Today’s retail sales report was disappointing. Nevertheless, overall consumption growth is likely to have topped 3.0% q-o-q annualised in Q3, and we remain optimistic about future consumption growth. Nominal total retail sales increased by a modest 0.1% m-o-m in September, slightly below consensus expectations (+0.2%). Moreover, August’s number was revised down from +0.2% to 0.0%. As widely expected, total sales were dented by a massive (-3.2%) m-o-m fall in nominal sales at gasoline stations (on the back of sharply lower gasoline prices). And there was another surprising monthly drop in sales of building materials and garden equipment (-0.3%, following -1.3% in August). However, nominal auto sales rose strongly m-o-m in September (+1.7%). This latter increase came as no surprise as already published data on unit car sales had shown a 2.0% rise m-o-m to a new cycle-high. Control sales softer in September As usual, it is particularly important to look at what happened to control sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, September’s results were quite disheartening. Control sales fell by 0.1%, well below consensus expectations for a 0.3% rise. Moreover, August’s figure was revised down from +0.4% to +0.2%, with July’s number downgraded from +0.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

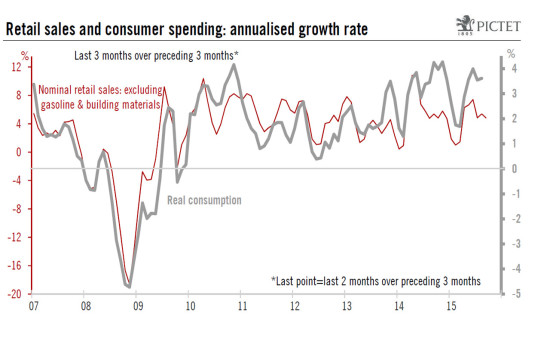

Today’s retail sales report was disappointing. Nevertheless, overall consumption growth is likely to have topped 3.0% q-o-q annualised in Q3, and we remain optimistic about future consumption growth.

Nominal total retail sales increased by a modest 0.1% m-o-m in September, slightly below consensus expectations (+0.2%). Moreover, August’s number was revised down from +0.2% to 0.0%.

As widely expected, total sales were dented by a massive (-3.2%) m-o-m fall in nominal sales at gasoline stations (on the back of sharply lower gasoline prices). And there was another surprising monthly drop in sales of building materials and garden equipment (-0.3%, following -1.3% in August). However, nominal auto sales rose strongly m-o-m in September (+1.7%). This latter increase came as no surprise as already published data on unit car sales had shown a 2.0% rise m-o-m to a new cycle-high.

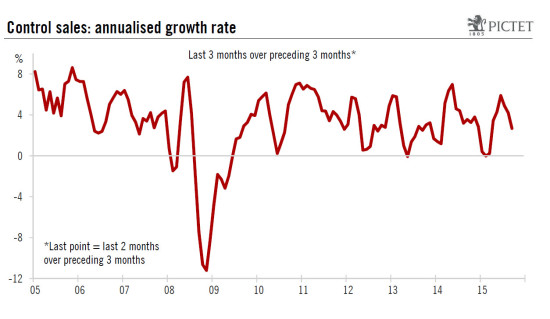

Control sales softer in September

As usual, it is particularly important to look at what happened to control sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, September’s results were quite disheartening. Control sales fell by 0.1%, well below consensus expectations for a 0.3% rise. Moreover, August’s figure was revised down from +0.4% to +0.2%, with July’s number downgraded from +0.6% to +0.5%. Nevertheless, even after these downward revisions, core retail sales appear to have grown quite solidly between April and August. The end-result is that core retail sales still managed to grow quite robustly overall in Q3: +4.2% q-o-q annualised, following +4.3% in Q2.

Today’s retail sales numbers suggest that overall real consumption will have proved soft in September and that August’s figure will be revised downwards. However, it is important to bear in mind that the data we had to hand for consumption in July and August had been particularly strong. They had been showing that, between Q2 and July-August, consumption had grown by a strong 3.6% annualised, after +3.6% as well q-o-q in Q2. However, despite these upbeat figures, we had opted to retain a relatively circumspect forecast of 3.3%. Today, that seems to have been wise, and this forecast for Q3 can be left unchanged despite the disappointing retail sales data published today. This means we still believe consumption growth was strong last quarter, topping 3.0%. And following the fall in gasoline prices over the last few weeks, we remain optimistic for consumption in Q4.

The strength in consumption, together with robust growth in residential investment and some improvement in non-residential investment, mean that final domestic demand most probably grew quite strongly q-o-q in Q3. However, data published recently (trade of goods & services, business inventories) have confirmed that both trade and stockbuilding were a sizeable drag on GDP growth last quarter.

These data on trade and stockbuilding, together with today’s disappointment in retail sales numbers, mean that our forecast for GDP growth in Q3 of 2.2% looks rather optimistic and that risks are clearly angled to the downside. However, given the uncertainties surrounding these data, we have chosen to keep this forecast unchanged. Q3 GDP numbers will be published on 29 October.

On a yearly average basis, our forecasts for 2015 and 2016 remain unchanged at 2.5% and 2.4%, respectively.