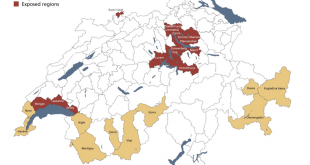

© Ppvector | Dreamstime.com Recent figures show an annual 4.2% rise in the number of vacant homes in Switzerland, extending a trend that started 10 years ago, according to the Federal Statistical Office. At the start of June 2019, there were 75,323 vacant homes, representing 1.66% of Switzerland’s total stock of homes. However, high vacancy rates in some regions masked low ones in others. While cantons such as Solothurn (3.40%), Thurgau (2.65%), Jura (2.59%), Aargau...

Read More »Housing vacancies rise in 20 Swiss cantons

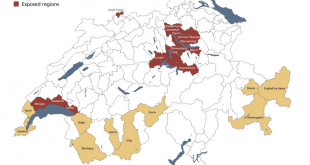

Recent figures show an annual 4.2% rise in the number of vacant homes in Switzerland, extending a trend that started 10 years ago, according to the Federal Statistical Office. © Ppvector | Dreamstime.comAt the start of June 2019, there were 75,323 vacant homes, representing 1.66% of Switzerland’s total stock of homes. However, high vacancy rates in some regions masked low ones in others. While cantons such as Solothurn (3.40%), Thurgau (2.65%), Jura (2.59%), Aargau (2.59%),...

Read More »Swiss real estate risk falls two quarters in a row, says UBS

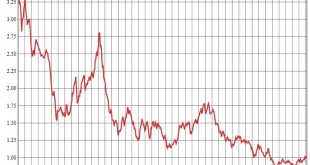

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow...

Read More »Swiss real estate risk falls two quarters in a row, says UBS

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. © Denis Linine _ Dreamstime.com Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow growth in mortgage lending (+2.6%),...

Read More »Swiss real estate risk falls two quarters in a row, says UBS

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. © Denis Linine _ Dreamstime.com Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow growth in mortgage lending (+2.6%),...

Read More »Swiss Real Estate: The Empty Dwellings Rate Continues to Increase

The Swiss Real Estate Bubble and Rents The number of empty dwellings is an important indicator for the Swiss real estate bubble. Prices of Swiss real estate had risen by 5%-8% per year between 2009 and 2014, while rents for existing contracts are regulated and have not followed this path yet. Landlords can only introduce higher prices levels for new buildings or new contracts. The reader should bear in mind that the...

Read More »Swiss home vacancy rate climbs to 15-year high

Switzerland has around 4.4 million homes. In 2000, 52,608 (1.49%) of them were vacant. By 2003, this number had dropped to 33,039, a vacancy rate of 0.91%. After fluctuating between this level and 1.07%, the rate started to climb in 2014 to its current rate of 1.30%, its highest level in 15 years. Before home hunters get too excited, it is important to look at regional differences. In some regions the market for accommodation remains tight. In some places it has become even tighter. City of...

Read More »UBS says Switzerland still at risk of real-estate bubble

Investec Switzerland. Source: UBS Risks to the Swiss property market remained elevated in the second quarter of 2016, with rock-bottom interest rates propping up demand for residential assets to be rented out for investment purposes. Still, UBS Group AG’s index experienced a “slight” decrease in the period, according to economists Matthias Holzhey and Claudio Saputelli. That’s because of a slowdown in the pace of mortgage growth and a 0.6 percent decline in home prices on an...

Read More »SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a “toothless measure” if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds. The following are the extracts from the monetary policy assessment of Swiss National Bank, 17 March 2016, and my comments.All SNB statements appear in quotes, my comments without quotes....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org