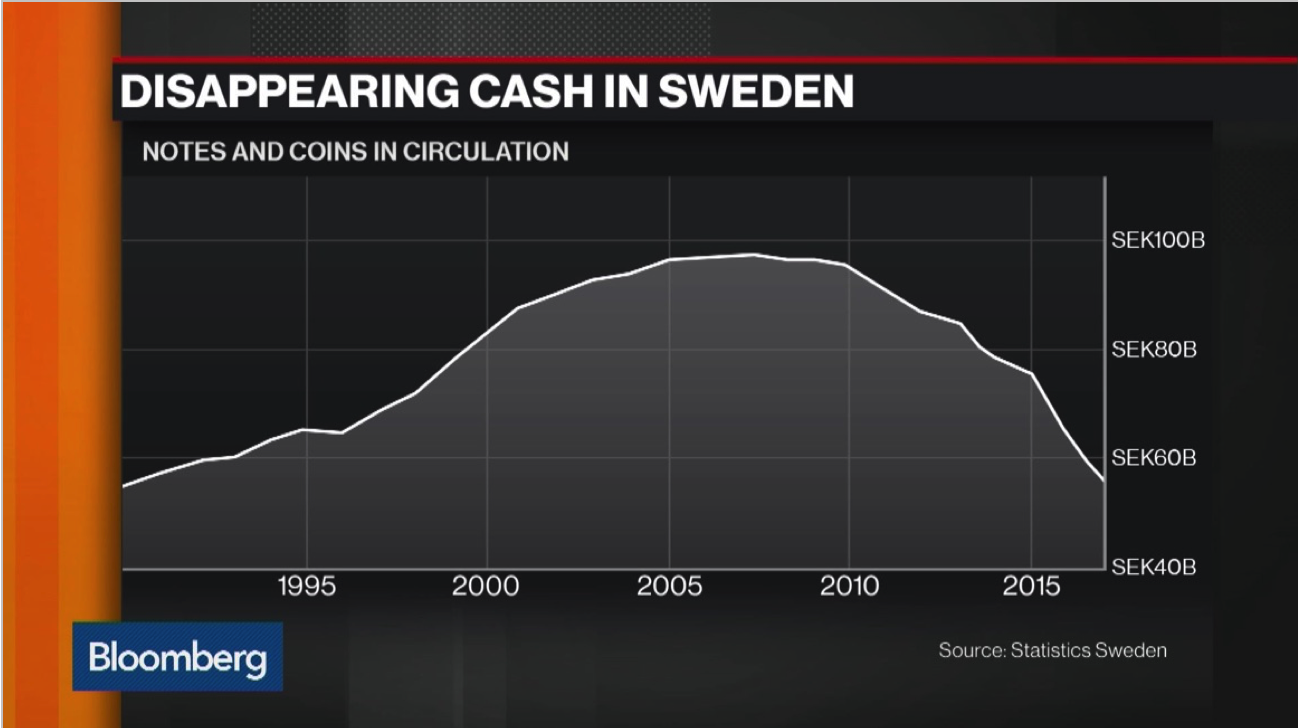

Disappearing Cash in Sweden, 1995 - 2018 |

Sweden’s Gone Too FarThe value of cash in circulation has fallen to its lowest level since 1990 and is more than 40% below its 2007 peak. The extreme push for cashless has seen the amount of cash in circulation fall, especially dramatically in 2016 and 2017. Strangely the central bank are now looking into launching the e-krona, a digital currency which will work as a complement rather than a replacement to cash. The jury is out on whether or not this is as much a PR stunt as it is a further ‘solution’ for the cashless economy. Sweden may have moved too quickly as protest groups are beginning to rally against the cashless economy. Some declare the refusal to accept cash as undemocratic whilst the elderly are being rapidly locked out of services that would have previously been open to cash payments. If you have the means to pay in the legal tender (in this case krone) then who is to say how you can pay? After all, currently cash is not illegal, so why are so many people being made to feel like they’re wrong to use it? Going cashless arguably increases the number of vulnerable economic participants. This isn’t meant in reference to those who are unbanked. In fact, the opposite: Those who are currently society’s least vulnerable – those with savings, investment portfolios and a good banking relationship – could become extremely vulnerable. How do you go cashless without a bank?There is also the issue of those who are simply unable to offer anything other than cash – the unbanked. “The beauty of cash is that it’s a direct and simple transaction between all kinds of different people, no matter how rich or poor,” financial writer Dominic Frisby told The Guardian. “If you begin to insist on cashlessness, it does put pressure on you to be banked and signed up to financial system, and many of the poorest are likely to remain outside of that system. So there is this real danger of exclusion.” In Sweden, the unbanked is not a major issue. But, in the likes of America where 7% are unbanked and in developing countries it is a problem. Banks and governments are keen to ‘on-board’ these customers as easily as possible, but in some cases it is just not worth it. “Billions of poor people in the developing world depend on cash to buy goods for very small amounts, often mere cents,” Srinivasan Sivabalan wrote in Bloomberg. “It may be too costly to host those transactions on a network. That could create a second-class citizenry of people who don’t have equal access to banking services.” |

Criminalising cash thanks to its criminal links

One of the major arguments against cash, by governments, is that it facilitates illegal activities such as money laundering and the drug trade. Last year, we highlighted the Swedish authorities’ role in making cash an almost criminal possession:

“In general, the rule of thumb in Scandinavia is: ‘If you have to pay in cash, something is wrong,’” writes Mikael Krogerus for Credit Suisse. Arvidsson explains that “At the offices which do handle banknotes and coins, the customer must explain where the cash comes from, according to the regulations aimed at money laundering and terrorist financing,” The hassle, for the depositor, is enough to make them go cashless.

Here in the UK, cash as a criminal’s payment of choice has been widely touted but it might not be so relevant. The Guardian spoke to several individuals and businesses about how cashless could or was impacting them. One of them was a drug dealer who fundamentally disagreed that the push for cashless would stop drug dealing:

People always go on about how the cashless society will spell the end of drug dealing but although I started selling for cash on the street, my trade has been entirely online for the last couple of years at least. There are different ways customers can pay for drugs on the darknet. They can use Bitcoins, localbitcoins, virtual private networks or [an operating system called] Tails. Buying on the darknet is more risky for dealers than customers.

Compared to selling on the street, the darknet is easier and safer for me – and also more profitable because I sell in bulk rather than dealing with individual pills and small bags of weed. And because I’m selling in bulk, my prices are lower than when I dealt on the street, so it’s a win-win.

I’ve heard some people say the darknet is the next generation of drug dealing. But from where I’m looking, it’s this generation’s way of buying drugs. Cash never comes anywhere near buyer or seller, so all the government’s promises that the cashless society would outlaw drug dealing are a lie.

Making the stronger, weaker.By demanding one pays just with digital cash – by card, by digital currency etc. then you are demanding that a person store their wealth with a counterparty. Of course, the majority of us do this for many elements of our wealth, especially that which we use for day-to-day expenses. But, currently we have the option to hold some in cash and some in digital form. If we go cashless then we can no longer do this. This makes us vulnerable to huge forces, beyond our control. Namely, malicious hackers and the banks with their all-too-easy-to-invoke bail-in policies. As interest rates turn negative and the risk of bail-ins grows closer by the day, holding cash appears increasingly attractive but also unattractive for those politicians and bankers who want an easy way out of another financial crisis. Physical assets such as gold and silver, when held in segregated, allocated accounts cannot fall victim to these sticky fingered forces. As Dr. Constantin Gurdgiev reminds us: Cash and monetary assets, such as gold, cannot be expropriated or bailed-in as long as they are held in physical form and under proper storage. Cashless accounts amplify the importance of monetary assets, such as gold, in fulfilling the function of being safe havens against systemic risks – risks that are associated with high probability of Government expropriation. Once all of your money is in the digital banking system you are immediately vulnerable. You can get ready for it to be frozen, taken to fund a bail-in and even taxed. And in the meantime, enjoy governments, banks and possibly large corporations knowing what you’re spending your money on. |

What’s the alternative?

Of course, if you find yourself in Sweden or any other country pushing the cashless agenda you may feel there is little you can do to ‘opt out’ of the new regime.

There is one thing you can do and that’s in regard to your savings. Of course, your day to day spending money will have to be in the form of fiat-based cashless payments but what you decide to keep in the bank in the short-term does not have to be cash.

Cash and other forms of intangible assets are difficult to protect in this digital era.

Dostoevsky wrote, ‘Money is coined liberty’. Sadly this only remains true for one form of money: gold and silver. It is no longer the case for cash. History shows multiple attempts of wealth confiscation and restrictions on freedom, each time individuals and governments have returned to gold and silver in order to protect their savings and their privacy.

The role of precious metals in a cashless society are key and investors should remember the importance of diversification and holding assets, under direct ownership, outside of the vulnerable and exposed banking system.

Tags: Daily Market Update,Featured,newslettersent