Summary:

Check the context before uncritically accepting sensationalist conclusions. Let’s start with a primer on how to write a sensationalist story that can be passed off as “journalism:” 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as “fact” rather than data that requires verification by disinterested researchers. 3. Exaggerate the data as much as possible and set the tone and context with emotionally laden words: “shocking,” etc. 4. Select a context that sensationalizes the conclusion. Now let’s take a look at a story that has been swallowed whole, with little to no fact-checking or disinterested inquiry: bitcoin’s electrical consumption, i.e. the electricity

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Check the context before uncritically accepting sensationalist conclusions. Let’s start with a primer on how to write a sensationalist story that can be passed off as “journalism:” 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as “fact” rather than data that requires verification by disinterested researchers. 3. Exaggerate the data as much as possible and set the tone and context with emotionally laden words: “shocking,” etc. 4. Select a context that sensationalizes the conclusion. Now let’s take a look at a story that has been swallowed whole, with little to no fact-checking or disinterested inquiry: bitcoin’s electrical consumption, i.e. the electricity

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Check the context before uncritically accepting sensationalist conclusions.

Let’s start with a primer on how to write a sensationalist story that can be passed off as “journalism:”

1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized.

2. Present the data as “fact” rather than data that requires verification by disinterested researchers.

3. Exaggerate the data as much as possible and set the tone and context with emotionally laden words: “shocking,” etc.

4. Select a context that sensationalizes the conclusion.

Now let’s take a look at a story that has been swallowed whole, with little to no fact-checking or disinterested inquiry: bitcoin’s electrical consumption, i.e. the electricity consumed by mining/maintaining bitcoin’s blockchain.

Let’s start by stipulating that energy consumption is a consequential matter worthy of serious inquiry. It’s important to measure the energy consumption of all the systems that operate within the current status quo, and compare the consumption levels of these systems.

With that in mind, let’s take a look at the story.

Right off the bat, the context we’re offered to grasp the enormity of bitcoin’s mining consumption is the electrical consumption of Nigeria, a nation, we’re breathlessly informed, with 186 million residents. Wow! That’s a crazy amount of electrical consumption, right?

Let’s do some very basic fact-checking before we accept sensationalist conclusions, shall we?

Nigeria consumes about 24 billion kWh annually, while the U.S. consumes 3,913 billion kWh annually.

So Nigeria uses 3/5th of 1% (0.6%) of the electricity the U.S. consumes.

Now let’s compare that electrical consumption with the amount of electricity consumed in the U.S. by residential devices and chargers on stand-by, i.e. appliances, devices, chargers, gizmos, etc. that aren’t in use and doing no work but that are still consuming electricity.

About a quarter of all residential energy consumption is used on devices in idle power mode, according to a study of Northern California by the Natural Resources Defense Council. That means that devices that are “off” or in standby or sleep mode can use up to the equivalent of 50 large power plants’ worth of electricity and cost more than $19 billion in electricity bills every year.

source: Just How Much Power Do Your Electronics Use When They Are ‘Off’? (May 7, 2016, New York Times)

(Please read the article to find out just how much power the 50+ gadgets in your home consume doing absolutely zero work.)

According to the U.S. Energy Information Administration, annual residential electrical consumption totals 1,410 billion kWh.

So 25% (the amount of household electricity consumed by stand-by devices) of 1,410 billion equals 352 billion kWh consumed annually by residential appliances and devices on stand-by in the U.S.

Now let’s compare the annual electrical consumption of Nigeria (24 B kWh) with the annual residential electrical consumption of devices on stand-by in the U.S.

The annual electrical consumption of Nigeria (24 B kWh) is 6.8% of the annual electrical consumed by household devices on stand-by in the U.S. That means the supposed consumption of bitcoin mining is 1/14th of the power lost to residential devices on stand-by in the U.S., devices doing essentially nothing.

Now let’s add in all the appliances and devices in government and private-sector offices on stand-by. Let’s conservatively estimate another 150 B kWh lost to all this stuff on stand-by.

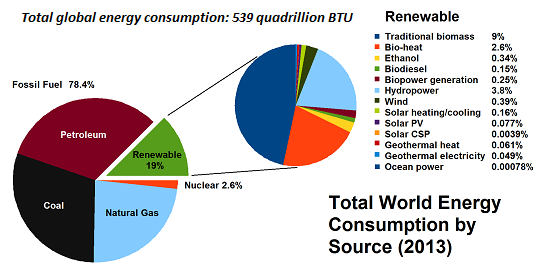

Now let’s multiply the total of electricity lost to stuff on stand-by mode (doing no work whatsoever) in the U.S., 500 B kWh annually, by five, since the U.S. consumes roughly 20% of all electricity globally.

Electricity production 2016 (Enerdata)

This gives us an estimate of all the electrical power lost to electrical appliances and devices on stand-by globally every year: 2,500 billion kHh. 1% of that wasted electricity is 25 billion kHh. If you reckon this seems high, let’s shave these totals to 1,500 billion kHh and 15 billion kHh.

Let’s go back to the story about bitcoin’s consumption of electricity which tells us “a shocking 215 kilowatt-hours (KWh) of juice (is) used by miners for each Bitcoin transaction.”

But then a few paragraphs down, we discover the electricity per transaction might only be 77 kWh– nobody really knows for sure. Hmm. 77 is 36% of 215, so the “shocking” consumption might overstate actual consumption by a factor of three?

Let’s choose a number between 77 and the “shocking” 215, since nobody really knows what the real number is: shall we guesstimate 135, or 2/3 of the high guesstimate? That would drop the annual consumption of bitcoin mining from 24 B kWh annually to 15 B kWh, less than 1% of the electricity wasted annually on stand-by devices doing no work whatsoever.

|

And so, um, bitcoin mining is a threat to the planet because it consumes less than 1% of all the electricity squandered by appliances and devices on stand-by? If we want to stop wasting so much energy, perhaps we should start by mandating near-zero stand-by power consumption for the hundreds of millions of devices which are not in use that are nonetheless sucking up electricity every second of every day.

Here’s another thought: check the context before uncritically accepting sensationalist conclusions.

|

Total Global Energy Consumption |

Tags: Featured,newsletter