The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow growth in mortgage lending (+2.6%), considerably below the 10-year average of 3.8%. The bank did note that growth in mortgage lending might be underestimated. Insurers and pension fund have entered the mortgage market with guns blazing, however their lending reporting is inadequate, according to the

Topics:

Investec considers the following as important: Editor's Choice, Featured, newslettersent, Property, Swiss Markets and News, Swiss property prices, Swiss real estate

This could be interesting, too:

Investec writes Federal parliament approves abolition of imputed rent

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

| The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row.

Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow growth in mortgage lending (+2.6%), considerably below the 10-year average of 3.8%. The bank did note that growth in mortgage lending might be underestimated. Insurers and pension fund have entered the mortgage market with guns blazing, however their lending reporting is inadequate, according to the bank. |

|

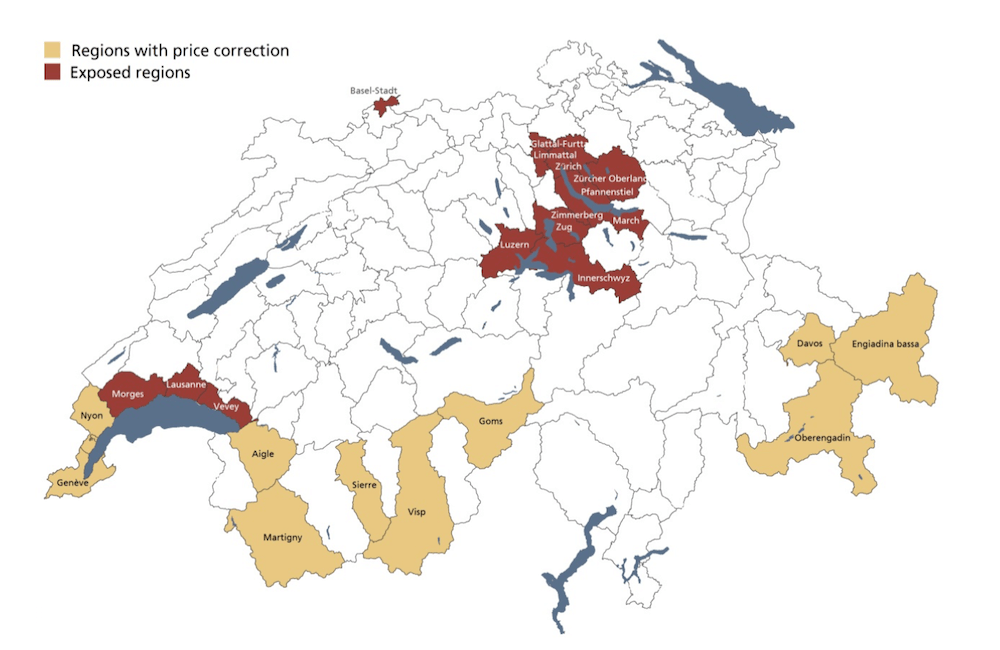

Some parts of Switzerland remain at greater risk of price corrections. They are the usual suspects: greater Zurich and the surrounding region incentral Switzerland, Basel and the Lake Geneva Region.

UBS real estate bubble index Q4 2017The map above shows regions at risk in burgundy. The areas in brown have seen price falls since 2014. |

Tags: Editor's Choice,Featured,newslettersent,Property,Swiss property prices,Swiss real estate